Colony Capital has pulled out of talks to acquire Weinstein Co., sources say

Colony Capital is no longer interested in buying Weinstein Co., the mini-studio co-founded by disgraced movie mogul Harvey Weinstein, according to two people close to the collapsed deal talks.

The company behind “The King’s Speech” and “Django Unchained” has been reeling from the scandal that has continued to widen since Harvey Weinstein, formerly its co-chairman, was accused last month of sexual harassment and assault by multiple women. He was fired Oct. 8.

Colony said in mid-October that it would provide Weinstein Co. with a cash infusion to stabilize its operations as it explored an acquisition of all or part of the studio during an exclusive negotiation period.

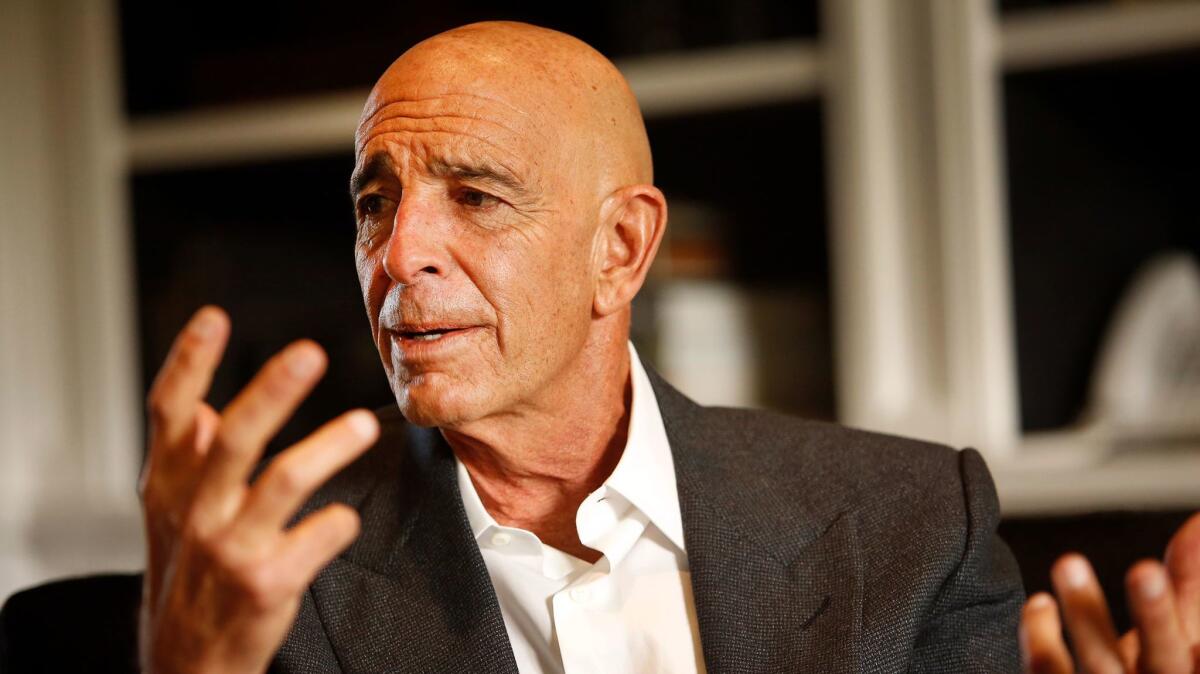

But soon after, there were clear signs the deal was faltering. Colony pulled out of the agreement to provide rescue financing, and founder Thomas Barrack compared the struggling studio to a dying patient. Barrack told Bloomberg TV that no one wants a deal that would benefit Harvey Weinstein, who still owns 23% of the company.

Colony and Weinstein Co. disagreed over price. The board maintained the company could fetch roughly $300 million, said people familiar with the talks who were not authorized to comment.

Some parts of the company still are believed to have value, including the television production arm that makes “Project Runway” and its robust library of films. However, the association with Weinstein has depleted the value of the company, according to financing experts.

Weinstein Co. did not respond to a request for comment Tuesday. Colony Capital declined to comment.

Weinstein Co. is now trying to line up $20 million to $40 million in capital to stay afloat as it explores options, said a person close to the matter who asked not to be named because the talks are supposed to be private. The company hopes to use its film library as collateral against such a loan, though that would be in addition to previous financing backed by the library, one knowledgeable person said.

It remains unclear who would swoop in to provide the company with a lifeline. New York equity fund manager Fortress Investment Group had been in talks to provide $35 million in capital to the company, according to people close to the discussions, but no deal has materialized.

Colony’s latest move is another sign that the company is teetering on the brink of bankruptcy after years of struggles well before allegations of Weinstein’s misconduct were first published by the New York Times and the New Yorker.

Weinstein Co. has engaged business advisory firm FTI Consulting to help with a possible restructuring, said people familiar with the matter who were not authorized to comment.

If no bankers are able to agree on terms for funding the Weinstein Co., the New York-based studio will likely have to file for Chapter 11 bankruptcy protection. That process could lead to a sale of assets and protect prospective buyers from liabilities that would come with a deal.

“I see no chance of anything happening outside of a bankruptcy proceeding,” said Los Angeles investment banker Lloyd Greif. “The only thing that surprises me is that they haven’t filed already.”

Meanwhile, the sexual misconduct scandal has continued to spread, with new criminal investigations into Weinstein’s behavior and a civil lawsuit against his company. The New York Police Department last week said it had received a “credible” rape allegation from an actress and was gathering evidence for an arrest warrant.

There’s also the specter of a growing legal battle between the firm and Weinstein over his ouster. On Oct. 26, Weinstein sued the company to obtain his email and personnel file, which he says will help him defend himself against allegations of sexual abuse that led to his firing.

ABC News first reported that Colony had ended takeover talks.

Times staff writer Richard Winton contributed to this report.

Twitter: @rfaughnder

UPDATES:

2:10 p.m.: This article was updated to say Weinstein Co. has engaged a consultancy to prepare for a possible restructuring, according to sources.

11:15 a.m.: This article has been updated with additional information about Colony Capital’s collapsed talks with the Weinstein Co.

This article was first published at 8:40 a.m.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.