Wilshire Grand developer seeks public assistance on $1-billion project

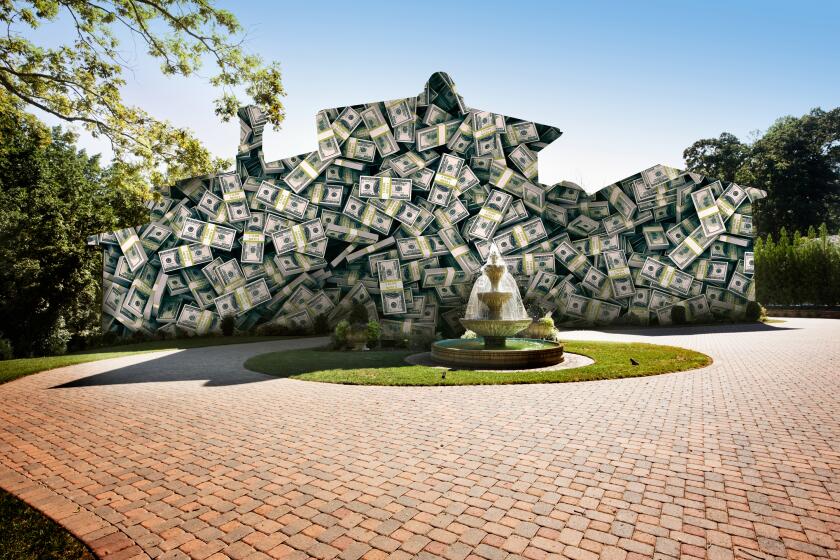

The developers of a proposed $1-billion hotel, office and retail complex downtown say the project would reap huge benefits for Los Angeles, but that they need a guarantee of economic assistance from the city before they can move forward.

Hanjin International Corp., owner of the Wilshire Grand Hotel, and its partner Thomas Properties Group, which develops and manages real estate, plan to build the project on the site of the existing hotel at Figueroa Street and Wilshire Boulevard.

They are seeking assistance that would include a partial waiver of the city’s transient occupancy tax, or bed tax, that would have to be paid once the project is up and running, according to a draft agreement between the city and the developers.

In the interim, the developers would pay all project-related city revenues now generated at the site, including the existing bed tax charges, throughout construction of the new facility.

“At no time will the city have a reduction in its general fund revenues,” said Ayahlushim Hammond, senior vice president for Thomas Properties Group. “It’s a great deal for the city.”

Without the requested financial assistance, however, the project probably would not proceed, Hammond said.

Other options might include shutting down the hotel and waiting for favorable financial market conditions, selling the structure or settling on development alternatives that would not include a hotel, Hammond said.

The 1950s-era Wilshire Grand is now “obsolete” and has been “losing money for years,” Hammond said. It also is not feasible to make upgrades, such as expanding room sizes, without completely demolishing the structure, she said.

The Los Angeles City Council’s Housing, Community and Economic Development Committee has authorized a study to be conducted to evaluate the type of assistance the developers might get, and whether such aid is justified.

The study would be carried out by independent consultants hired by the city, and funded from $250,000 that the developers have agreed to pay the city for contracting consultant services, according to information published by the city.

Such economic assistance provided for hotel renovation and development projects are not uncommon. But they have generated controversy in the past.

For example, owners of the Westin Bonaventure at 4th and Figueroa streets objected to Anschutz Entertainment Group getting a bed tax waiver to build the massive downtown LA Live entertainment and hotel complex.

In 2005, the City Council agreed to provide up to $290 million in subsidies and loans for construction of a 55-story hotel next to the Los Angeles Convention Center

Such deals often invite controversy because other existing hotels might feel slighted, said Richard Green, director of USC’s Lusk Center for Real Estate and a professor at its business school.

Other hotels are “going to feel, what’s so special about these guys relative to us?” Green said.

Gerry Miller, the city’s chief legislative analyst, said financial assistance provided for hotel renovation and developments is determined on a case-by-case basis and takes into consideration the project’s specific needs.

In the case of AEG, there was virtually no existing tax revenue from the property on which the hotel and LA Live project were built, Miller said. The city was getting only parking tax from the surface parking lots — a paltry sum compared to the revenues, such as the continued bed tax, guaranteed from the Wilshire Grand project.

Hammond, of Thomas Properties Group, said the developers would guarantee the existing annual revenues to the city. These include the bed tax now paid into the general fund and the property tax paid to the city, in addition to other taxes. The amount would be a fixed sum, determined by annual historical payments made by the hotel’s owners, and would continue for a period after completion of construction, Hammond said.

But, ultimately, the tax revenues to the city from the LA Live development “were enormous,” Miller said.

Of the Wilshire Grand project, Miller said the commissioned study would evaluate the costs and effect of the development, assess the possible returns on the city’s investment and determine whether the project could be built without financial assistance.

The draft agreement calls for a cap on assistance, in the form of relief from paying the bed tax, which would not exceed 50% of the new net revenues expected to be generated by the project, Miller said.

The idea is to ensure that the city’s general fund “is always protected” and to avoid the project developers from getting an unfair profit windfall, he said.

Los Angeles Councilwoman Jan Perry, whose 9th District includes the proposed Wilshire Grand project, said she was “extremely excited” that the developers were still able to proceed with a project of such magnitude given the tough economic climate.

Perry said she is hopeful the project will help create new jobs, provide new tax revenues and contribute to the city’s general fund. Hotels in Los Angeles are taxed at a rate of 14% of their net revenue, and the bed tax provides a critical injection of revenue to the general fund, city officials said.

Perry said city officials would review the prospective findings of the independent study to determine whether providing assistance to the Wilshire Grand project is the best approach.

“Early indications are that it is … from the standpoint that it would protect our general fund,” Perry said.

“The city will get more than adequate revenue through the creation of this asset,” said Hammond, of Thomas Properties Group.

But some analysts are not convinced.

“There’s a long history of cities subsiding hotels and convention centers without much to show for it afterwards,” Green said.

ann.simmons@latimes.com

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.