Capitol Journal: The Republican tax plan is a victory for the Democrats — maybe

Republicans won the tax fight in Congress by overpowering Democrats. Now the battle begins to retain that power in next year’s elections. Their celebrated victory could cost them control of the House.

Theoretically anyway.

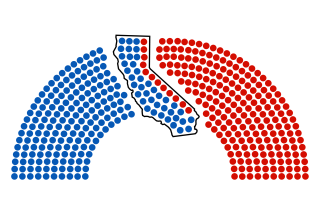

Democrats need to pick up 24 Republican seats nationally to take back the House and end the GOP’s control of Washington.

Seven congressional races in California will be crucial. In all of those districts, voters elected Republicans to Congress last year, but they snubbed then-candidate Donald Trump and voted for Democrat Hillary Clinton.

So the Democratic strategy is a no-brainer. The tax bill is unpopular in California and across the country. Trump is equally disliked in this state. Tie both around the Republican House incumbent and this makes a nice Democratic victory package. Maybe.

How much does voting for the GOP tax bill really hurt vulnerable California Republicans?

“The quick and easy answer is that 12 Republicans [who voted for the bill] just committed hari-kari,” says Darry Sragow, a veteran Democratic strategist who publishes the nonpartisan California Target Book, which handicaps congressional and legislative races. “But whether that’s true or not is unclear. There are an incredible number of unknowns.”

No one really knows how the Republican tax plan will play out. Few even seem to know precisely what’s in it. One thing is certain, however: Individuals in high-tax Democratic states like California and New York will be worse off than people in lower-tax GOP states because of new limits on state and local tax deductions.

The GOP tax plan passed. Now Democrats have another big issue to use in the midterms »

In the final days of Republicans compromising among themselves, the GOP wisely softened the bill’s impact on taxpayers who itemize deductions, as a third of California taxpayers do.

The final bill will allow up to $10,000 in deductions of state and local taxes, which is especially important in California. There’s currently no limit on those deductions. And the bill will permit mortgage interest deductions on new loans up to $750,000, rather than $500,000 as originally planned.

Two of the most threatened California Republicans played it smart. Reps. Darrell Issa of Vista and Dana Rohrabacher of Costa Mesa took no chance on a voter backlash and shielded themselves by voting “no” on the bill.

“The bill was improved, but not enough for a significant # of my constituents,” Rohrabacher tweeted.

Issa also tweeted that “the changes do not go far enough to guarantee tax relief for constituents in my district.”

The Cook Political Report, a national tip sheet for political junkies, rates the Issa and Rohrabacher races as toss-ups. Also rated a toss-up is the reelection bid of Republican Steve Knight of Palmdale. Knight joined all the other California Republicans in voting for the tax bill.

Three other Republicans representing districts that voted for Clinton are rated by Cook as “leaning” their way for reelection. They’re Reps. Mimi Walters of Irvine, Ed Royce of Fullerton and Jeff Denham of Turlock. A fourth, David Valadao of Hanford, is considered by Cook a likely winner for another term.

But it’s very early. What happens next November will depend on the quality of candidates and campaigns.

Bombastic Democratic rhetoric — such as Gov. Jerry Brown likening Republican congressional leaders to “a bunch of Mafia thugs” — probably just drives GOP voters deeper into their party corner.

There’s enough natural California fear of the new tax law and resentment of President Trump to propel Democratic campaigns without hyperventilating.

A poll released this week by the nonpartisan UC Berkeley Institute of Governmental Studies showed California’s dislike for both the tax plan and the president. That’s a potentially fatal combo for at-risk Republicans who voted for the bill. The tax plan was supported by only 30% of registered voters. It was opposed by 51%, including 42% who disliked it strongly. Opinions broke along party lines — with 60% of Republicans supporting it, 67% of Democrats against. But only one-third of Republicans felt that the bill will have a positive impact on California.

A mere 30% of voters approved of Trump’s job performance; 66% disapproved. Again, it was party line: 73% of Republicans approving but 93% of Democrats disapproving.

In much worse shape was Congress: 15% approval, 76% disapproval. Even 70% of Republicans disapproved of the GOP Congress.

“It’s not a great year to run for reelection to Congress with congressional approval so low,” says Mark DiCamillo, the poll director.

Especially for a California Republican.

But Wayne Johnson, a longtime Republican consultant, says his prognosis of the tax bill’s political impact has changed. He’s now more optimistic.

Asked whether it could hurt Republicans’ reelection efforts, Johnson replied: “The first reaction I had was probably yes. But the more I’ve looked at it and got into the details, I really don’t think so. I think Republicans have done a terrible job of explaining it.”

“The effect of doubling the standard deduction [for non-itemizers] is huge,” the consultant continued. “Nobody is looking at that.”

Sragow says: “Is it a good day for Democrats? Sure. They’ve got dreams of sugar plums in their heads. Republicans are tossing and turning. But that’s just tonight.”

The stark reality of the bill’s effects won’t be known until April 2019 when taxpayers file their tax returns for the first time under the new law. And that will be long after next November’s elections.

Follow @LATimesSkelton on Twitter

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.