Tax increases stack high in Pico Rivera

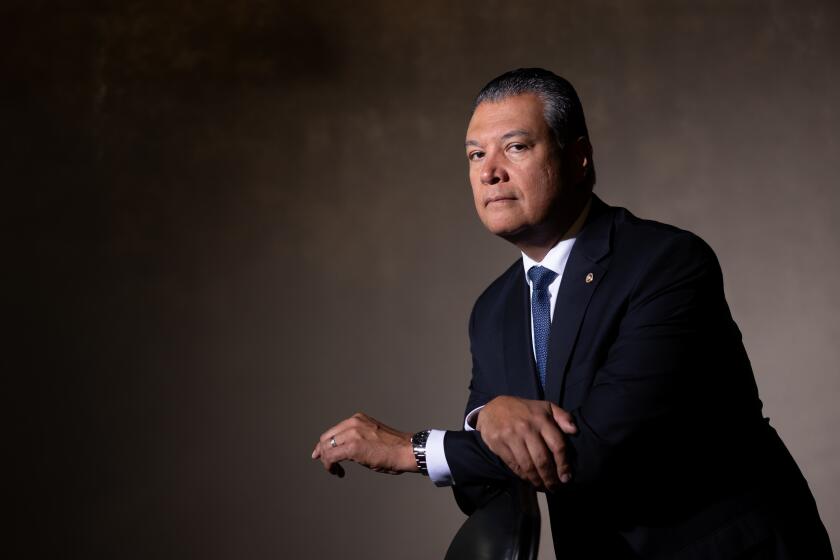

Bill Medrano is more attuned than most Pico Rivera residents to a series of sales tax increases that -- starting today -- will push the rate in his blue-collar suburb to nearly 11%, the highest in the state and one of the steepest in the nation.

And he’s not happy.

“It’s almost as if we’re getting punished,” the 32-year-old security firm assistant manager complained this week on a trip to one the town’s large retail centers. “It all adds up: a penny here, a penny there. . . . It’s a big deal because everything is going up.”

No California community is facing a more abrupt reckoning with a wave of mid-recession sales tax increases than Medrano’s bedroom community southeast of Los Angeles.

To avoid cuts in crime-fighting and other services, city voters last year agreed to impose a 1% local sales tax on top of Los Angeles County’s 8.25% rate. A few months later, lawmakers piled on another 1% statewide to bail Sacramento out of its fiscal crisis. Both increases take effect today.

A half-cent boost in the countywide sales tax will kick in July 1, thanks to last fall’s voter-approved transportation measure, Measure R.

In all, Pico Rivera sales taxes will have climbed from 8.25% to 10.75% in just three months -- a total tax increase of 30% that is still sinking in for many residents and businesses.

“Unbelievable,” said Dale Snowden, a sales manager at a Pico Rivera firm that sells large trucks and repair parts. Already anxious about the taxes beginning today, he groaned when told of the transit tax increase yet to come. “It’s a huge financial impact on our customers,” he said, predicting some may take their parts purchases to lower-tax communities.

The increases also mean families like Medrano’s, looking to buy a new car in the next year, will fork out hundreds of dollars more. Auto sales taxes are based on rates in the town where the owner registers the vehicle.

For Pico Rivera residents, that translates to 20% to 30% more in taxes than for car buyers living in higher-income cities in Orange and Ventura counties, where rates will remain under 9%. Only nearby South Gate, which phased in a local sales tax last fall, will match Pico Rivera. Both cities are on track to surpass Chicago, which now collects a 10.25% sales levy, one of the country’s highest. And they’ll be closing in on a handful of small Arkansas towns collecting 11%.

Pico Rivera officials stress that their voters overwhelmingly approved the city sales tax, which will close a $4.8-million gap in the city’s $34-million budget and help pay for a high-tech library and other projects.

“I don’t think anybody is enthusiastic about increasing the sales tax,” said Assistant City Manager Jeff Prang. But he said residents and city officials “had a real strong understanding about . . . the taxes and revenues necessary to pay for services.”

The new local tax should bring in an extra $6 million annually, doubling what the city now receives from its basic share of sales tax revenue, said Bob Spencer, the city’s senior public information officer.

City voters also strongly approved Measure R, the countywide sales tax increase taking effect in July to raise $40 billion for traffic relief, new commuter rail lines and other transit investments.

Still, Prang acknowledged some residents and businesses are voicing concern about the accumulation of tax hikes. He noted that when city officials decided last summer to put the sales tax hike on the ballot, they didn’t know that the state also would boost its tax or that the county transit tax would be approved.

Indeed, the city distributed mailers and information stressing that the proposed tax was only a penny on the dollar.

The stacking of sales tax increases in the midst of record job losses troubled a number of residents and business operators interviewed this week.

“That’s amazing,” said Jeff Zaus, who’s lived in the city 14 years. “It’s a good city . . . but so many people are struggling just to keep food in the house.”

Jesus Vasquez, an out-of-work tow truck driver, voted against the city tax. He didn’t realize state and county tax increases were coming. “That’s just outrageous,” he said.

“We do a lot of price shopping,” he said, heading into a Food 4 Less. “I could just go to Downey and not pay the 1%” levied by the city.

Speculating how customers, who are counting dollars more closely these days, will react had several retailers on edge.

Ariel Gonzalez, co-owner of a high-performance car accessories shop, said he planned to enlarge a copy of the instructions he received for collecting the tax and post it near his cash register. He’s hoping that will assuage any suspicions about the unusually high rate.

“We want to be able to say, ‘Look. It’s official.’ ”

His savvy clients already try to negotiate for reduced credit card fees and extra products on large purchases. With the higher taxes and more intense competition for fewer customers, “We’ll have to drop our profit margins,” he said.

“It hurts everyone. But you’ve got to go the extra mile to get these people anymore.”

The run-up to today’s tax hikes offered an opening for those trying to move big ticket items. They had been urging customers to act quickly.

“For me, it was a good sales pitch,” said Alex Sarr, scanning his lot of used Hondas, Fords and Toyotas on Rosemead Boulevard.

Now, he’s uneasy about what comes next. “I know in my heart I’m going to drop in sales,” he said. About 30% of his customers come from Pico Rivera, and they will face an extra $100 or more in sales taxes on a typical deal.

Like Gonzalez, he expects increased pressure to offset higher taxes with lower prices. “Some cars, you only make $500,” he said.

Medrano said he and his wife have been checking out new cars costing up to $25,000. Now they’re adjusting their sights downward. In addition to the higher sales taxes, he noted that the cash-starved state had raised car license fees. “We’re looking to see how much it’s going to affect us. . . . We’re looking at something lower,” he said.

He’s also questioning sales tax disparities that are hitting him harder than those living in some more affluent areas. Under the new sales tax scheme, for example, a Simi Valley resident registering an $18,000 new car today will pay $1,485 in sales taxes because that city’s rate is 8.25%.

By the time Medrano is ready to buy, he’ll face a sales tax of $1,935 on the same car because Pico Rivera’s rate will be 2 1/2 percentage points higher.

“You wonder,” he said, “why certain individuals who make so much more money don’t get taxed” the same.

--

Times staff writer Doug Smith and Times data analyst Sandra Poindexter contributed to this report.

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.