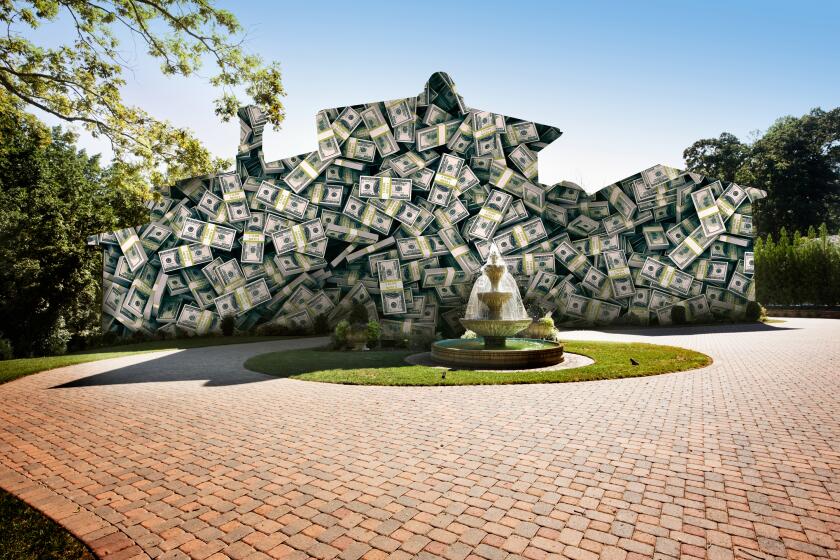

Signs of an easing of credit requirements are surfacing

WASHINGTON — Could the end of the refinancing boom be stimulating slightly more favorable mortgage terms for home buyers? The latest comprehensive study of activity in the market suggests the answer could be yes.

Ellie Mae Inc., a mortgage technology firm in Pleasanton, Calif., conducts a survey involving a massive, nationally representative sample of loans closed each month. Its August findings point to a gradual easing on credit scores for borrowers.

Consider these hard numbers provided by Ellie Mae Chief Operating Officer Jonathan Corr:

•Last month, 30% of all successful applicants for home mortgages had FICO credit scores less than 700, compared with 15% a year earlier. That doubling in just 12 months is significant and tells prospective buyers: Just because you don’t have stellar scores, you can still be approved if your application shows compensating strengths such as steady income, solid recent payment performance on credit accounts, moderate household debt loads and adequate financial reserves in case you run into a rough patch. (FICO scores run from 300 to 850; higher scores signify a lower risk of default for the lender.)

•Average FICO scores are down across the board. Conventional Fannie Mae-Freddie Mac scores for approved applicants dropped a point from July to August to 758. That’s still high in historical terms but down from 764 in November. Federal Housing Administration-insured loans for buyers continued their slow decline, hitting 695 last month versus 702 in April 2012. The biggest drops in scores have been on Fannie-Freddie refinancings as recent interest-rate jumps have scared away applicants. Approved borrowers in August had average scores of 737 compared with 746 in July.

Corr said in an interview that many lenders are seeing refi applications decline sharply, and this may be pushing them to be more flexible and competitive on loans for home purchases.

One example of a major lender loosening up a little: Wells Fargo Home Mortgage has relaxed its minimum down-payment requirement on so-called jumbo mortgages, those with starting balances above the Fannie-Freddie conventional limit of $417,000. Rather than its previous minimum of 20% down, Wells is now accepting 15% on primary residences “in most markets around the country,” company spokesman Tom Goyda said. There is no mortgage insurance requirement, but applicants must have a minimum 740 FICO score, no higher than a 35% total household debt-to-income ratio and 12 months of financial reserves available to them. Essentially, Wells Fargo is saying: If you are a strong candidate on most criteria, we’ll give you the benefit of the doubt and lower the amount of cash you need to bring to the table.

Some mortgage companies say that for well-qualified applicants they can go one step better. Paul Skeens, president of Colonial Mortgage Group in Waldorf, Md., says that he can arrange jumbos with 10% down payments: A standard first mortgage and an accompanying second mortgage or deed of trust that in combination create a 90% loan-to-value ratio for the borrower.

But not everybody in the mortgage market is seeing an easing trend.

The Mortgage Bankers Assn. has reported a slight tightening of lending conditions. The reason: Fewer lenders are offering specialized products such as interest-only mortgages and loans with terms extending beyond 30 years. Both of these features render loans ineligible for the federal “qualified mortgage” designation that is scheduled to go into effect nationwide in January.

Other banned types: Loans with negative amortization, balloon payments and adjustable rate mortgages underwritten at teaser interest rates. Fannie Mae and Freddie Mac have announced that they will not invest in or guarantee loans that are not qualified mortgages.

“I don’t see any easing in lending,” said Bruce Calabrese, president of Equitable Mortgage Corp. in Columbus, Ohio. He cited FHA’s increases in mortgage insurance premiums and Fannie Mae’s recent cancellation of its 3% minimum down payment program as troubling signs for borrowers.

Bottom line here: Credit score requirements are definitely more flexible than a year ago, and jumbo loans might require less cash out of pocket. But we’re still in a highly restrictive market compared with seven or eight years ago near the peak of the boom.

Distributed by Washington Post Writers Group.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.