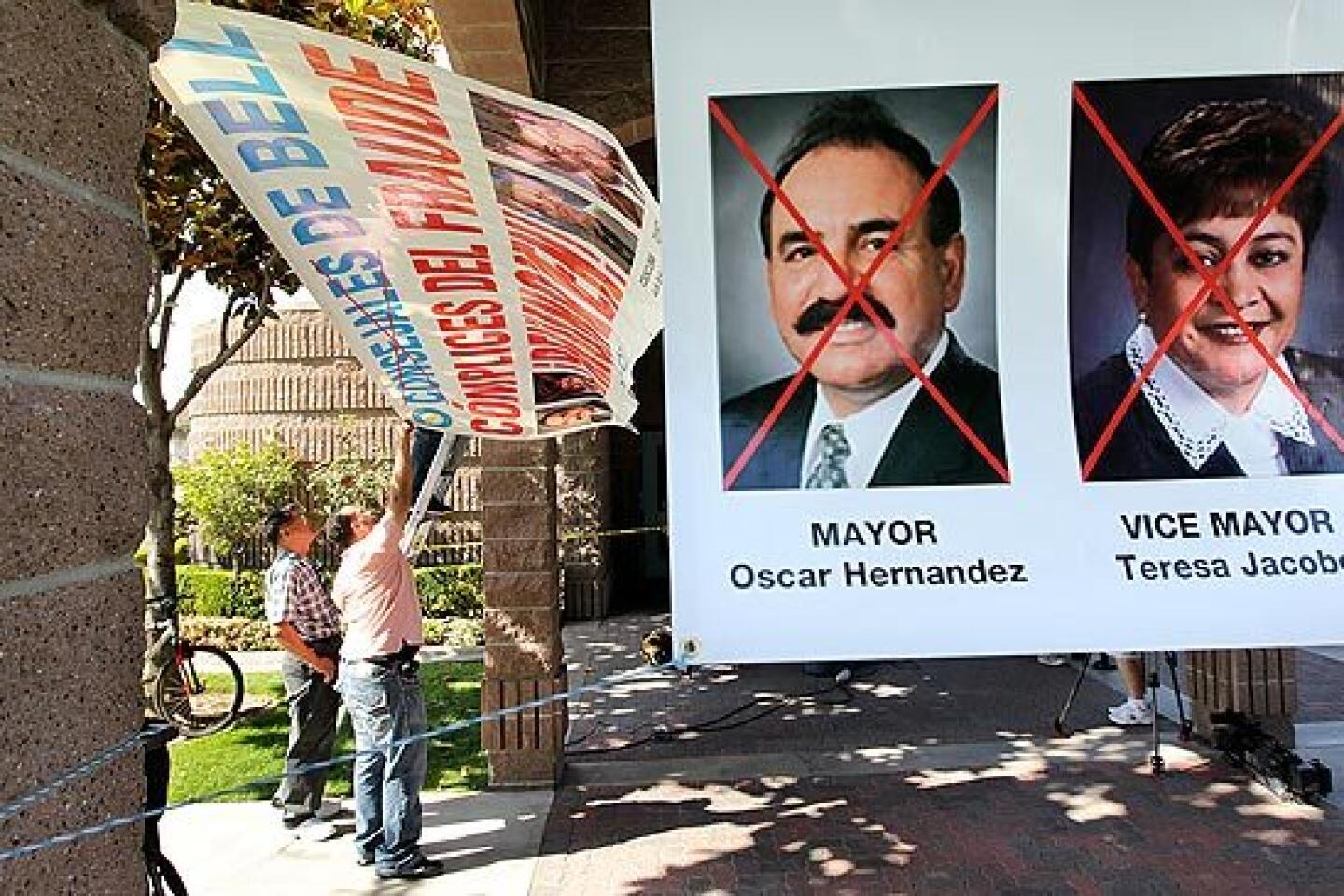

Other cities stuck with the tab for Bell officials’ massive pensions

The unfolding story of the high salaries paid to municipal officials in Bell has delivered a surprise twist to taxpayers in Glendale, Simi Valley, Ventura and several other Southern California cities — they’re on the hook for the pension bills.

FOR THE RECORD:

Shared pension costs: An article in Monday’s LATExtra section about cities’ sharing the cost of pensions for highly paid Bell officials said that La Canada Flintridge and Goleta were among the cities in the same pension liability pool as Bell. They are not. Bell’s pool includes Norco, Ridgecrest and Morro Bay, among other cities. —

More than half of former city manager Robert Rizzo’s $600,000-a-year pension will be spread among 140 small cities and special districts such as Norco, La Cañada Flintridge and Goleta that are in the same pension liability pool as Bell.

The rest would be shouldered by his former employers, Hesperia and Rancho Cucamonga, according to estimates made by The Times and reviewed by pension experts.

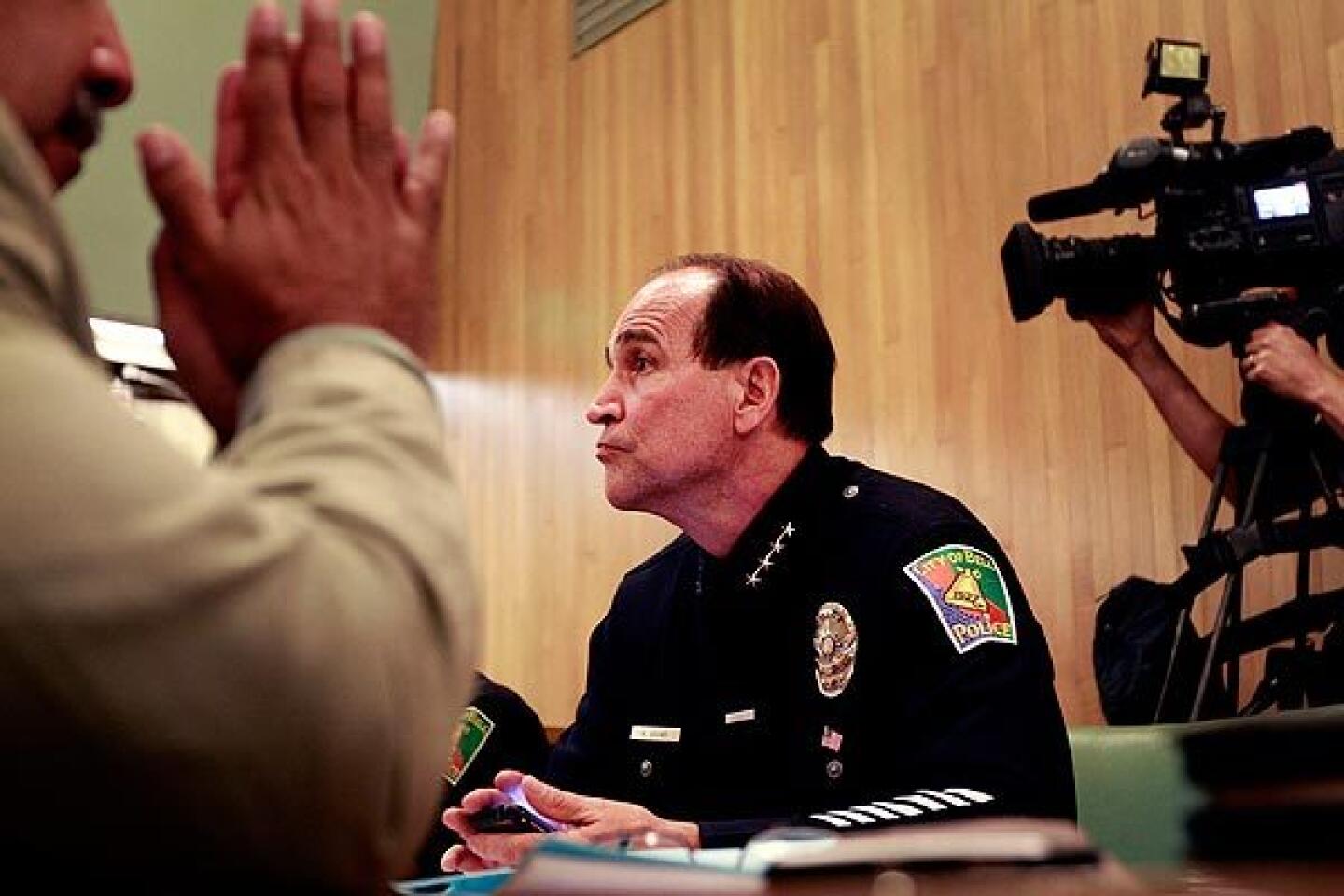

In the case of its former police chief, Randy Adams, Bell escapes nearly all the costs of his estimated $411,300-a-year pension. Under CalPERS rules, the city is responsible for just 3% of that because he only worked there for one year. Taxpayers in Glendale, Simi Valley and Ventura would have to pick up the rest.

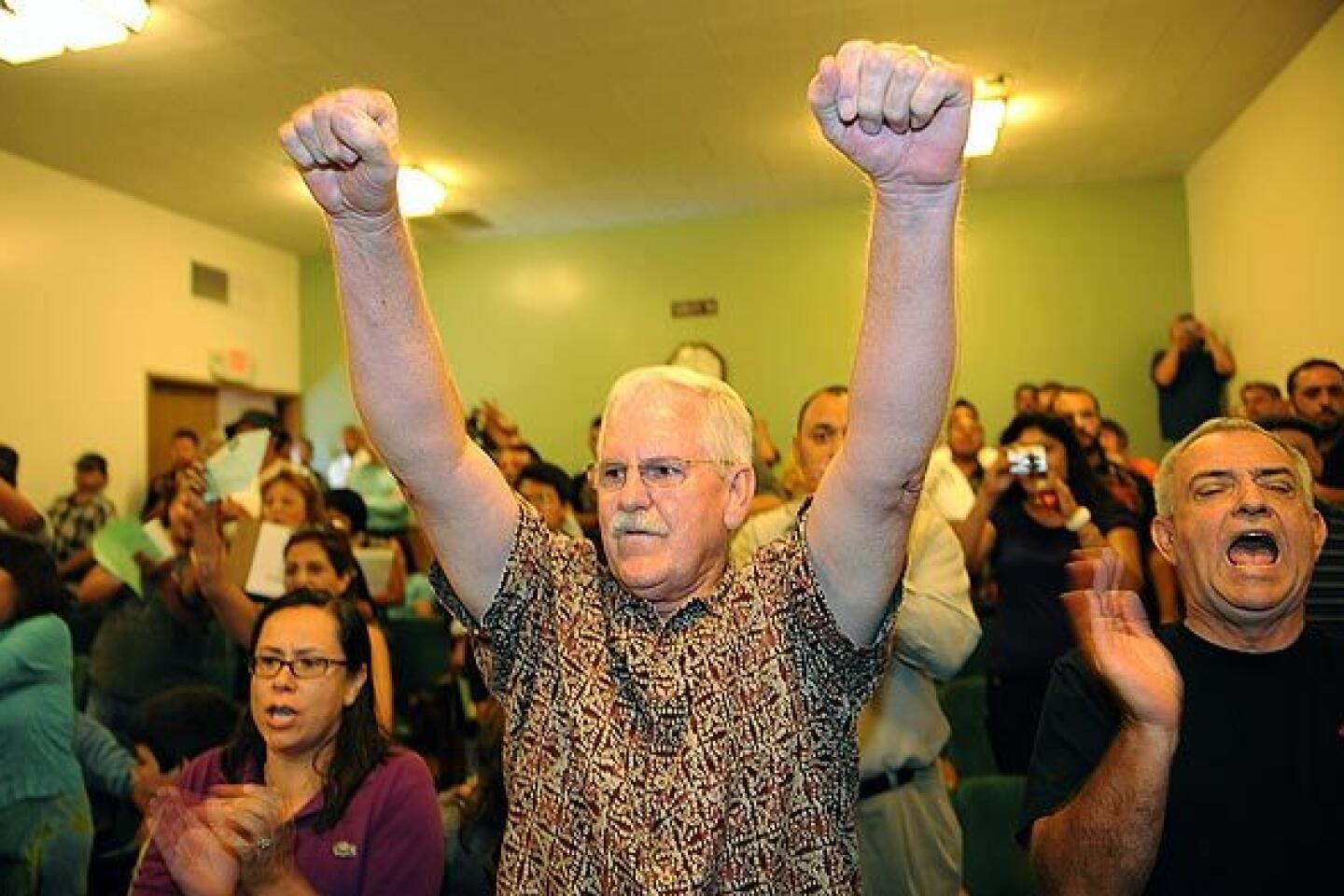

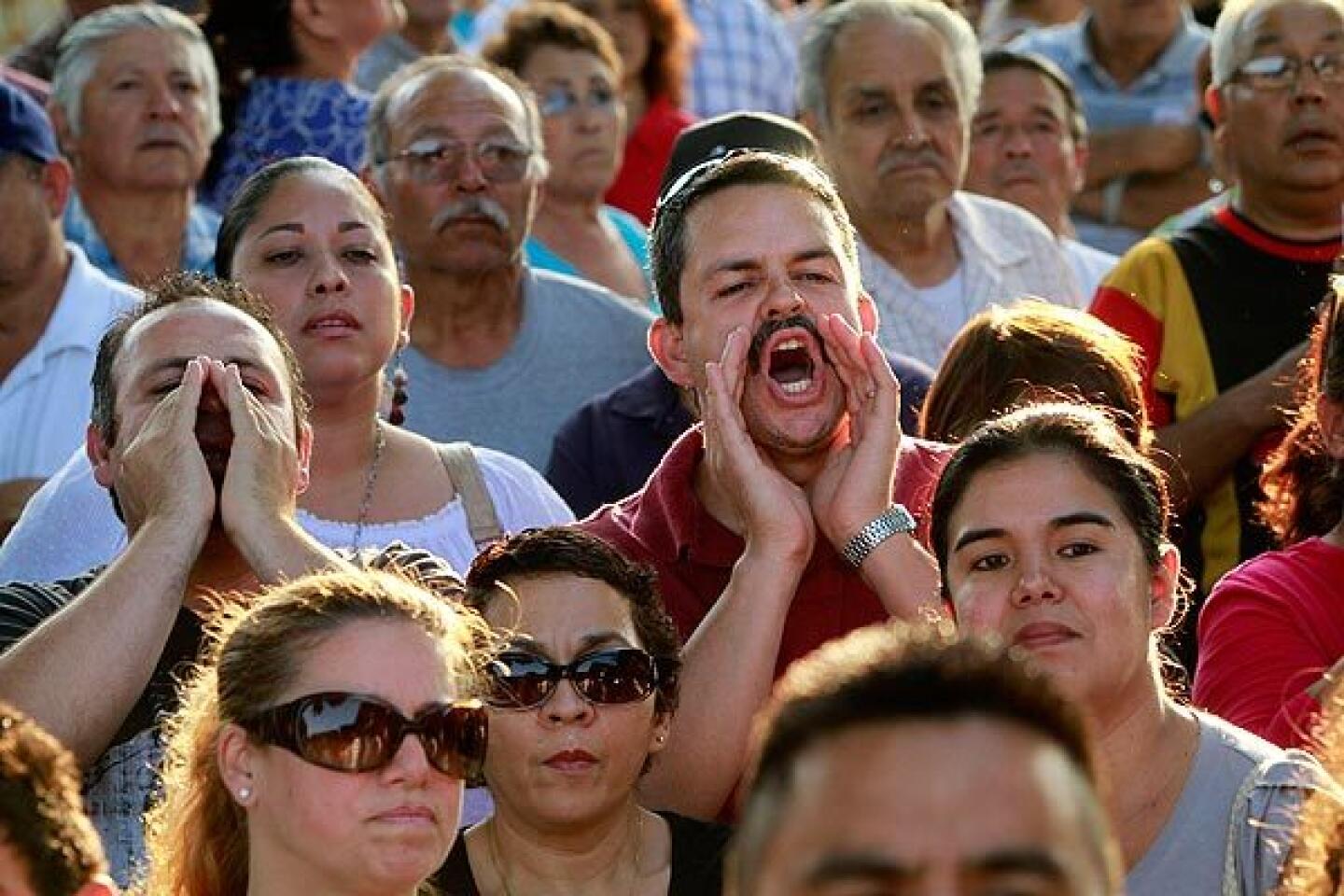

As the Bell pay scandal reverberates across California, it is opening a window on the arcane world of public pensions. The state’s permissive pension laws and a host of variables that can dramatically affect retirement pay have created a system that is virtually impossible for the public to grasp, reform advocates say.

Other cities will be on the hook for much of Rizzo’s and Adams’ pensions costs even though their salaries were relatively modest until they landed in Bell. When they resigned last week, Rizzo was making nearly $800,000 a year and Adams was making $457,000.

Bell hired Adams at more than double the salary he was making in Glendale. That salary spike also doubled his eligible pension amount under CalPERS, the state’s public employee retirement plan.

Glendale would probably have to pay around 16% of Adams’ pension. Simi Valley, where he served as police chief for seven years, would absorb 18%, and Ventura, where he worked for 23 years, would pick up the lion’s share, around 63%.

City managers in Glendale and Simi Valley estimate they’ll have to come up with an extra $40,000 in taxpayer dollars each year to cover Adams’ pension costs. Ventura’s tab could go much higher.

“We had no control over his final year’s salary,” said Glendale City Manager Jim Starbird. “Yet the rest of us will be bearing the brunt of Bell’s decision.”

The complexity of the nation’s largest pension system makes it difficult for the public to understand what works and what needs to change, according to advocates of reform. Gov. Arnold Schwarzenegger and the two gubernatorial candidates, Meg Whitman and Atty. Gen. Jerry Brown, are urging reforms in the system.

“Even the governor’s office couldn’t figure these Bell pensions out,” said Marcia Fritz, a certified public accountant and president of the California Foundation for Fiscal Responsibility.

CalPERS last week said it is putting both men’s pensions on hold pending multiple investigations into Bell’s lavish salaries.

Glendale and Ventura have sent letters to the attorney general supporting the investigations; Mike Sedell, city manager of Simi Valley, said his council is likely to approve a similar approach when it meets Monday. All three of Adams’ former employers say their attorneys are looking at whether there is a legal basis to deflate his pension by setting aside his final-year salary.

Three basic factors go into retirement calculations: age, years of service and ending salary.

Rizzo, for instance, worked for three cities over 30 years and gets 2.7% of his final pay for every year worked. Therefore, Rizzo, 55, would be eligible for an estimated pension of $637,985, or 81% of his final $787,637 salary.

Adams’ pension formula allows 3% of pay for every year worked. Public safety personnel typically have higher pensions than other municipal workers but cannot earn more than 90% of their final year’s pay.

Adams, 59, because of his long career in law enforcement, would be entitled to a projected pension of $411,300, or 90% of his final pay.

Other compensation items could be tacked onto each man’s final year’s pay, pushing retirement income even higher. In addition, both are entitled to automatic cost-of-living increases. Fritz estimates that Rizzo’s payout could exceed $30 million over his lifetime.

Internal Revenue Service rules limit compensation payouts to $245,000 a year, said Brad Pacheco, a CalPERS spokesman. But the limit doesn’t apply to Rizzo or Adams because they were already in the CalPERS plan when the federal law was adopted in 1996, he said.

CalPERS manages retirements for 1.6 million active and retired employees. An estimated 90% of public agencies in California participate in the retirement system.

Public pensions are difficult to rescind. Courts have repeatedly upheld the contracts in favor of employees, said Stephen Silver, a Santa Monica attorney who specializes in public pension law.

“It’s pretty hard to do,” Silver said. “You’d have to prove some sort of fraud or undue influence.”

Former Orange County Sheriff Michael S. Carona, convicted of witness tampering, receives a pension of about $215,000 a year. Robert Citron, who led Orange County into bankruptcy in 1994, collects $142,000. And Former Vernon City Manager Bruce Malkenhorst Sr., indicted for misappropriating public funds, collects the highest public pension in California, $509,664.

Rizzo would be at the top of the pension list once he begins to collect, and Adams would be right behind Malkenhorst.

Silver said that perhaps the best chance for rescinding at least part of a pension would be for investigators to show that Bell’s high salaries were an unlawful expenditure of public funds.

“That’s what this really smacks of,” he said.

catherine.saillant@latimes.com

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.