California’s use of coal drops dramatically — to almost nothing

- Share via

When it comes to dependence on coal, California is not exactly West Virginia.

But it is still striking to see that the Golden State’s use of coal to generate electricity has dropped so dramatically — essentially going from small to almost microscopic.

Two recent reports from the U.S. Energy Information Administration drive the point home.

First, the share of California’s total megawatt hours of power generated by burning coal dropped from 1% in 2007 to just 0.2% in 2015.

Second, in a report that the agency released last week, California saw a 96% decrease in coal-fueled electric power consumption during the same time frame. That is the steepest fall by percentage of any state.

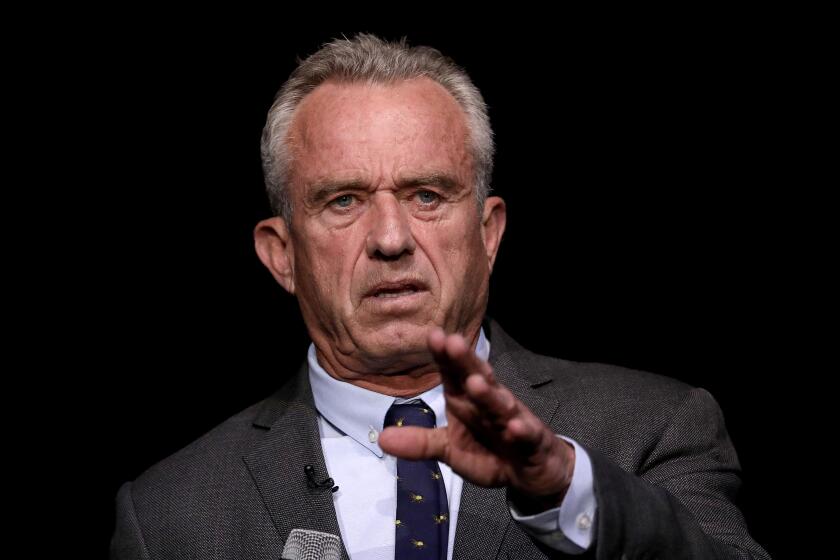

“As a provider of power into the grid, [coal in California is] dead as a doornail,” said Bill Corcoran, western regional director for the Sierra Club’s Beyond Coal campaign.

Nationally, consumption of steam coal — used for electricity generation — fell from more than a billion short tons in 2007 to 739 million short tons last year, a 29% drop.

Coal’s decline is largely a result of two factors: utilities switching from coal-fired to natural gas-fired power plants because of low prices for the latter fuel, and government rules aimed at making the air cleaner and hastening the adoption of renewable energy sources.

For example, the 1,636-megawatt coal-fired Mohave Generating Station in Laughlin, Nev., shut down at the end of 2005. Southern California Edison had a 56% interest in the plant.

There is only one active coal-fired electricity generating plant in the state, according to the California Energy Commission: the Argus Cogeneration Plant in the high desert town of Trona. Two other coal-fueled plants in Bakersfield — Rio Bravo Jasmin and Rio Bravo Poso — are on “indefinite shutdown.”

In California, one of the regulations that put a major crimp on coal was the Greenhouse Gas Emissions Performance Standard Act, passed in 2006.

“What the bill basically said is, if you’re going to sell power in California, you have to be as clean as the power that we burn here in California,” said Dan Jacobson, legislative director for the advocacy group Environment California.

But the mining industry is quick to point out that electricity rates in California are among the highest in the country.

When it comes to the average retail price of electricity, California ranks eighth-highest in the nation and sixth-highest for the continental U.S., at 15.15 cents per kilowatt hour.

“You in California are already paying a lot for electricity, at least in part because you use so little coal, which is so cheap,” said Luke Popovich, vice president of external communications at the National Mining Assn.

While California’s rates are higher, the state consumes less electricity per household than most others. That’s partly because of mild weather along the coast but also the greater efficiency of household appliances used in the state.

California’s average monthly bill in 2014 was $23 less than the national average.

“Energy efficiency has been an important part of California’s energy policy in not only reducing pollution from dirty fuels like coal, but helping consumers use less power to do more work,” Corcoran said.

See the most-read stories this hour >>

As the use of coal has dropped, natural gas has risen. It’s now the largest single source of power generation in California.

In 2005, natural gas made up about 48% of in-state electric generation. In the most recent figures from the California Energy Commission, that number jumped to 61.3%.

“It’s great that we’re dropping coal, but it’s bad that we’re picking it up with natural gas,” Jacobson said. “What we need to do is move away from fossil fuels and go toward clean, renewable energy.”

The transition highlights a larger debate that extends beyond California.

“Our electricity prices in this country have been historically low by any standards set in other countries,” Popovich said. “There’s no way those prices are going to stay low as long as we stay on this trend. It’s not going to happen.”

But coal’s critics say the public-health costs linked to pollution have to be taken into account.

The Obama administration and the U.S. Environmental Protection Agency have stepped up enforcement and rules designed to reduce levels of the greenhouse gas carbon dioxide. A 2011 analysis by the Associated Press estimated that 32 mostly coal-fired power plants in 12 states would close because of tougher regulations.

The EPA’s rollout of the Clean Power Plan, which calls for a 32% cut in carbon emissions from hundreds of mainly coal-fired power plants by 2030, has put even more pressure on coal companies.

Even before the rise of nuclear power in the 1960s and increases in wind and solar energy use in recent years, California never had many coal mines. The vast majority of its coal was imported from coal-mining states in the West.

Those numbers have dropped precipitously.

According to the California Energy Commission, the state imported coal from just four out-of-state facilities in 2014 — in Arizona, New Mexico, Utah and Oregon. That was down from seven in 2007. And by 2025, affiliations with all out-of-state coal-fired plants are expected to end.

In 2000, electricity generated by coal and petroleum coke provided about 11% of California’s electricity. The commission expects that percentage to hit zero by 2024.

Jacobson acknowledged the problem of “intermittency” when it comes to solar and wind energy — that is, generating energy when the sun isn’t shining or the wind isn’t blowing.

“We have to be concerned about that, but that means more investment into the [research and development] for solar and wind, in the battery technologies and various programs, not more fracking and coal mining,” Jacobson said.

ALSO

Activision Blizzard to bring live eSports to Facebook

How politics could disrupt the SpaceX rocket revolution

California regulators approve Charter’s takeover of Time Warner Cable

Nikolewski writes for the San Diego Union-Tribune.

rob.nikolewski@sduniontribune.com

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.