Opinion: Is the cavalry finally on the way to help keep small businesses alive? Kinda sorta

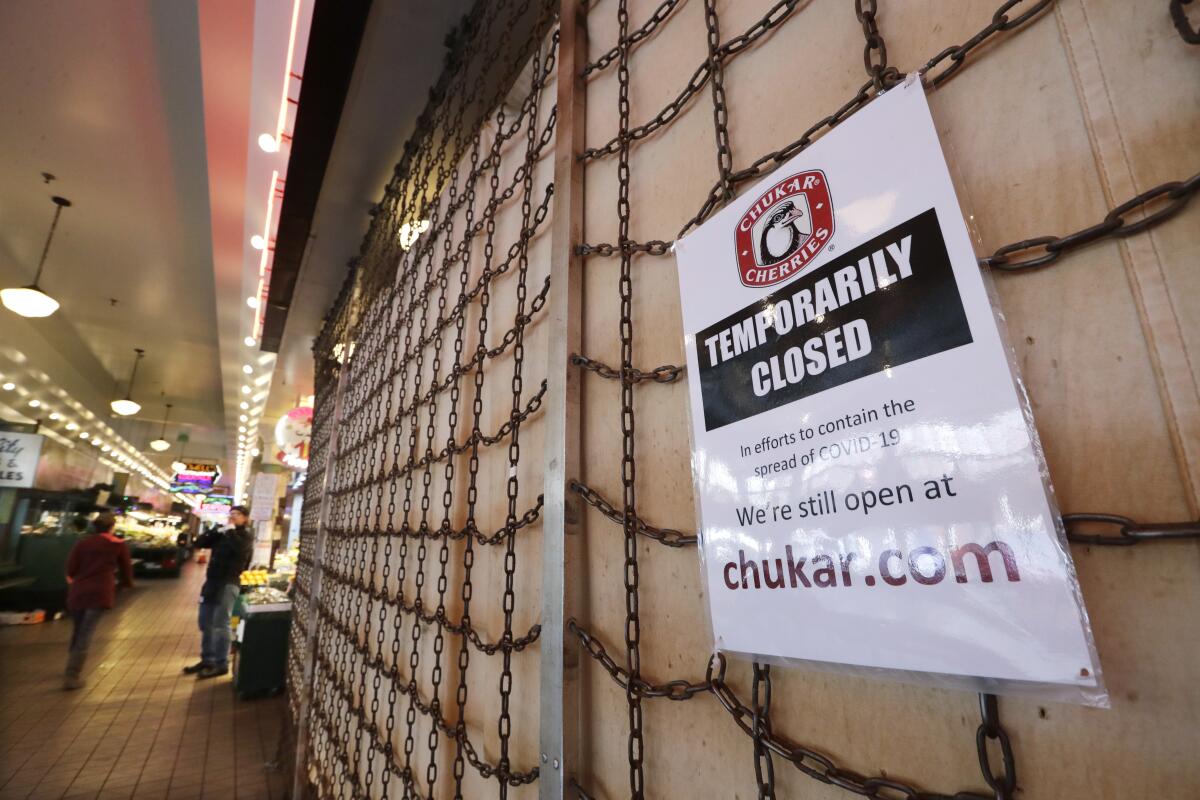

Are you a small business owner or employee scared stiff about the COVID-19 pandemic putting you out of work? Or a small nonprofit or sole proprietorship? Good news — the calvary rides in today! Well, some of them. Maybe.

Amidst one of the biggest surges ever in U.S. unemployment, banks were scheduled to launch a new federally guaranteed low-interest loan program Friday to help small businesses avoid layoffs, furloughs and pay cuts. The Small Business Administration’s Paycheck Protection Program, the first tangible fruit of the $2-trillion economic rescue bill that Congress passed last week, offers businesses and nonprofits with 1 to 500 employees short-terms loans that will be completely forgiven if the money is spent mainly on their workers.

The loans would cover two months’ worth of payroll, rent and utility costs, keeping even a mothballed company on life support while waiting for the pandemic to pass. Except that it looks like many desperate borrowers are going to have to wait a little longer for the help to arrive.

Nearly $350 billion for the loans was included in last week’s big stimulus bill, H.R. 748. That money will cover the costs of forgiving the Payroll Protection Program loans and the fees paid to banks — from 5% of the principal amount for loans of $350,000 or less, down to 1% of the principal amount for loans of $2 million or more.

(Yes, it’s grating to see that the banking industry will once again be profiting from our misery. But banks are far better equipped to get these loan dollars out rapidly to struggling businesses than the government is, and their services aren’t free.)

There’s a lot to like about the loan program, starting with the fact that it will keep people in their jobs. After the bloodbath in the labor markets over the last two weeks, with 10 million people filing initial claims for unemployment benefits, that’s a welcome tonic. Friday’s unemployment numbers from the Bureau of Labor Statistics, which showed an increase of 1.4 million idled workers and an unemployment rate of 4.4% were based on data collected before states started issuing the stay-at-home orders that are choking the economy. Adding the last two weeks’ claims would more than double the unemployment rate.

The 11 states that are still foolishly acting as if the coronavirus isn’t a problem.

Washington is moving so fast to get the program going, though, it may have given too little attention to some crucial details. In particular, bankers are saying the Small Business Administration wasn’t providing guidance on how to evaluate would-be borrowers. With the feds guaranteeing the loans, a bank may not care whether Struggling Business X can repay it. But the SBA might, and banks needed to know that.

That’s why a number of banks have said they probably won’t accept any loan applications Friday, which no doubt means some struggling small businesses and nonprofits won’t be able to make payroll this week.

The agency issued an interim final rule providing answers to that question and many others last night, giving banks little or no time to digest the instruction before they were supposed to start signing businesses up for loans. On the other hand, the guidance on underwriting was explicit: Any business that met the program’s criteria in terms of size and payroll could have a loan, with no consideration for its ability to repay. No collateral is required, nor any personal guarantees. And banks can rely on the borrowers’ certifications, rather than demanding other forms of proof, to “determine eligibility of the borrower and use of loan proceeds.”

In short, these are the SBA’s equivalent of the infamous no-document “liar loans” that fueled the housing bubble. Back then, it was reckless risk-taking based on the dubious assumption that property values would keep rising in perpetuity. Now, the point is simply to use banks and employers as a conduit to deliver money to workers while the economy is in free fall.

Because at the end of the day, the government isn’t planning to get its money back. As long as at least 75% of a loan is spent retaining or rehiring employees and maintaining payroll, and the rest on rent or mortage and utilities, the SBA will forgive the principal. If you borrow money through this program, you’ll owe only the interest payments, which are capped at 1% per year and deferred (along with any principal repayments owed, which could happen if a borrower lays off workers) for six months.

Here’s hoping that banks digest the SBA’s tardy guidance document quickly — it’s only 31 pages, people! — and get the loans flowing forthwith. Independent contractors and self-employed people are scheduled to be able to apply starting April 10, so banks need to get cracking.

For more information on whether you’re eligible, how much aid is available and how to apply, check out this Q&A from the U.S. Chamber of Commerce. A number of banks also are providing information about the loan program on their websites, although in cases like this, the message Friday was the not-so-helpful “We aren’t accepting applications for this program at this time. Check back for updates.” Others, like Bank of America, appear to be accepting applications, but only from businesses that already have accounts there. Or in BoA’s case, accounts and outstanding loans or credit card accounts.

Could it be that the program doesn’t allow banks to profit enough from our misery?

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.