Newspapers place bets on a regional strategy

- Share via

The Los Angeles Times and U-T San Diego will soon share an owner, in a bet that they can usher in a new era of newspapering in Southern California built on geographic strength in numbers.

Combining newspapers in adjacent regions has become the struggling industry’s business model du jour as print publications join forces to share stories, wield advertising clout and cut costs — rather than going it alone.

Largely gone are the days when newspapers were owned by wealthy families, who used the publications to champion their pet causes. That gave way to media corporations with publications scattered in far-flung cities. Now, newspapers are increasingly being realigned by proximity, resulting in pockets of sister papers around the country.

“Smartly done, it makes a lot of sense,” said media analyst Ken Doctor, who cautioned that the experiment doesn’t always work. Nearby newspapers can share content and benefit from merging technology, advertising sales, printing, analytics and other operations.

Consolidation could allow the companies to extend the life of newspapers and generate revenue to invest in digital products and other ventures.

That’s the goal of Tribune Publishing, the Chicago-based company that owns The Times and other newspapers, in acquiring the U-T, eight community weeklies and related websites for $85 million. The deal gives The Times’ parent company an expanded presence in one of the most populous regions in the country, with more than 21 million people in the Los Angeles and San Diego metropolitan areas.

Tribune Publishing’s newly formed California News Group will oversee operations in the two markets. Times Publisher Austin Beutner, who will also become publisher of the U-T and lead the California News Group, said the two papers would remain standalone entities and share stories but has not specified how the consolidation would work.

Media watchers said it’s too soon to say whether Tribune’s clustering strategy will succeed.

The properties face a larger threat as print advertising revenue continues to decline, said media consultant Alan Mutter.

“For newspapers, the existential challenge is you have an extremely aging and shrinking readership and a decreasing demand for advertising among the big advertisers they used to count on,” he said.

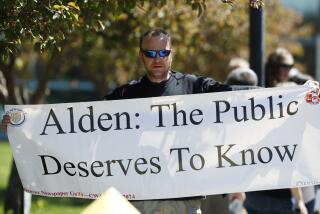

One media company well known for clustering newspapers is Digital First Media. The Denver company has built up a media portfolio across several regions around the country, including in Northern and Southern California.

In the Bay Area, it owns a portfolio of newspapers including the San Jose Mercury News, Oakland Tribune, Contra Costa Times and Santa Cruz Sentinel.

The papers share printing presses and stories, eliminating the need for multiple reporters covering the same beat. Copy-editing and design functions were consolidated into one central desk in the East Bay; for employees who were relocated from the Mercury News, which is located in affluent Silicon Valley, that meant significant pay cuts.

Doctor said Digital First has done “decently” with its consolidation. As a resident of Santa Cruz, he receives community news written by local Sentinel staff while also benefiting from coverage of professional sports teams by the bigger papers.

“They’ve cut way too much in terms of number of journalists and experience, but it is a model that works for business efficiency,” Doctor said.

Douglas M. Arthur, managing director at Huber Research Partners in Greenwich, Conn., surmised that The Times and U-T could merge business functions such as accounting, printing and advertising. The goal, he said, would be to reduce cost on the back end while expanding the properties’ reach in both print and digital.

The papers could also pitch their wider reach to advertisers — and possibly enable them to raise advertising rates.

“It gives you greater scale to leverage digital revenues,” Arthur said. “You can go out to the major digital advertisers — banner advertising, social, mobile, video — with a much bigger audience and potentially charge more.”

But clustering can be a gamble, particularly with respect to maintaining the quality of journalism.

“You basically risk losing the connection with readers by pushing out more content that comes from some type of central editing room that is all of a sudden charged with serving numerous communities as efficiently as possible,” said Gabriel Kahn, co-director of the Media, Economics and Entrepreneurship program at USC’s Annenberg School for Communication and Journalism.

Big regional consolidations don’t always work.

Two years ago, the New York Times sold the Boston Globe for about $1 billion less than it paid for it 20 years earlier. The recession and a shrinking newspaper industry hurt, but differences between New York and Boston also dealt a blow, Arthur said.

“It seemed on paper a great strategic fit, but it didn’t work,” Arthur said. “Are San Diego and L.A. similar enough?”

And in the Southland, Aaron Kushner and Eric Spitz bought Freedom Communications and its flagship Orange County Register in 2012 and tried to build up a regional powerhouse by buying the Riverside Press-Enterprise and launching two new dailies.

Their bold bet on print quickly fizzled. Rounds of layoffs and buyouts ensued and Freedom closed its new dailies in L.A. and Long Beach. In March, Kushner and Spitz stepped down from their executive roles.

Media analysts said they expect the Register to put itself on the market. Freedom Chief Executive Rich Mirman declined to answer questions about a potential sale Friday.

If Tribune Publishing buys the Register, it would give the newly spun-off company additional leverage with advertisers.

“One group that would be able to deliver an advertising reach from the northern edge of L.A. County to the Mexican border — that is a powerful opportunity,” Kahn said.

In an interview this week, Beutner declined to comment on whether the company was looking to make more acquisitions in Southern California. Digital First is exploring several options for its business, including the sale of the entire company or clusters such as its Los Angeles News Group, whose publications include the Daily Breeze, the Los Angeles Daily News and other local publications.

Media analysts point out that outright acquisitions aren’t always needed, especially because in recent years beleaguered newspapers have been more willing to work together.

When acquisitions are made, newspaper companies have to be ready to use the financial savings to make new investments, instead of just looking at them as a way to cut costs, analysts said.

“The No. 1 question for Tribune Publishing,” Doctor said, “is whether it has sufficient time and money as a public company to make the kind of transformation it still needs to make.”

On Friday, Tribune Publishing’s stock gained $1.40, or 8.7%, to close at $17.45.

Twitter: @byandreachang @khouriandrew

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.