Majority white areas got more PPP business loan money than Latino areas, UCLA study says

Majority white areas of California received more money from the federal Paycheck Protection Program for small businesses than majority Latino areas did, according to a study by UCLA researchers.

The disproportionate amount of PPP money going to wealthier, whiter areas may make economic and racial disparities worse across the state, the study said.

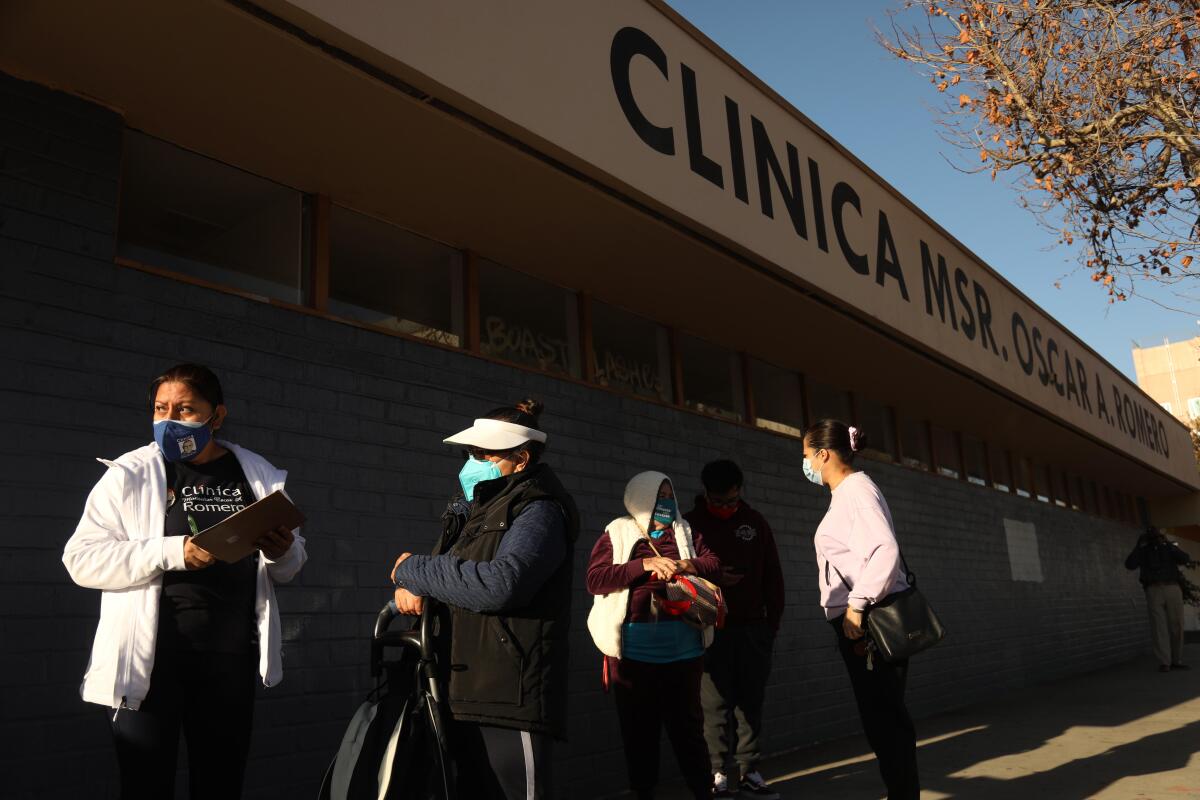

The disparities arose primarily because the loans, which are awarded to businesses affected by the COVID-19 pandemic, were distributed on a first-come, first-served basis by big banks, said Rodrigo Dominguez-Villegas, director of research for the UCLA Latino Policy and Politics Initiative, which released the study on Wednesday along with the UCLA Center for Neighborhood Knowledge.

Larger businesses that had relationships with the big banks were better equipped to get the loans than smaller Latino businesses with fewer banking ties and less knowledge about how to apply, said Dominguez-Villegas, the study’s lead researcher.

The difficulty of obtaining the federal loans, which can be forgiven if a business uses the money to keep workers on the payroll, is a further blow to Latino communities where people are disproportionately falling ill and dying from the coronavirus.

The study “adds to a lot of other evidence that shows that not only is the Latino population being disproportionately affected by the health and economic impacts of the pandemic, but that policymakers are not responding in ways that would allow Latino communities to recover from the pandemic,” Dominguez-Villegas said.

President Biden recently announced a two-week period, from Feb. 24 to March 9, where all PPP loans will go to businesses with fewer than 20 employees. The Biden administration is also trying to make access more equitable by lifting some restrictions and increasing loan amounts to sole proprietors.

The program ends March 31, but Congress is negotiating a new coronavirus stimulus package.

The UCLA researchers analyzed PPP funding in California by congressional district.

Of the 14 majority-Latino districts in California, none were in the quintile that received the most PPP loan dollars.

Congressional districts 44 and 40, home to cities such as Compton, South Gate, Huntington Park and Cudahy, were among the districts that received the least amount of PPP aid.

The 10 districts that received the least funding have a median annual household income of slightly more than $66,000, compared to more than $108,000 for the 10 districts with the most funding.

Rep. Nanette Barragán (D-San Pedro) of the 44th District said in a statement that her constituents, many of whom are working class, low income and people of color, have contracted COVID-19 at higher rates and have been more likely to face economic hardship in the pandemic.

“As a result, many mom-and-pop, minority-owned businesses in our communities have been devastated,” she said. “It is wrong that we have received less in PPP loans than businesses in wealthier neighborhoods that may be better connected. We need to fix this.”

Rosalva Aguilar, whose parents own Tamaleria Maria’s in Lynwood, described a confusing PPP application with a lot of paperwork and back-and-forth between the business and banks.

Aguilar said her parents, immigrants from the Mexican state of Sinaloa, didn’t apply for the first round of PPP funds but did apply for the second for their tamale restaurant, which is in Barragán’s district. They hired a professional to help, but Aguilar fears they won’t qualify because they only have four employees.

Federal funds would go a long way for the family business, she said. Her parents lost about $60,000 in 2020 and need to revamp their space to be COVID-19 safe. Meanwhile, the taxes and bills pile up.

Aguilar said she’s not surprised to learn that wealthier and white majority areas got more money.

“I think it’s unfair, because we’re the most affected communities,” she said. “It comes down to knowledge. People in wealthier areas, they’re more educated and they’re business smart, while people in lower-income areas” are less so.

It’s been frustrating, she said, to see her family’s mom-and-pop restaurant suffer while big chain restaurants get aid.

Betty Jo Toccoli, president of the California Small Business Association, said she does not think the disparities stemmed from race but from the amount of help that local legislators offered to small businesses to navigate the process.

The association needs to do a better job of educating legislators, especially newly elected ones, on the needs of the small-business community, she said.

“A lot of people that were eligible for the federal funding didn’t get it because of the fact they thought they weren’t eligible,” she said. “This was disappointing, but they felt it was too complicated. I think there were not simple, clear instructions.”

In another recent study, focusing on L.A. County, the UCLA Latino Policy & Politics Initiative and the Center for Neighborhood Knowledge found that predominantly Latino neighborhoods got $367 in PPP loan money per resident, compared to $666 per resident in white neighborhoods.

Researchers said they hope that analyzing the data by congressional district will help lawmakers ask for changes that will benefit their constituents.

After the first UCLA study on PPP disparities was published in December, lawmakers earmarked a chunk of the second round of PPP funds to be distributed through community development financial institutions, Dominguez-Villegas said.

As lawmakers wrangle over the next stimulus package, the UCLA researchers gave three recommendations: that some funds are allocated to businesses owned by underrepresented groups, that those businesses are provided with application assistance and that data is quickly available for researchers to analyze.

“The Latino population in California is one of the fastest growing and youngest in the state.” Dominguez-Villegas said. “What that means is that Latinos are the future of California.”

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.