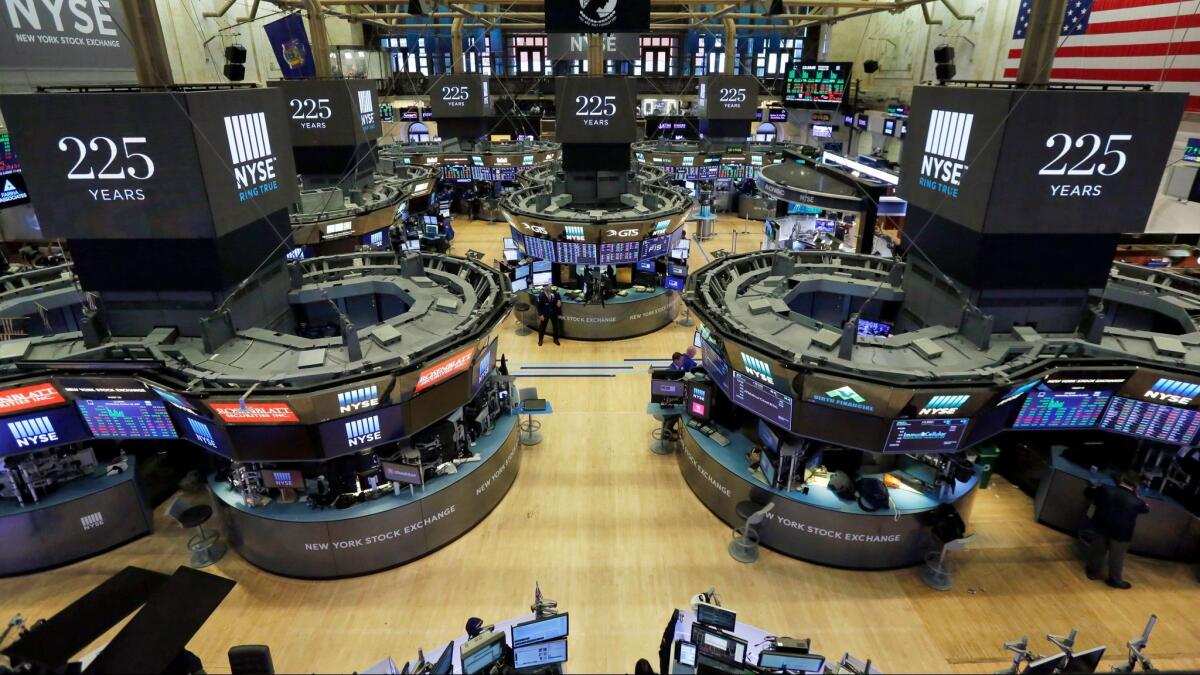

Bond yields jump, upending stocks’ rally

U.S. stocks closed broadly lower Wednesday, erasing a gain, as investors reacted to a surge in bond yields late in the session.

Bond yields climbed to their highest level in four years after the Federal Reserve released minutes from its latest policy meeting. The minutes showed bullish sentiment among policymakers, confirming their intention to raise interest rates this year.

The yield on the 10-year Treasury note rose sharply after the minutes came out, touching 2.95%, its highest level since January 2014. Higher bond yields indicate investors expect more risk of inflation. They also can threaten stock prices by making bonds more appealing than stocks.

“We’re moving back to normal volatility. We’re moving back toward normal interest rates, normal inflation,” said Erik Davidson, chief investment officer for Wells Fargo Private Bank. “This is what normal looks like.”

The Standard & Poor’s 500 index ended the day down 14.93 points, or 0.6%, at 2,701.33. The Dow Jones industrial average fell 166.97 points, or 0.7%, to 24,797.78. The blue-chip average was up 300 points earlier in the day.

The Nasdaq fell 16.08 points, or 0.2%, to 7,218.23. The Russell 2000 index of smaller-company stocks shed most of its gains from earlier in the day. It ended up 1.84 points, or 0.1%, at 1,531.84.

The major stock indexes started the day on pace to recoup some of the market’s Tuesday losses as investors sized up the latest company earnings.

Technology companies, retailers and industrial stocks led the way much of the day. The rally kicked into higher gear shortly after the Fed minutes release.

Traders appeared to initially welcome the details in the meeting minutes.

Then bond yields began to climb, and the day’s stock gains began to evaporate. For a while, bank shares jumped in response to the rise in bond yields, as higher bond yields can benefit banks by enabling them to charge higher interest rates on loans. But soon bank stocks also slid into the red.

The yield on the 10-year Treasury, which is used as a benchmark for mortgages and other loans, has been rising in recent months from a recent low of 2.04% in September.

Despite the broader market slide, investors bid up shares in some companies that reported better-than-expected earnings or outlooks.

Advance Auto Parts vaulted 8.2% to $114 after reporting better earnings than analysts expected. The stock was the biggest gainer in the S&P 500. Rival auto parts retailer AutoZone rose 0.9% to $719.49.

La-Z-Boy also got a lift from its latest quarterly report card, rising 9.9% to $31.75.

Walmart continued to slide, falling 2.8% to $91.52 the day after its biggest single-day drop in 30 years.

Devon Energy slid 11.8% to $30.57 after the energy company disclosed a smaller-than-expected profit and 2018 forecast that raised concerns among analysts.

Benchmark U.S. crude fell 11 cents to $61.68 a barrel in New York. Brent crude, used to price international oils, rose 17 cents to $65.42 a barrel in London.

In other energy futures trading, heating oil was little changed at $1.93 a gallon. Wholesale gasoline rose a penny to $1.76 a gallon. Natural gas rose 4 cents to $2.66 per 1,000 cubic feet.

The dollar rose to 107.78 yen from 107.30 yen. The euro weakened to $1.2300 from $1.2336.

Gold rose 90 cents to $1,332.10 an ounce. Silver rose 18 cents to $16.62 an ounce. Copper rose 3 cents to $3.22 a pound.

Major indexes in Europe ended mostly higher. Germany’s DAX slipped 0.1%; France’s CAC 40 rose 0.2%; and Britain’s FTSE 100 climbed 0.5%.

In Asia, Japan’s Nikkei 225 index climbed 0.2%, and Hong Kong’s Hang Seng gained 1.8%. The Kospi in South Korea added 0.6%. India’s Sensex gained 0.3%. Shares in Southeast Asia were mixed. Australia’s S&P ASX 200 edged up 0.1%.

UPDATES:

2:20 p.m.: This article was updated with closing prices, context and analyst comment.

11:55 a.m.: This article was updated with more recent market prices, context and analyst comment.

This article was originally published at 7:25 a.m.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.