Inside HBO Max’s scramble to launch a massive bet on streaming

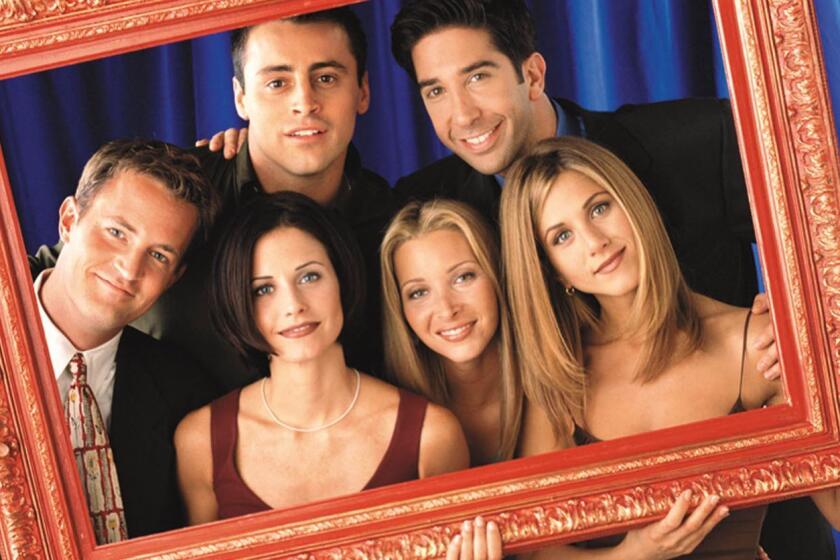

Pairing Tony Soprano with Elmo and Chandler Bing was always going to be tricky.

Would the murderous mob boss befriend a red muppet? Forget about it. Nor would Tony Soprano have much patience for the wiseguy antics of Chandler Bing, the neighbor from “Friends.”

Yet here they are, pillars of a new streaming service, HBO Max, that rolls out May 27. Ever since telecommunications giant AT&T bought Time Warner nearly two years ago and renamed the company WarnerMedia, executives have been building toward this event. HBO Max’s launch will be a watershed moment as a major Hollywood player for nearly a century attempts a high-wire pivot into a new media powerhouse.

But in figuring out how to market HBO Max, WarnerMedia executives confronted inherent conflicts. There are already three other HBO-branded products: HBO, the premium television channel; HBO Go, an app for subscribers to watch shows on the go; and HBO Now, a stand-alone service dedicated to the network’s signature programming. How do you make the fourth, and possibly the grandest, iteration stand out, particularly in a pandemic?

To lure new customers, the company has long envisioned combining its signature HBO programs, such as “Game of Thrones,” “The Sopranos” and “Succession,” with more commercially oriented original shows and the deep Warner Bros. library of TV hits, cartoons and movies.

But the supermarket approach to HBO, which for years has operated as an island of excellence and sophistication, creates the risk of a disconnect for viewers: Queen Daenerys and her dragons from “Game of Thrones” coexisting with Dorothy and Scarecrow from “The Wizard of Oz,” and Scooby-Doo, Tweety Bird and Elmer Fudd.

“The HBO brand has always been the premium brand in television,” said Deana Myers, a research director at S&P Global Market Intelligence. “But now they are doing originals for HBO Max, including reality shows, that look nothing like an HBO show. I think they are going to confuse the brand.”

Another challenge: The production shutdown caused by the coronavirus outbreak disrupted WarnerMedia’s plans to have a robust slate of original programs to promote. Streaming services have found that originals are a key tool in recruiting new subscribers. When it goes live, HBO Max will offer just six fresh shows.

HBO Max launched Wednesday.

In addition, HBO Max will be offered at $14.99 a month, making it the priciest streaming service. Netflix’s most popular plan is $13 a month. HBO Max’s higher rate may discourage some consumers, given skyrocketing unemployment.

WarnerMedia has offered a teaser rate — $11.99 a month for a year — for customers who sign up before the May 27 launch.

Executives believe that, with 10,000 hours of studio-produced content, subscribers will find that HBO Max is worth the price, and that scores of binge-viewers will be hungry for a fresh trove of quality programming. AT&T predicts that HBO Max will have 50 million customers in the U.S. by 2025, and it promised to spend $4 billion on the service over the next three years.

“We’re going to put all of our muscle behind HBO Max,” Bob Greenblatt, chairman of WarnerMedia Entertainment and Direct-to-Consumer, said in an interview. “We think we have a really good and valuable product to offer.”

HBO has long been a leader, dating to its 1972 birth. It was the first U.S. network to use satellites to deliver its programming. It wrote the rules on premium TV, then ambitiously carved out its niche in prestige television in the late 1990s and early 2000s with such culture-setting programs as “The Sopranos,” “Sex and the City” and “The Wire.”

But the rapid acceleration of cord-cutting and the rise of streaming have forced legacy networks like HBO to adapt to the new digital TV world.

HBO Max is bringing up the rear in the streaming wars.

The years-old streaming skirmish has now become a pitched battle — for talent, for money, for your time and your eyes— as Apple, Disney, HBO and NBC to enter the fray with major subscription services.

Rivals Apple TV+ and Disney+ launched in November at $4.99 a month and $6.99 a month, respectively. Last month, NBCUniversal offered a free preview of its Peacock service to customers of parent company Comcast. Jeffrey Katzenberg and Meg Whitman’s Quibi also clamored aboard. All are racing to catch trailblazers Netflix, Hulu and Amazon Prime Video.

“We were sitting in a position that we had to do this,” said John Stankey, AT&T chief operating officer who ran WarnerMedia until last month.

AT&T is banking on HBO Max to propel its television businesses into the future and prove that its $85-billion purchase of Time Warner wasn’t another costly mistake.

Five years ago, AT&T acquired DirecTV in El Segundo, just as consumers began dropping pricey pay-TV bundles in favor of lower-cost alternatives. As Stankey and other executives worked to make DirecTV fit within AT&T, they were struck by a surge in video use by mobile device customers as technology enabled data-intensive streams. The solution, AT&T figured, wasn’t simply distributing content — it was owning it too.

But the company was dealt significant setbacks. In October 2016, AT&T announced its $85-billion takeover of Time Warner, which was hailed as a marriage of technology and traditional entertainment. With access to more than 170 million customers for mobile, TV and broadband service, AT&T pledged to deliver entertainment like none other.

AT&T’s dealings with regulators, however, turned into quicksand: The Justice Department in 2017 sued to block the merger, which led to a protracted court battle that AT&T eventually won. In June 2018, AT&T consolidated Time Warner. Then came nearly a year of management turmoil.

HBO’s chief, Richard Plepler, and other senior Time Warner leaders departed; new high-level executives were brought in, including Greenblatt, the former NBC Entertainment chairman who took over HBO, the Turner entertainment channels and HBO Max programming. Earlier this month, Jason Kilar, who more than a decade ago helped create rival service Hulu, joined WarnerMedia as chief executive. The new team got on board with Stankey’s mandate that individual Time Warner properties — Warner Bros. studio, TBS, TNT, Cartoon Network and HBO — must collaborate to bolster HBO Max.

Stankey pushed to have the platform ready by early 2020, which proved too optimistic.

“We said: We’ll have more to offer if we have more time,” Greenblatt said, recalling last year’s internal debate. “But we were already the last one in.”

Programming executives recognized the urgency, and scrambled to get shows into production. The group planned for 31 new shows, branded as “Max Originals,” to debut this year. A breakthrough came in late February when the six cast members from “Friends” agreed to an hour-long reunion special to help launch the service.

The slogan for HBO Max is “Where HBO Meets So Much More,” and marketers prepared for a blitz. Billboards were booked. Events were created for the South by Southwest festival in Texas in mid-March and the Met Gala in New York in early May. A three-month ad campaign was scheduled to tip off during the March Madness basketball tournament.

Then the coronavirus outbreak hit.

“We didn’t expect this at the 11th hour,” Greenblatt said.

TV and film production abruptly shut down. WarnerMedia immediately recognized that it wouldn’t be able to stage the “Friends” reunion or finish most of the “Max Originals” planned for the launch.

“We saw what was happening in the world; we didn’t want to be insensitive, but we immediately thought: What will we do with HBO Max?” Greenblatt said. The technology team, including a large group in Seattle, worked quickly to determine whether they could pull off the launch amid so much disruption.

“The tech people said: ‘We can do it.’ ” Greenblatt added. “It became a bit of a rallying cry. Everybody rolled up their sleeves.”

Marketing plans were ripped up.

“It wasn’t the right time to make a grand announcement,” said Chris Spadaccini, a longtime HBO executive who now is WarnerMedia’s chief marketing officer. “There were no live sports, no major cultural awards. We had to be nimble and innovate.”

Promotions were put on hold for more than a month, until April 22.

That’s when ads were unleashed to drive home the depth and breadth of HBO Max. “We’ve Got the Heroes,” teases one HBO Max ad that depicts Aquaman, Wonder Woman and Superman. Another boast: “We’ve Got the Redheads,” which portrays Conan O’Brien and Elmo, among others. There was another hoped-for pairing: Oscar the Grouch and Larry David of “Curb Your Enthusiasm.” But David said “no,” Spadaccini said.

Not all the pieces worked. One tweet riffed “Where Bada ... Meets Bing ... Meets Bang,” with side-by-side photos of James Gandolfini, a.k.a. Tony Soprano, next to Matthew Perry, a.k.a. Chandler Bing, and Jim Parsons of “The Big Bang Theory.” The news site Fast Company decried the mash-up, claiming: “HBO Max is a Branding Disaster, and This Ad Proves It.”

Spadaccini brushed off the barb.

“While everyone is entitled to their opinion, we’ve gotten many more people who have weighed in saying they found the campaign thoughtful, clever and intriguing,” Spadaccini said. “The way we’ve told the story of HBO Max is in its own unique brand voice, which isn’t the brand voice of HBO, which is very prestigious and premium.”

But the flap underscores lingering worries about whether HBO will retain the qualities that make it special.

“My favorite question,” Greenblatt said, feigning dismay. “The goal is not to denigrate HBO, but to lift it up with this large platform. We’re not throwing everything and the kitchen sink into it. We’re actually being very discerning about the things that we don’t think people are going to care about or want to watch.”

Besides, the world has moved on: HBO no longer is the only destination for award-winning content.

Stankey, who is poised to become AT&T’s chief executive in July, has long argued that HBO needed more heft. One reason was because HBO, like other niche services, suffered a flight of customers when marquee shows such as “Game of Thrones” went on hiatus or ended. Beyond “Sesame Street,” HBO didn’t offer much children’s programming, which is a key driver for subscription sales to streaming services.

“HBO is an extraordinary service with an extraordinary brand,” Greenblatt said. “But it’s also vulnerable in a world that now has super giants, Amazon and Netflix and Disney, these platforms that go right to your home and have all of this great content.”

Some critics have dismissed HBO Max’s prospects, saying its appeal could be limited to movie buffs or those who already subscribe to HBO. And then there’s lingering confusion about the various HBO products.

WarnerMedia executives say such criticisms miss the mark.

“Customers who didn’t think we had anything for them — they may come in the door from the Max side,” Greenblatt said. “Then they will get exposed to programming from HBO they never would have seen before, like “Insecure,” “Veep” or “Barry.”

There will be six “Max Originals” ready at launch, including “The Not Too Late Show With Elmo”; “Love Life,” a romantic comedy anthology starring Anna Kendrick; and “On the Record,” a high-profile documentary about Russell Simmons’ accusers. Additional originals will quickly be added to the service, including the 1930s L.A.-based period piece “Perry Mason,” an HBO original starring Matthew Rhys in late June, and the mystery “The Flight Attendant” with Kaley Cuoco.

Much of the viewing is expected to be content from the Burbank-based Warner Bros., which has the most enviable library in Hollywood. It has steered to the platform “Crazy Rich Asians,” the “Lord of the Rings” trilogy, “A Star Is Born,” as well as all 236 episodes of “Friends;” all 279 episodes of “The Big Bang Theory,” and “The Fresh Prince of Bel-Air.” HBO Max also boasts classics, including “The Jetsons,” “Casablanca,” “Citizen Kane” and “When Harry Met Sally.”

Next year, HBO Max will premiere Zack Snyder’s director’s cut of “Justice League” from Warner Bros. Pictures and DC, heeding calls from fans who agitated for its release.

HBO Max boasts 10,000 hours of programming, including “Game of Thrones,” “Friends” and “The Fresh Prince of Bel-Air”

The pandemic has inspired other fare, including an upcoming cooking show featuring Selena Gomez and her grandfather, inspired by their quarantine routine.

“It’s difficult now, more than ever, to stand out,” said Meredith Gertler, executive vice president of content strategy and planning for HBO Max and HBO. “But I’m a firm believer that the cream always rises to the top.”

HBO Max is expected to have a slower international rollout because of existing contracts with foreign broadcasters with the rights to HBO programming.

But Eunice Shin, a San Francisco-based analyst and partner in the consulting firm Prophet, said HBO Max’s launch amid the coronavirus crisis may be fortuitous.

“COVID-19 put the craziest spin on the streaming wars,” Shin said, noting that millions of viewers have spent hours over the last two months streaming content. “There’s now a joke that goes: ‘OK, I’ve finished Netflix. What’s next?’ And here comes HBO Max, with this huge library.”

Ultimately, though, in order to compete with big-spending rivals such as Netflix, HBO Max will need to demonstrate its value to consumers.

“There needs to be a reason to subscribe to HBO Max beyond ‘we have all this great content,’ ” Shin said. “Will the content be strong enough to keep people paying each month? If they don’t have that — or enough original content — then it’s going to be a real struggle.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.