Tesla’s loss grows as Elon Musk claims customers are confused by Model 3 name

Tesla says Model S orders have taken a hit because some customers think the 3 is a new version. (May 4, 2017) (Sign up for our free video newsletter here http://bit.ly/2n6VKPR)

Elon Musk used his quarterly conference call with analysts Wednesday to talk about his sex problem. Or, more precisely, his S3X problem.

He also tried to assure investors, after Tesla reported a deepening loss for the first quarter. Its stock fell sharply on the day.

Musk said the midmarket Model 3 is on track to begin initial production in July. And he fretted about confusion over the Model 3 name and his regrets about trying to be too cute with it.

Tesla now sells two luxury cars, the Model S and the Model X. Musk wanted to call the midmarket car the Model E.

S-E-X. Get it? And there’s the upcoming Model Y.

But Ford laid previous claim to the designation, and Musk went with 3, which sort of looks like a backward E, to take its place.

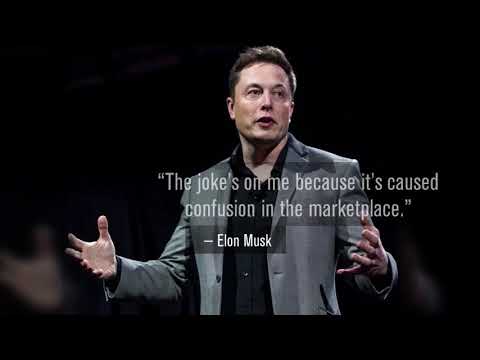

“The joke’s on me because it’s caused confusion in the marketplace,” he said. “We’re going to be a broken record on this front because we have to clear up an error.”

Tesla says Model S orders have taken a hit — just how much Musk didn’t say — because some customers think the 3 is a new version of the S, so they’re holding off on Model S purchases.

“It’s a bit confusing because one is a letter and one is a number,” Musk said.

The company has communicated the issue to its retail stores and other employees, but Musk said he’s worried potential buyers remain confused.

Meantime, Tesla said its net loss grew to $397.2 million, or $2.04 per share, in the first quarter. In the fourth quarter of 2016, Tesla lost $219.5 million.

First-quarter revenue was up 18.4% from the previous quarter, to $2.7 billion, and doubled from a year earlier. Car deliveries rose 12%, to 25,051.

“I’m feeling quite optimistic about the future,” Musk said.

Efraim Levy, analyst at CFRA, retained his sell recommendation on the high-flying stock, although he’s pleased that the Model 3 seems on track. “Our view is [Tesla] is priced like it can do no wrong, but U.S. automakers can do no right.”

Cash spent on operations increased during the quarter, to $397.2 million from $219.5 million in the previous quarter, reflecting the costs of gearing up the Model 3 assembly line.

Few expect the electric car and alternative energy company to make a profit for some time. Its future now depends on the Model 3, which unlike the Tesla Model S and Model X luxury cars is aimed at a wider consumer base, with a stated entry price of $35,000.

Tesla plans a run rate of 5,000 cars a week by the end of the year, and 10,000 cars a week “at some point” in 2018. In earlier discussions, the company had talked about producing 500,000 cars in 2018. Last year, the company manufactured about 84,000 cars total.

About 375,000 people have laid down $1,000 refundable deposits for a Model 3, the company says.

To meet expected demand, the company is expanding its retail stores and its Supercharger network.Tesla’s stores are its own; it doesn’t work through traditional franchised dealerships. Wednesday the company said it would add nearly 100 retail, delivery and service locations.

It will also begin a pilot program to provide mobile service to owners who don’t need to have their cars brought to a repair shop, with 100 mobile service trucks. If it works out, the system will be expanded. The company explained it could save capital costs while making repairs more convenient for customers.

The Supercharger network will double in 2017, the company said, to more than 10,000 units.

Tesla stock got slammed Wednesday after the Wall Street Journal reported that the U.S. Securities and Exchange Commission is investigating its SolarCity arm for not adequately disclosing how many customers are canceling their contracts.

Tesla shareholders approved the company’s purchase of SolarCity in November. Musk had been SolarCity’s chairman and largest shareholder.

The stock had fallen $7.87, or 2.47%, to $311.02 at the close of trading Wednesday. It was down another $7.52, or 2.42%, after the conference call ended. The company’s $50.73 billion market value remained higher than that of General Motors.

Twitter: @russ1mitchell

ALSO

Viacom revenue grows, but TV ad sales weaken and Paramount is still hemorrhaging money

Soylent gets a $50-million investment led by Google’s venture capital arm

In Silicon Valley, even mobile homes are getting too pricey for longtime residents