Weinstein Co. bidders move to revive deal after meeting with New York attorney general

Former Obama administration official Maria Contreras-Sweet moved closer to reviving her proposed purchase of the Weinstein Co.’s assets, in the first sign of life for the sale process since the New York attorney general’s office sued the company.

Joined by a team of lawyers and bankers, Contreras-Sweet met with New York Atty. Gen. Eric Schneiderman for three hours in an effort to salvage her bid on Wednesday, according to people briefed on the talks.

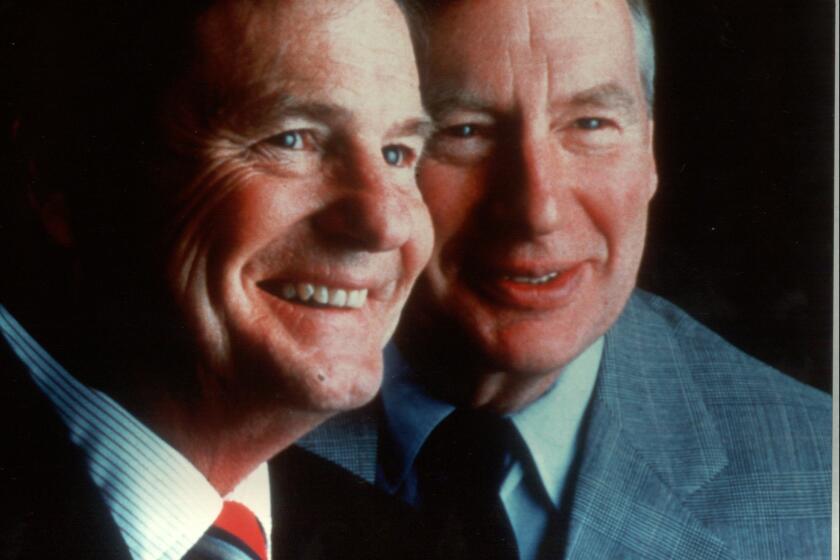

The investor group led by former U.S. Small Business Administration head Conteras-Sweet and backed by billionaire Ron Burkle had been close to a $500-million deal to buy the New York entertainment company earlier this month.

Those plans came to a sudden halt Feb. 11 when Schneiderman’s office filed a lawsuit accusing the studio’s board and management of being complicit in Harvey Weinstein’s alleged abuse of women.

The attorney general, a Democrat, demanded that Weinstein’s accusers be adequately compensated, and sought assurances that employees would be protected, and that people who enabled Weinstein would not be rewarded in the sale.

Contreras-Sweet’s bid promised to remake Weintein Co. as a new, female-friendly enterprise that would establish a fund to compensate Weinstein’s accusers. Schneiderman openly questioned those plans in public remarks, saying that documents his office reviewed did not mention a dedicated victims fund beyond a $10-million line of credit.

At the attorney general’s office in Manhattan, Conteras-Sweet and Burkle made the case for her plan to raise at least $40 million for victims by selling off Weinstein Co. film and television projects, on top of the $10-million credit line, said people familiar with the proposal.

The meeting, described as productive, is the first step toward resolving the issues with the proposed deal. Still, the two sides remain days away from an agreement that will allow the sale to proceed, said one person familiar with the matter who was not authorized to comment.

Though Schneiderman has expressed concerns with the deal, it does not appear he wants to scuttle it. If a deal is not reached, Chapter 11 bankruptcy likely awaits the company, which Weinstein and his brother, Bob, founded in 2005. If that happens, victims’ claims would fall behind a long list of secured creditors.

“The last thing the attorney general wants is to be seen killing this deal,” said corporate law expert Larry Hutcher, co-managing partner of Davidoff Hutcher & Citron LLP. “Nobody’s walking away with anything in the event of a bankruptcy. It would be a fire sale of the assets.”

The bidders have offered to buy the company for $275 million and assume $225 million in debt. Burkle, a major donor to the Democratic Party, would take a roughly 20% stake in the new company.

The meeting comes just days after Weinstein Co.’s board of directors fired President and Chief Operating Officer David Glasser. Schneiderman singled out Glasser in a news conference, saying he failed to protect women who had complained about the executive’s behavior.

Glasser has retained a law firm to sue the studio and its directors for wrongful termination, with his lawyers saying he is being scapegoated by the board. Seeking $85 million in damages, the lawsuit will allege retaliation, breach of contract and defamation.

“Mr. Glasser worked tirelessly to protect the employees of the company from Harvey Weinstein’s frequent outbursts,” Eve Wagner, a founding partner of Sauer & Wagner LLP, said in a statement Wednesday. “Numerous documents and emails clearly show that Mr. Glasser acted appropriately and responsibly whenever allegations of misconduct were brought to his attention.”

The once-influential studio has been trying to avoid bankruptcy since Harvey Weinstein was accused of sexual harassment and assault by dozens of women. The allegations have led to criminal investigations and lawsuits against the producer in multiple cities and sparked a movement across media and government to oust men accused of misconduct.

Weinstein, who was fired by the board Oct. 8, has denied all allegations of nonconsensual sex.

The claims have resulted in mounting legal woes for Weinstein and his former studio.

Weinstein Co. on Tuesday filed a motion to dismiss a federal class-action lawsuit against the company filed in December that described a massive scheme that the plaintiffs’ lawyers say facilitated predatory behavior by Weinstein.

Weinstein Co. said Weinstein acted alone in his alleged abuses and that most of the incidents occurred more than a decade ago.

On Tuesday, Harvey Weinstein also asked the court judge to toss the suit, which additionally named Weinstein’s former studio, Miramax, as one of the defendants. Weinstein’s lawyers argued that the suit’s racketeering claims are subject to a four-year statute of limitations, and that the plaintiffs’ proposed class designation is too general.

Twitter: @rfaughnder

UPDATES:

3:45 p.m.: This article was updated to include information from the meeting with the New York attorney general.

Feb. 21, 8:55 a.m.: This article was updated with a statement from Eve Wagner, a lawyer for David Glasser.

This article was originally published Feb. 20 at 9 p.m.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.