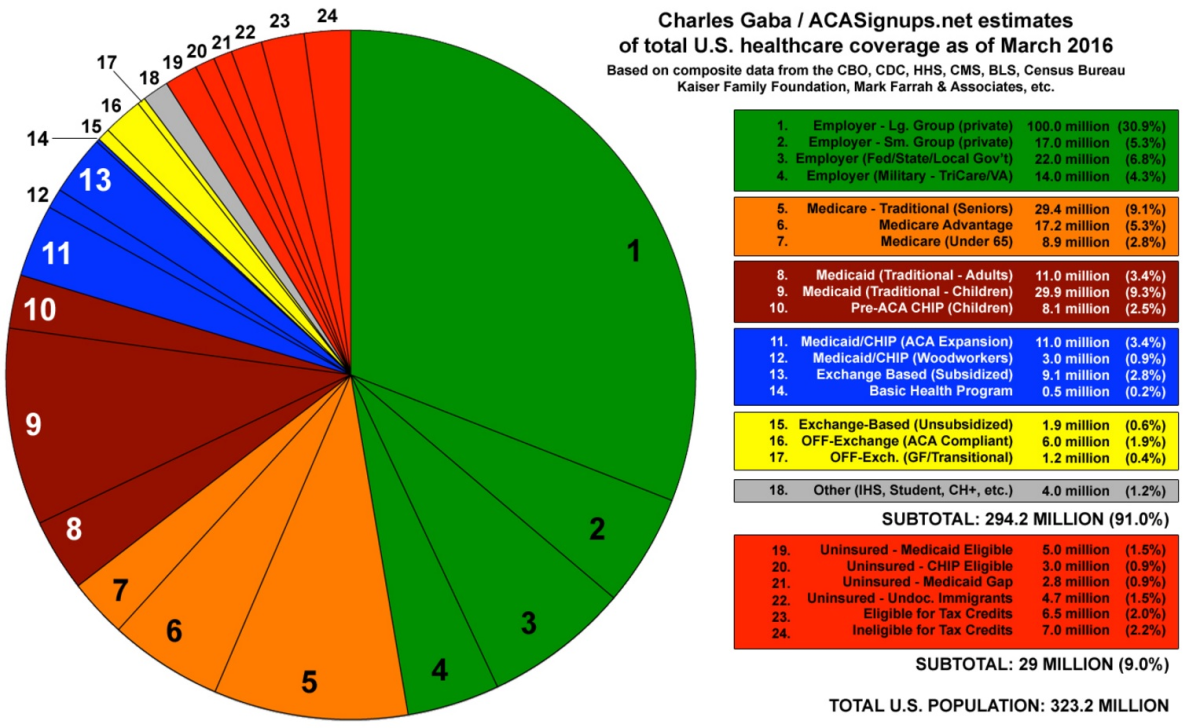

Where America gets its health coverage: everything you wanted to know in one handy chart

Charles Gaba is an independent web designer in Bloomfield Hills, Mich. For several years now he has been making life easier for every journalist who follows the Affordable Care Act by heroically compiling health insurance enrollments under the law, explaining developments, debunking myths, and hectoring the nearly infinite sources of mis- and disinformation (not excepting, on occasion, the Department of Health and Human Services) into getting things right. His handiwork can be found at ACASignups.net, and he tweets at @charles_gaba.

Gaba, who describes himself as "a technophile and all-purpose cybergeek," does all this as a labor of love. He's an indispensable resource. His latest effort, displayed here, tells you why. It's a pie chart showing all the different ways in which Americans get their health insurance.

Estimates of total U.S. healthcare coverage

| Insurance type | Enrollees (in millions) | Percent of population |

|---|---|---|

| Employer | ||

| Large group, private | 100 | 30.9 |

| Small group, private | 17 | 5.3 |

| Fed/state/local government | 22 | 6.8 |

| Military, TriCare/VA | 14 | 4.3 |

| Medicare | ||

| Traditional (seniors) | 29.4 | 9.1 |

| Medicare Advantage | 17.2 | 5.3 |

| Medicare (under 65) | 8.9 | 2.8 |

| Medicaid | ||

| Traditional (adults) | 11 | 3.4 |

| Traditional (children) | 29.9 | 9.3 |

| Pre-ACA CHIP (children) | 8.1 | 2.5 |

| Medicaid/CHIP | ||

| ACA Expansion | 11 | 3.4 |

| Woodworkers | 3 | 0.9 |

| Exchange based (subsidized) | 9.1 | 2.8 |

| Basic health program | 0.5 | 0.2 |

| Affordable Care Act | ||

| Exchange-Based (unsubsidized) | 1.9 | 0.6 |

| OFF-Exchange (ACA compliant) | 6 | 1.9 |

| OFF-Exchange (GF/transitional) | 1.2 | 0.4 |

| Other | ||

| HIS, student, CH+, etc. | 4 | 1.2 |

| Uninsured | ||

| Medicaid eligible | 5 | 1.5 |

| CHIP eligible | 3 | 0.9 |

| Medicaid Gap | 2.8 | 0.9 |

| Undocumented immigrants | 4.7 | 1.5 |

| Eligible for tax credits | 6.5 | 2 |

| Ineligible for tax credits | 7 | 2.2 |

Gaba explains his sources and methodology here. A few notes:

1. Most Americans still get their coverage from traditional sources: from their employers (153 million, or 47.3%) and government programs such as Medicare and Medicaid--the pre-ACA variety, covering mostly children and their parents in low-income households. They account for 79.7% of the population and are represented by the green and orange wedges. their numbers haven't changed much since the ACA--in fact, the stability of the employer-covered wedge has surprised healthcare planners at HHS and the Congressional Budget Office, who expected lots of migration from employer-covered plans to Obamacare exchanges.

Gaba acknowledges that his employer number is a bit lower than estimates by the Kaiser Family Foundation and the CBO, but attributes that to rounding and overlap.

2. More than 20 million Americans have gained coverage directly as a result of the ACA, but that's not the whole story. This is the blue wedge, and it includes Medicaid expansion (11 million enrollees) and subsidized enrollments on the ACA exchanges. Gaba adds 3 million Medicaid "woodworkers," who are people previously eligible for Medicaid who finally signed up as a result of ACA-prompted outreach and publicity. Another 10 million are enrolled in exchange plans but are unsubsidized, or off-exchange but ACA-compliant individual plans, or grandfathered plans that may not comply with the ACA but are still serving previously-enrolled customers.

3. Some 29 million Americans (9%) still don't have insurance. They're in the red wedge. They include 2.9 million in the "Medicaid gap," which is created by state legislatures and governors, invariably Republican, who have refused to expand Medicaid in their states despite almost all its funding coming from the federal government. These people are victims of political stupidity.

4. The ACA has impacts on health coverage far beyond direct enrollments in exchange plans and Medicaid. As Gaba notes, many of the law's provisions apply to other health plans. These provisions include the ban on exclusions for pre-existing conditions, preventive care without co-pays or deductibles, the outlawing of lifetime benefit limits, and other consumer-friendly standards. And that's not even to mention incentives built into the law aimed at moderating the growth of healthcare costs, bringing costs down, and improving physician and hospital practices.

Keep up to date with Michael Hiltzik. Follow @hiltzikm on Twitter, see his Facebook page, or email michael.hiltzik@latimes.com.