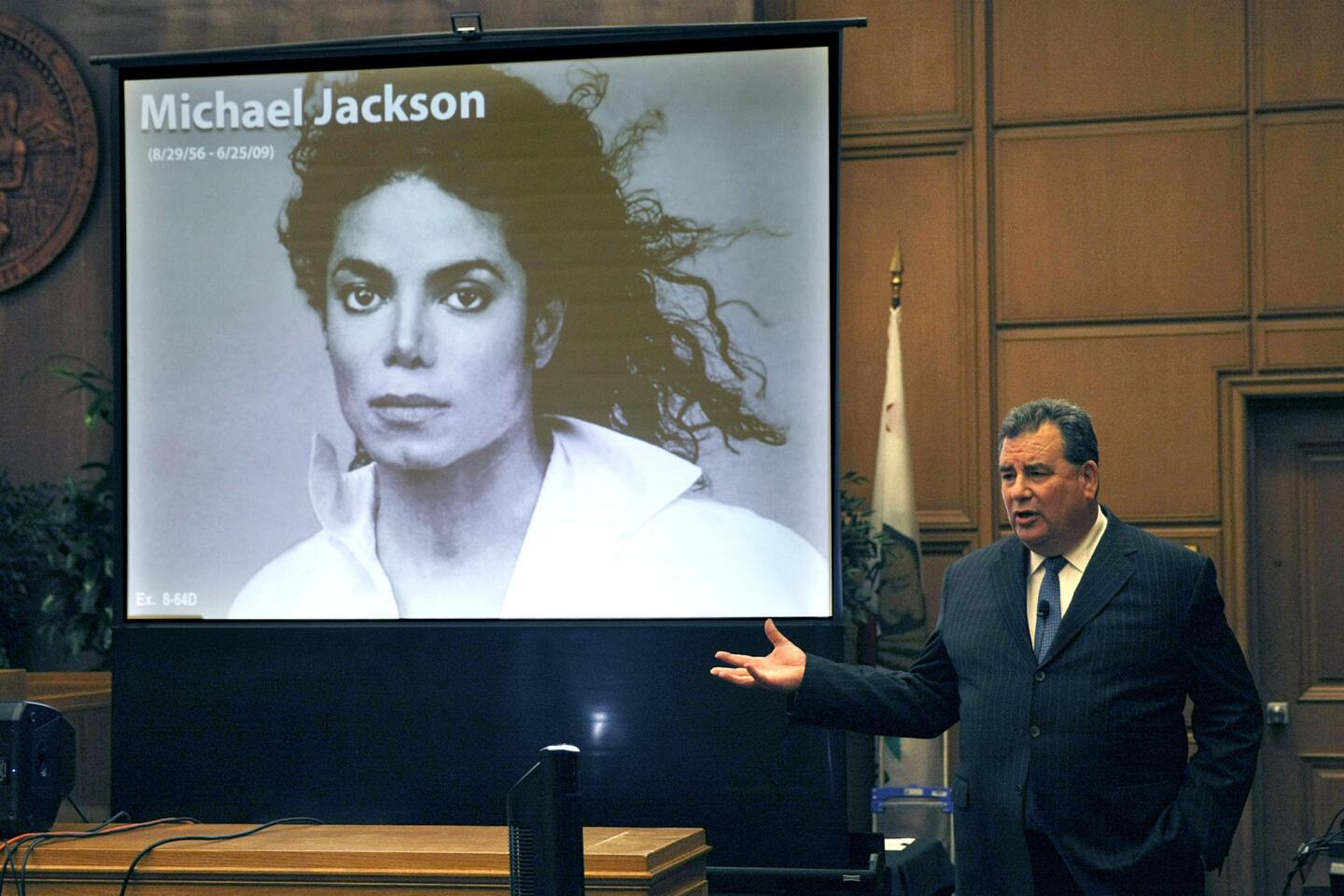

L.A. Now Live: Discuss Michael Jackson estate’s IRS battle

Join Times staff writer Jeff Gottlieb for a live chat at 12:30 p.m. Wednesday on the battle between Michael Jackson’s estate and the Internal Revenue Service.

The agency has told Jackson’s executors that the estate owes $505 million in taxes and an additional $197 million in penalties, for a total of more than $702 million.

According to documents filed with the U.S. Tax Court in Washington, Jackson’s executors placed his net worth at the time of his June 2009 death at slightly more than $7 million.

PHOTOS: Michael Jackson | 1958-2009

The IRS placed it at $1.125 billion, a difference so vast it looks like a typo.

Jackson’s return was so inaccurate, the IRS said, that it qualified for a gross valuation misstatement penalty, which would allow the government to double the usual 20% penalty for underpayment.

“I’ve never even heard of the gross valuation misstatement penalty being asserted,” said Andrew Katzenstein, an estate tax expert at the law firm Proskauer Rose in Los Angeles.

PHOTOS: Behind the gates at Neverland

Most of the dispute is over the value of Jackson’s image, along with his interest in a trust that includes the rights to some of his songs and most of the Beatles catalog, including “Yesterday,” “Sgt. Pepper’s Lonely Hearts Club Band” and “Get Back.”

The estate valued Jackson’s likeness at just $2,105.

The IRS put it at $434.264 million.

Gottlieb, who also covered the the wrongful-death lawsuit the Jackson family filed against AEG, will answer your questions. Readers can join the conversation at 12:30 p.m. and submit questions live or tweet them to @aribloomekatz or the hashtag #lanowlive.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.