Editorial: House Republicans unveil the wrong tax overhaul

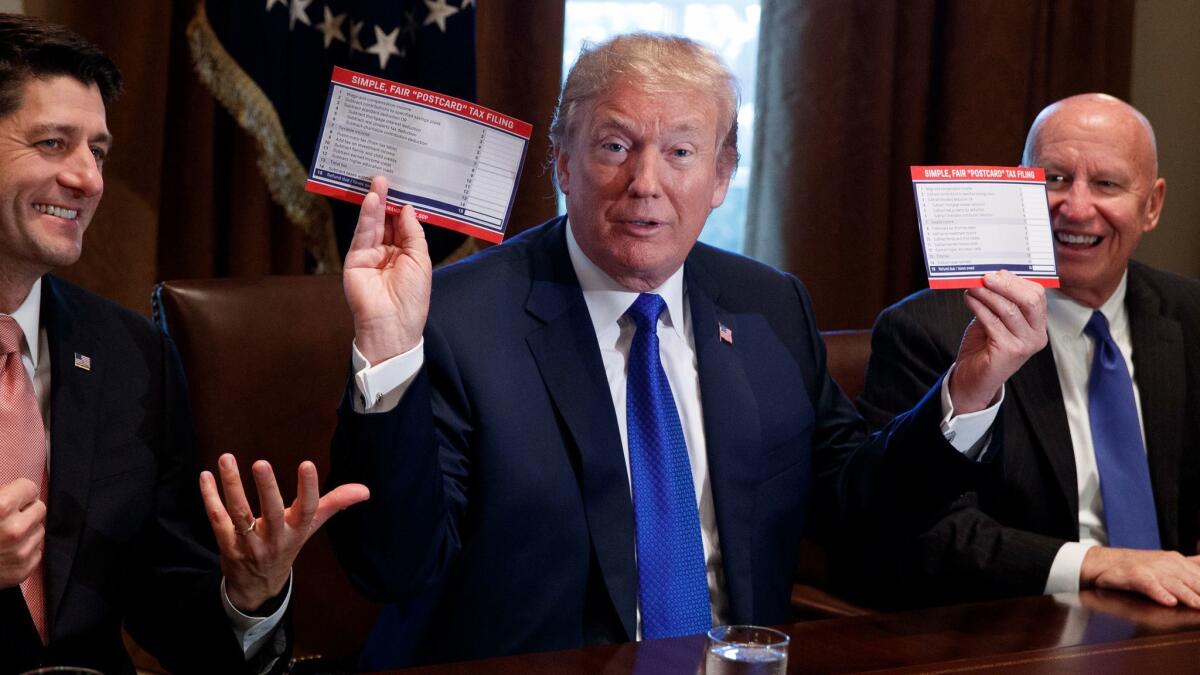

Top House Republicans unveiled their long-awaited tax cut proposal Thursday, and it’s hard to argue with their stated goals: faster economic growth, more investment by U.S. businesses, and a simplified tax code with lower rates but also fewer breaks and loopholes. One fundamental flaw, however, is that it ignores why Washington collects taxes in the first place, which is to cover the cost of the services the federal government delivers. Financed in part with budget gimmicks, the GOP plan is likely to raise the federal deficit more than its supporters acknowledge, with predictable and unwelcome results.

Debate over the bill, hammered out privately by top congressional Republicans and the Trump administration, will probably focus on the winners and losers it’s likely to create, and whether those shifts in the tax burden are fair. That’s an important question. Before we get to that point, though, we’re troubled by an assumption at the very heart of the bill: the belief that cutting corporate and individual taxes will unshackle the U.S. economy, triggering the sort of growth in business output, payrolls and incomes that we haven’t seen since the 1990s.

Such growth in the past has boosted median incomes, reduced income inequality and shrunk the federal deficit. The tides of the U.S. economy are influenced by multiple factors, though, including the number of workers and their productivity. This country has been struggling on both fronts, with a shrinking percentage of working-age adults holding jobs and productivity growth stuck in low gear for several years. Based on what’s happened after previous tax cuts, it’s doubtful that dramatic improvements in growth can be summoned and maintained just by cutting taxes at a time when the economy is already expanding (albeit slowly), especially when at least one of the most pro-growth proposals — allowing businesses to write off their investments in a single year — is set to expire in 2022.

Even assuming the bill does lead to robust growth, its sponsors acknowledged that it would add $1.5 trillion to the national debt over 10 years. That’s likely to be the most optimistic estimate. If Congress approves these deficit-inflating cuts, history tells us that lawmakers will feel compelled to respond in short order by raising taxes again. If they don’t, they’ll either have to cut vital programs or run the risk that ever-larger federal borrowing will weigh down the economy like a cold, wet blanket.

The details matter in any tax proposal, and the ones in this 429-page bill would create winners and losers aplenty. But on the corporate side, the tax cuts overwhelm the reductions in tax breaks and special deals. If lawmakers want a tax reform that simplifies the code, eliminates loopholes and lowers corporate rates to make them more competitive with the rest of the world’s, they should design one that doesn’t dump the cost on future generations.

Follow the Opinion section on Twitter @latimesopinionand Facebook

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.