What’s the problem for which Apple Pay is the solution?

- Share via

The late, great social critic Neil Postman used to pose a question that had to be asked whenever a new technology appeared in the marketplace: “What is the problem to which this is the solution?”

It was a rigged question, of course, because more often than not the answer was “Nothing.”

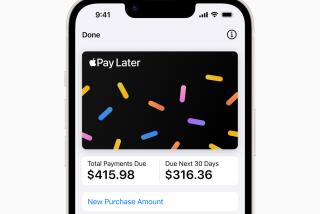

That looks like the case with Apple Pay, the marvelous, revolutionary, “so cool” (says Apple CEO Tim Cook) payment system Apple introduced Tuesday, along with new iPhones and the Apple Watch. The idea is that you’ll be able to hold your iPhone 6 or Apple Watch up to a device at the checkout counter and, presto, you’ve paid. No more rummaging around in your pocket or handbag for your credit card; you’ll just have to rummage around for your iPhone.

As Kevin Drum and Neil Irwin (among others) point out, the technical term for this is “big whoop.” At the introductory event, Apple executives made much of the insecurity of the conventional credit card, and they’re right--as the baleful experience of shoppers at Target, Home Depot and other hacked retailers shows. But the solution to credit card hacking is already being rolled out in the U.S., years behind the rest of the world: chip-bearing smart cards, which protect payment information much more securely.

Payment devices are always a mixed curse, whether they’re the cash in your wallet, credit cards or other geegaws. A few years ago, Exxon Mobil introduced a keyring dongle, linked to your gas card, that you could swipe at the gas pump to pay. That seemed “so cool,” too, until the things disappeared from keyrings left with valet attendants, only to be discovered missing when mystery charges showed up on the monthly statement. (Yes, this happened to me.)

It’s hard to say just yet whether it’s good, bad, or merely neutral that users will have to keep track of one more set of payment-enabled devices. Apple says the credit information won’t be housed on the devices, so if they’re lost or stolen there’s no risk to the consumer.

We’ll see: Credit account information will flow between the customer and Apple at some point, somehow. Apple’s systems haven’t been anything like secure in the past (see here and here), so the company’s promise that this one will be rock-solid shouldn’t be taken as gospel. The devices may not be insecure, but the risk will reside somewhere. Anyone want to guess the over/under on how long after Apple Pay is rolled out that hackers uncover and disclose a critical security flaw? My bet is 24 hours.

Apple Pay raises another question Postman used to ask: “Who gains special economic and political power from this new technology?” In this case the answer is plainly Apple, which will extract a fee for purchases made by Apple Pay and use the system as a come-on to sell iPhones and watches, tying its customers more deeply into the Apple ecosystem. Think of it as a network enhancement; once your payment habits are tied to the iPhone, it will be all the more difficult for you to switch to an Android device.

Apple Pay may be, in some circumstances, a convenience. But is it earth-shaking? Paying for things with credit cards simply isn’t a huge burden; as Irwin points out, most people with Pay-enabled iPhones will probably have to carry their credit cards with them as backup anyway. The revolutionary advance of Apple Pay, so far, is still just Apple spin.

Keep up to date with The Economy Hub by following @hiltzikm.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.