GM says it could fail in a matter of weeks

Reporting from Washington and Los Angeles — Turning to Washington for a lifeline, General Motors Corp. has asked lawmakers for up to $18 billion to stave off collapse, promising in return to slash executive pay and jettison its poorly performing brands.

GM, along with Ford Motor Co. and Chrysler, submitted its restructuring plan to Congress on Tuesday, the same day domestic and foreign automakers reported a withering 37% U.S. sales decline.

The depths of GM’s troubles were brought fully to light in its proposal, released late Tuesday. In November, GM said it could run out of operating cash sometime in the first six months of 2009. Now it appears that GM could fail in a matter of weeks without immediate aid.

“There is no Plan B,” said Fritz Henderson, GM’s president and chief operating officer, who faces a 30% pay cut himself. “Frankly, the shortage of liquidity does focus the mind.”

Together, the Big Three U.S. automakers are asking Congress for $34 billion in low-cost government loans -- $9 billion more than the roughly $25 billion the automakers had sought just last month.

GM said it would need $4 billion immediately to avoid complete collapse before year’s end, plus $8 billion early next year. On top of that, the company wants access to a $6-billion line of credit. Last month it had requested $10 billion to $12 billion.

“Absent support, the company can’t fund its operations,” Henderson said.

For its part, the automaker said it would eliminate or sell its Saab and Saturn brands, shrink its venerable Pontiac division to a few niche models, lay off tens of thousands of employees and put nearly 2,000 dealers out of business.

GM also said it would reduce pay 20% or more for four top executives and pay Chairman and Chief Executive Rick Wagoner a $1 annual salary.

Chrysler again requested $7 billion in a bridge loan to help it operate through 2009. Ford, which last month sought $7 billion to $8 billion, asked for a $9-billion line of credit but took pains to point out that it might not need the money.

The three Detroit automakers prepared their plans at the behest of Congress, which sent the companies’ top executives home last month after excoriating them for failing to make a compelling case for taxpayer support.

This week the executives will return to Washington -- driving, this time, instead of taking private jets. They are set to appear before the Senate Banking Committee on Thursday and the House Financial Services Committee on Friday. A vote on a bailout could come next week.

House Speaker Nancy Pelosi (D-San Francisco) said the plans would be reviewed by congressional committees, the Federal Reserve, the Government Accountability Office and Bush administration officials.

“We want to see a commitment to the future. We want to see a restructuring of the approach that they have -- a new business model,” she told reporters Tuesday.

At the same time, Pelosi said, the government had little choice but to help one of the nation’s most important industries. “Everybody is disadvantaged by bankruptcy, including our economy, so that’s not an option,” she said.

Both Chrysler and GM have repeatedly dismissed the idea of filing for bankruptcy protection and continued to do so Tuesday. Still, GM’s plan indicates that at current spending levels, it would run out of cash sometime this month.

The latest bleak window into Detroit’s troubles came on the same day that the industry as a whole reported the worst U.S. sales month since January 1982, according to Autodata Corp.

GM, in reporting its own 41% sales decline from a year earlier, painted the results with an even darker brush. According to GM’s chief sales analyst, Mike DiGiovanni, the month’s sales, adjusted to reflect population growth, were the worst since 1958.

The new dealer data, combined with Monday’s official certification that the U.S. has been in recession since last December, “will embolden Congress to act quickly,” predicted Thomas Mann, a senior fellow at the Brookings Institution.

The weak sales numbers will only bolster their case, noted Wes Brown, an auto industry specialist at marketing firm Iceology. Overall sales for the U.S. carmakers are down 22% year to date.

“If I’m the Big Three, I’m going to Washington and pointing out the sales numbers,” Brown said.

The automakers’ plans share many similarities. Not only would all three chief executives take a salary of just $1 next year, but the three automakers have also drastically reduced, if not altogether eliminated, bonuses and raises this year and next.

All three would also commit to producing far more fuel-efficient vehicles such as hybrids and electric cars. For example, Ford pledged to produce an electric van by 2010 and electric passenger cars by 2011.

Ford has said it would explore the sale of its Volvo brand but indicated that it would not necessarily need access to the $9-billion line of credit it requested.

“Ford is in a very different situation from our competitors because we believe our company has the necessary liquidity to weather this downturn,” said Jim Farley, Ford’s head of sales and marketing. Ford mortgaged much of the company to borrow $23 billion in late 2006, a crucial decision that has protected it -- somewhat -- from the down market.

In its business plan, Ford said it was on track to return to profitability by 2011. Through the third quarter of this year, Ford has lost $8.7 billion, while GM has lost more than $21 billion. GM executives have said the company has been unable to borrow money in the last six months.

As a privately held company, Chrysler does not open its books, but it said in Tuesday’s plan that a “perfect storm” of declining sales, frozen credit markets and a weak global economy had “jeopardized our ability to complete the dramatic restructuring plan that we began in 2007.”

In a plan relatively short on detail, Chrysler suggested that a merger or manufacturing alliance with another automaker could save it as much as $9 billion a year.

Of all three proposals, GM’s is by far the most sweeping.

The company seeks to reduce its debt load to $30 billion from $62 billion, in part by persuading bondholders to swap their bonds for equity in the company.

Such a move has been criticized by debt-rating firms, which warn that they might view it as a default.

In addition, with government money in hand, GM would reduce the models it sells in the U.S. to 40 by 2012, from 48 today. It would also increase efficiency at factories while closing nearly a dozen of them and reducing its workforce to as few as 65,000 hourly employees from 96,000 today.

GM also said it would sell or retire its Saturn and Saab brands and transform Pontiac from a stand-alone brand to a “niche specialty” line sold in Buick-GMC-Cadillac dealerships. At the same time, it would thin the ranks of its dealers to 4,700 from 6,540.

That could be extremely costly, because closing dealers and eliminating brands can cost billions because of franchise agreements signed by the automakers. Wagoner indicated that GM did not have all the answers at this time.

“This marks the beginning of the process,” Wagoner said in a conference call with reporters. “These aren’t the kinds of things we like to do, but we have to be robust enough to handle them.”

Separately, GM held a call with dealers Tuesday to discuss its plans. Details were not made public.

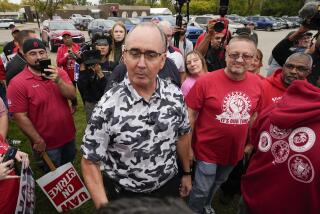

The company also suggested that it would seek concessions from the United Auto Workers. The union has called an extraordinary meeting in Detroit today, and its leadership has expressed willingness to bend in a few areas, including reducing or ending the “jobs bank” program that continues to pay workers from factories that are idled or closed.

How Congress receives the industry’s new road maps remains to be seen.

Sen. Carl Levin (D-Mich.) contends that some sort of financial aid is crucial. “Everybody around the world is in essentially the same situation. . . . and other countries are clearly coming to the support of their auto industries because of the importance of these jobs to their economies,” Levin said.

Bensinger and Puzzanghera are Times staff writers.

jim.puzzanghera@

latimes.com

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.