Wall Street insiders open up for ‘Money Never Sleeps’

Wall Street is notoriously close-mouthed about its arcane wealth-producing ways, but when Oliver Stone came knocking last year, doors swung open.

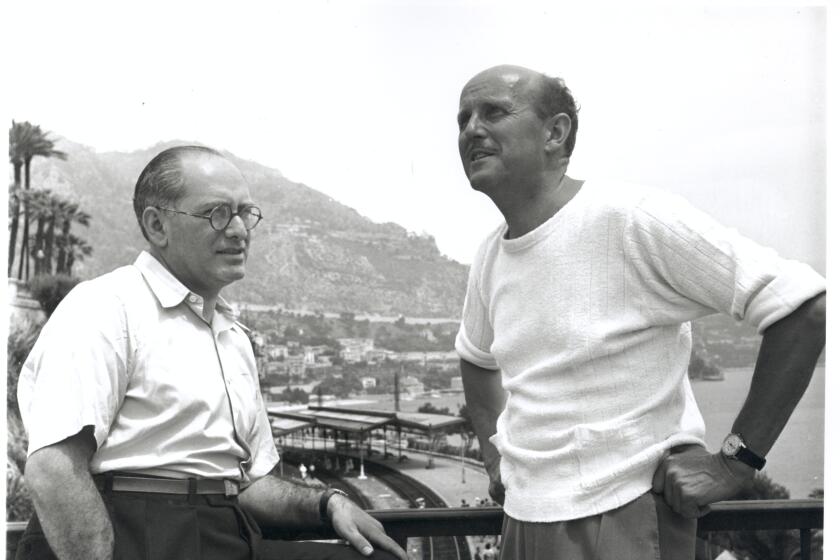

Stone’s new film, “Wall Street: Money Never Sleeps,” includes cameos by Warren Buffett and short-seller James Chanos. The filmmaker shot on Wall Street trading floors given over for the purpose. And he plumbed the wisdom of numerous kings of finance.

When Stone first asked financier Dave Molner to serve as an advisor on the film, Molner said, “That’s not what I do, and you couldn’t pay me enough to make it worth my while. But I’m happy to help you.”

“If nothing else, it’s fantastic bragging rights at parties,” Molner said by way of explanation.

There were a few instances, however, when people and institutions ducked Stone’s invitation for a little background help, the director said in an interview.

“When my name was invoked, sometimes it would strike fear into the hearts of the bankers,” he said. “Certainly Goldman Sachs and [JPMorgan] Chase were not in the market to talk to us.”

But Stone said he made sure to reach out to defenders of Wall Street as well as the critics.

“By talking to people like that, you have the right to question the big shots,” he said.

The involvement of Molner and other Masters of the Universe underscores the continuing complicated relationship between Wall Street and its most unabashed cinematic critic, Stone, whose newest critique of high finance debuts nationally Friday.

The relationship began in Stone’s 1987 film “Wall Street,” which set up the main character, Gordon Gekko, as a cautionary tale about greed run amok but ended up creating a glamorous archetype for a subsequent generation of young traders and investment bankers.

In “Money Never Sleeps,” Stone draws a scathing picture of how the entire Wall Street complex helped create the near-meltdown of the global financial system.

“The ones who run the show, at the top of the totem poll, they completely let us down,” Stone said. “They should have been fired, and some of them should go to jail.”

But the film itself was shaped from beginning to end with cooperation from among the biggest names in the industry — some of whom struggle to explain their affinity for the wily, often anti-capitalist director.

“I’m a registered Republican; I’m a fairly free-market person. But that doesn’t mean I don’t have a good relationship with Oliver Stone,” said Anthony Scaramucci, founder of the hedge fund Skybridge Capital, who pops up in the film as a talking head on a news program. “Oliver Stone is taking a different opinion. He believes that the lower quartile of society is suffering in a megalomaniacal capitalist society — and you know, he’s probably right on some of the stuff he’s saying.”

Vincent Farrell, the chief investment officer at Soleil Securities, had a much simpler explanation: “I’m like everybody else, totally star struck.”

The involvement of Wall Street insiders in the new film began long before the first takes. At the very beginning there was Stone’s father, who was a stockbroker all the way into the 1980s at Shearson Lehman.

“My father was the old school,” Stone said. “Dad would always say things like, ‘There should not be a profit without production,’ and ‘The engine of capitalism — Wall Street — should be geared to productivity.’ ”

Working from this upbringing, Stone created a script for “Money Never Sleeps” with Allan Loeb that he then circulated to financial bigwigs.

The original script involved a hedge fund-related murder, and the first thing Stone heard was that he needed a different plot. Even for ruthless traders and bankers, whacking one of their own was a bit over the top.

“If you are going to do a sequel, here you have one of the great Wall Street stories sitting at your doorstep,” Chanos, the founder of Kynikos Associates, said he told Stone, referring to the credit crisis that hit in 2008.

“We switched it to bankers, because I realized that’s where the action is,” Stone said.

Some advisors say that as the project unfolded they were able to exercise a moderating influence on the director’s view of financiers.

“He was convinced there had to be a single bad guy,” Molner said. “I told him, ‘It’s not that simple. You can’t point to any one person’s actions. But it would be sophomoric to reduce it to one big bad wolf.’ ”

Soon enough Stone had a new script that told a lightly fictionalized version of the crisis, with a firm named Churchill Schwartz that looks a lot like Goldman Sachs, and a Treasury secretary with a bald head who bears an uncanny resemblance to Henry M. Paulson.

As Stone’s actors began preparing for their roles, they spent weeks on the trading floor of firms including Knight Trading and John Thomas Financial watching the traders at their desks and then discussing the subtleties at drinks after work. Sometimes the conversation revealed common interests. When Chanos met co-stars Douglas and Josh Brolin for dinner, Chanos learned that Brolin was an avid day trader.

“We ended up talking about stocks the whole night,” Chanos said.

Once shooting got underway Stone had a financial executive on set the entire time to get the details right. Farrell, a senior executive at Soleil, trudged to the New Jersey set every weekend for a few months and sat at a video monitor keeping tabs of shooting with a runner at his side in case anything looked wrong.

One weekend, Farrell raised questions about a scene in which the villainous bank CEO — based partly on JPMorgan Chase & Co. Chief Executive Jamie Dimon, Stone said — was at a late-night meeting with his tie loosened and his jacket off.

“He would not have his jacket off; he just wouldn’t, because he’s the man,” Farrell said he told Stone. “You might have that with government employees like Tim Geithner, but not with the masters of the universe.”

“Almost every time I said something, he said, ‘OK, we’ll do it that way,’ ” Farrell said.

A few financiers managed to get even more involved. When Stone was scouting for locations, he came across Thomas Belesis, the chief executive of the trading firm John Thomas Financial, and told him to go straight to casting.

“I did a reading and I blew it out of the water,” Belesis said. “He was very impressed, and he gave me a role.”

Belesis, a child of Greek immigrants with a working-class Long Island accent, brought his patented swaggering style to the film. When Belesis was shooting a scene depicting the downfall of a Lehman Bros.-like trading firm, he told Stone, “Listen, let me do it my way because I got a great thought for a scene like this. And he just let me roll with my way.” His “way” involved Belesis strolling out of the office with sunglasses on and a cigar dangling from his mouth.

“He’s a great character. He’s got the Greek warrior — the ‘300’ look,” Stone said.

The final product does not present Belesis and his traders in a terribly favorable light. Gekko is still a scheming manipulator, but as he watches the modern-day firms ramp up their leverage and splurge on credit default swaps, he says, “This puts me to shame.”

This might seem like a rebuke to players like Belesis, who founded a group to defend Wall Street, and Scaramucci, who told President Obama during a recent round table that he was tired of seeing Wall Street treated like a piñata for public bashing.

But both Belesis and Scaramucci said they thought Stone carefully chose his targets and got them right. As Scaramucci put it, “The truth of the matter is that we on Wall Street haven’t done such super great jobs — that’s the facts.”

Molner said that it was largely due to the credibility Stone won 23 years ago from “Wall Street” that beaten-down financialistas were willing to listen to him this time around, which might even provoke some reflection among a crowd not known for deep introspection.

“If you can enjoy the movie and ask a question or two, that’s a good thing,” Molner said. “It can be both entertainment and a support group.”

nathaniel.popper@latimes.com

More to Read

Only good movies

Get the Indie Focus newsletter, Mark Olsen's weekly guide to the world of cinema.

You may occasionally receive promotional content from the Los Angeles Times.