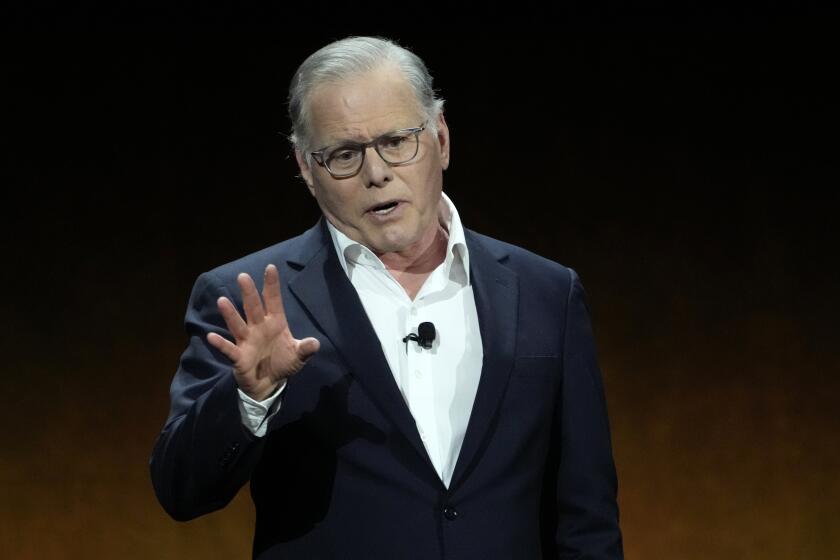

Disney-Fox deal is complete; CEO Bob Iger’s big swing could change media industry

Walt Disney Co. Chief Executive Bob Iger has scaled the mountain.

Through a series of sure-footed moves, Iger has worked tirelessly to position Disney as the world’s preeminent entertainment company. Now he is closer to realizing his vision as the Burbank giant late Tuesday finalized its $71.3-billion purchase of much of Rupert Murdoch’s 21st Century Fox.

The acquisition is the boldest — and riskiest — of Iger’s 14-year stewardship of Disney. It’s the culmination of an expansionist strategy that has guided Iger as he has transformed the storied company through a series of takeovers that have made Disney the home of “Star Wars,” “Black Panther” and “Incredibles 2.”

READ MORE: With Fox, Disney will have an even bigger footprint in Hollywood »

With the landmark purchase of Fox assets, Disney, already valued at $168 billion, is poised to be an even bigger force in Hollywood. Disney is taking over Fox’s movie and TV production studios and the rights to such valuable properties as “Avatar,” “Ice Age,” “Modern Family” and “The Simpsons.” The owner of ESPN and ABC also scoops up the FX and National Geographic channels, a controlling stake in streaming service Hulu and Fox’s international television portfolio.

“This is an extraordinary and historic moment for us — one that will create significant long-term value for our company and our shareholders,” Iger said in a statement Tuesday.

Analysts say the consolidation highlights massive shifts that are underway in media.

“This is a game changer for the industry,” Jessica Reif Ehrlich, media analyst at Bank of America’s Merrill Lynch, said in an interview. “When the Murdochs decided to sell Fox, the entire industry was turned upside down. The message was: ‘You either need to get bigger — or get out.’ ”

Iger sought the Fox assets to fortify Disney against the onslaught from the north. Technology giants with mounds of cash — Netflix Inc., Google Inc., Apple Inc. and Amazon.com Inc. — have attracted millions of customers to their streaming services.

READ MORE: Fox oral history: Inside the legendary studio at the end of its run »

So great is the threat that Murdoch opted to sell much of his empire. And the 68-year-old Iger — who is 20 years younger than Murdoch — seized the opportunity to bulk up Disney. But it is not certain that Iger can seamlessly integrate the cultures of two very different companies — or whether Disney will be as formidable a competitor as it takes on the streaming giants that have upended the industry.

“Bob is playing the game to win,” said Laura Martin, media analyst at Needham & Co. “But he’s taking a $71-billion risk with Disney shareholder money.”

Iger’s tenure at the top of Disney is one of the most successful in modern-day Hollywood. Since he took over in October 2005, the company’s stock price has more than quadrupled. Its shares fell $3.12, or 2.8%, to $110 on Tuesday.

Yet few would have predicted such an outcome when Iger first took the job. The Long Island native, whose first job in the business was as a TV weatherman, steadily rose through the ranks of ABC and was initially considered a long shot to succeed Michael Eisner, who had clashed with board members and investors.

But Iger moved quickly to repair damaged relationships with board members and key business partners, including Apple’s late visionary Steve Jobs, who co-founded Pixar Animation Studios. With gems such as “Toy Story” and “Finding Nemo,” Pixar had eclipsed Disney’s in-house animation unit.

Iger pushed Disney to expand globally through a series of savvy deals: the 2006 purchase of Pixar for $7.4 billion, the 2010 addition of Marvel Entertainment for $4 billion and the takeover in 2012 of “Star Wars” creator Lucasfilm, also for $4 billion.

Iger, through a spokeswoman, declined to comment.

“The thing that Bob has done, which is so impressive, is to continue the company’s legacy of pairing great creativity with technology,” Eisner said in an interview. “He has strengthened the company and kept Disney in a leadership role.”

Eisner disputed reports that he was initially skeptical about whether Iger, his handpicked successor, had the chops to lead the company.

“You don’t take someone and make him president of ABC, and then president of the entire company, if you don’t have faith in him,” Eisner said. “I never underestimated him.”

To be sure, there have been missteps. Disney’s $675-million gamble on Maker Studios, a network for YouTube creators, misfired. ABC has struggled to maintain its audience. And ESPN has felt the sting of cable TV cord-cutters, which cut its subscriber base and revenue. And its $400-million investment in Vice Media has yet to pay off.

Disney’s Fox acquisition: Everything you need to know »

Iger recognized nearly two years ago that Disney needed more TV and film firepower if it wanted to challenge Netflix, Amazon, AT&T Inc. and others amassing vast quantities of programming. The Fox assets are key to Iger’s strategy of operating several streaming services, including the family oriented Disney+, which is scheduled to launch later this year.

In August 2017, conversations with Murdoch began with the titans sipping wine at Murdoch’s Moraga Vineyards above Bel-Air and talking about the business. “In the course of reflecting on the growing challenges of the rapidly evolving media industry … the possibility of a strategic transaction involving Disney and 21st Century Fox” emerged, Disney said last year in a filing.

The Disney-Fox deal was unveiled in December 2017 and formally closed Tuesday night. Earlier in the day, the remaining assets of Murdoch’s company, including Fox News and the Fox broadcast network, were spun off into a new company called Fox Corp.

“Disney probably has enough content in its arsenal with ‘Star Wars,’ Marvel and Pixar, but the Fox properties will help give Disney more global strength,” Eisner said. “In many ways, this is an insurance policy to help protect all of these assets and compete, globally, with Netflix, Amazon and, soon, Apple.”

With so many challenges, there’s no guarantee Iger’s latest acquisition will quickly pay dividends. Disney was expected to take on $36 billion in debt to finance the deal, according to analysts.

Disney must find a buyer for Fox’s 22 regional sports networks. Last summer, when the U.S. Justice Department approved the Disney-Fox transaction, it told Disney to divest the regional cable channels because the company already owned ESPN. Disney had hoped a sale of those channels could generate as much as $20 billion, to defray the costs of the Fox assets, but the auction has not generated a frenzy of buyers.

Iger also must meld two distinctly different cultures. Thousands of Fox employees must adapt to Disney’s way of doing business. In addition, more than 3,000 workers are expected to lose their jobs as Disney tries to merge two organizations and reduce expenses.

“The Fox culture is very different from the Walt Disney culture, and that could end up being a problem,” said Martin, the analyst. “The cultural integrations are one of the biggest challenges of making this merger work.”

Disney must figure out how to balance wholesome figures such as Winnie the Pooh, Mickey Mouse and Elsa of “Frozen” with Fox’s sharp-edged characters such as the foul-mouthed Stewie from “Family Guy” and Bart Simpson. Iger has said the more boundary-pushing fare will appear on Hulu — not Disney+.

Another challenge is creating a streaming service with technology that will live up to Disney’s famously high standards. Competition will be fierce. Netflix and Amazon have had about a 10-year head start, and other rivals, including Comcast Corp. and AT&T’s WarnerMedia, also plan their own digital services.

“They have to make sure that their direct-to-consumer service works. It’s their biggest, boldest strategic move,” Reif Ehrlich said. “And, longer term, there is the question: When does Bob leave?”

Murdoch asked Iger to stick around to manage the integration of the two companies and launch of Disney+. Iger’s contract, which was due to expire this year, instead was extended to June 2021.

There are three internal candidates who could eventually take the reins from Iger: Kevin Mayer, chairman of Disney’s direct-to-consumer efforts, which include the streaming services; Bob Chapek, Disney’s parks and resorts chairman; and Peter Rice, a longtime Fox executive who joined the company this week as chairman of Walt Disney Television.

And there’s always the prospect Iger might stay longer or that Disney’s board could tap an outsider.

“When Iger leaves, those will be very big shoes to fill,” said Bill Simon, who leads the Los Angeles media and entertainment group at executive search firm Korn Ferry. “The next generation of leadership will have different skills and experience than Bob.”

Twitter: @MegJamesLAT

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.