How the U.S.-China trade deal will ripple through food, finance and energy

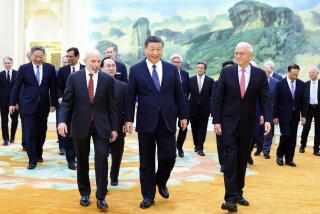

The phase one trade deal celebrated by President Trump and Chinese officials Wednesday received a mixed greeting from U.S. industries and markets. Here is how some in the key sectors expect to be affected.

Agriculture

Agriculture markets fell as traders grew skeptical over the deal’s payoff. Some traders expressed concern that the potential benefits of the trade truce are already priced in to commodities such as soybeans, cotton and hogs that are expected to benefit the most from increased Chinese purchases.

There was also concern over how China would reach its pledge to buy an additional $32 billion above pre-trade war levels over the next two years. The White House offered no details on specific commodity commitments, and China hasn’t agreed to tariff reductions under the agreement.

China committed to importing at least $12.5 billion more agricultural goods this year than in 2017, rising to $19.5 billion next year. China will also “strive” to purchase an additional $5 billion a year in farm products. That could get total purchases next year toward the $50-billion mark.

But doubts have surfaced on whether China will meet that target, particularly because the two governments have said they will keep secret the purchase benchmarks for individual commodities. The market is already looking for real evidence that China will follow through on its pledges of more purchases, and in big amounts.

In soybeans, Brazil already has a freight advantage in shipping goods to China more cheaply than out of the U.S. Gulf. A weakening Brazilian real has also made South American supplies a comparative bargain. Meanwhile, Chinese demand for soybeans could fall as the country deals with its swine fever epidemic, which is shrinking the hog herd and reducing the need for commodities used in livestock feed.

Finance

China brought forward the planned opening of its $21-trillion capital market by eight months, swinging the door open for global investment banks. Goldman Sachs Group Inc., JPMorgan Chase & Co., Morgan Stanley and other firms will now be allowed to apply to form fully owned units to do a broad array of investment banking and securities dealing in the Communist Party-ruled nation in April, compared with an earlier deadline of December.

“China shall eliminate foreign equity limits and allow wholly U.S.-owned services suppliers to participate in the securities, fund management, and futures sectors,” according the text of the trade agreement.

The deadline change was announced in conjunction with the signing of the trade deal, partially resolving a protracted dispute that has weighed on the world’s second-largest economy. It’s part of a broader opening of China’s financial markets, which also includes giving access to its asset-management and insurance markets.

By dismantling the wall to its financial market, China is counting on foreign financial firms to plow $1 trillion in fresh capital into the nation over the next few years, cushioning a slowdown in the economy and helping a transition to a more consumer-led growth model.

Meanwhile, U.S. credit rating firms emerged as one of the winners. The trade agreement means debt graders such as Moody’s Corp. can join S&P Global Inc. in rating debt in China’s $14-trillion bond market. S&P last year became the first wholly owned international firm to rate domestic bonds, while Moody’s efforts to expand its presence in China were held up.

Pharmaceuticals

China agreed to set up a system to resolve conflicts over drug patents, a move that may help U.S. pharmaceutical companies seeking greater protections for their branded medicine in developing nations.

The changes, which take key provisions from a U.S. law on the books for more than three decades, were included in the text of the broader trade pact. Under terms of the deal, patent disputes over potential generic drugs could be resolved before a copycat medicine enters the market in China, and brand companies would be able to seek an order to block any sales until the conflicts are resolved. That’s similar to American law, though the U.S. provides for an automatic 30-month block of regulatory approval once a lawsuit is filed.

Drugmakers would be able to seek extensions of their patents to compensate for “unreasonable” delays in the patent office or while waiting for Chinese health regulators to approve a drug for sale. Patent terms in both countries are for 20 years from the date of application, though clinical tests and regulatory filings often eat up a large portion of that time.

“Robust protection of intellectual property is critical to incentivizing the development of new and innovative treatments and cures,” the Trump administration said in a statement.

The trade deal doesn’t include an agreement on what’s known as “data exclusivity,” which temporarily stops rival firms from using data from the original maker of a product to develop their own versions. Drugmakers have been seeking greater protection for their branded medicines in emerging markets for years. It was a key part of the Trans-Pacific Partnership, the 12-nation deal that excluded China and was canceled when Trump took office.

China also pledged to step up enforcement efforts against counterfeit medicines, including bulk chemicals or active pharmaceutical ingredients, and publicize data on seizures, revocations of licenses and any fines imposed. And it agreed to share information on inspection of sites that make the raw materials for drugs. A Bloomberg investigation last year found that factories in China and India destroyed or hid testing data that showed quality failures.

Energy

China agreed to buy $52.4 billion of additional U.S. energy products. The purchases over two years will include liquefied natural gas (LNG), crude oil, refined products and coal, the U.S. said. It didn’t provide additional details on the energy purchases, which make up about a quarter of the $200-billion total of extra imports that China has committed to.

The accord is a promising sign for the U.S. LNG industry, which is facing a global market awash with excess supply. China, the world’s fastest-growing buyer of the heating and power-plant fuel, hasn’t imported any American cargoes since February 2019.

Though shipments of shale gas from American export terminals completed in the last three years have made the U.S. one of the world’s top suppliers, some newer projects have stalled without Chinese purchasers. The struggle to sign long-term sales contracts has undermined efforts to secure financing for the multibillion-dollar facilities.

U.S. oil exports to China have also slumped because of the trade war. China skipped crude purchases from the U.S. for six months through November, according to data from the U.S. Census Bureau.

Although China has tapered off its imports of American crude oil, the Asian nation hasn’t moved away from its dependence on foreign oil. China imported 10.16 million barrels a day last year, according to customs figures released Tuesday, topping the 10.12 million the U.S. bought at its importing peak in 2005.

Coal will probably be a small component of the trade accord. China is the world’s largest producer of the commodity. The U.S. shipped about $128 million of coal to China last year through November, according to U.S. Census Bureau data.

Tesla Inc., meanwhile, may be the single largest beneficiary of a provision that says China will import more energy storage systems and parts from the U.S. Tesla’s Gigafactory in Nevada is by far the largest battery plant in the U.S., representing 42% of nationwide production, according to data from BloombergNEF.

Although most of Tesla’s batteries go into electric cars, the company has been expanding its business of building massive battery packs that can store electricity for large-scale power grids. In fact, the Palo Alto company is negotiating a contract to supply cobalt — a key component in lithium-ion batteries — to its newly opened Shanghai Gigafactory, according to people familiar with the matter.

China is, by far, the world’s biggest battery producer, with factories capable of cranking out 275,560 megawatt-hours worth of cells. The U.S. is a distant second at 33,116 megawatt-hours, according to BloombergNEF data.