Most California GOP House members vote to pass tax bill, with some hoping the Senate will help fix it

California’s House Republicans took another tough vote Thursday, opting to approve a tax overhaul expected to cost many Californians more in taxes. Several of the Republicans said they supported the bill because they think a compromise with the Senate will make it better.

“I don’t know if they’re going to make it better, but we’ll see,” said Rep. Steve Knight (R-Palmdale), who is among the Republicans considered vulnerable in next year’s election. “There are some things in the Senate bill I like, there are some things in there that I don’t like.”

Supporting a bill in hopes that the Senate will improve it is similar to the tactic the Republicans tried in the spring when the GOP attempted to push through a controversial effort to repeal and replace Obamacare. But the Senate never mustered enough support to pass a healthcare bill, leaving all 14 California Republicans with a “yes” vote on their record and nothing to show for it.

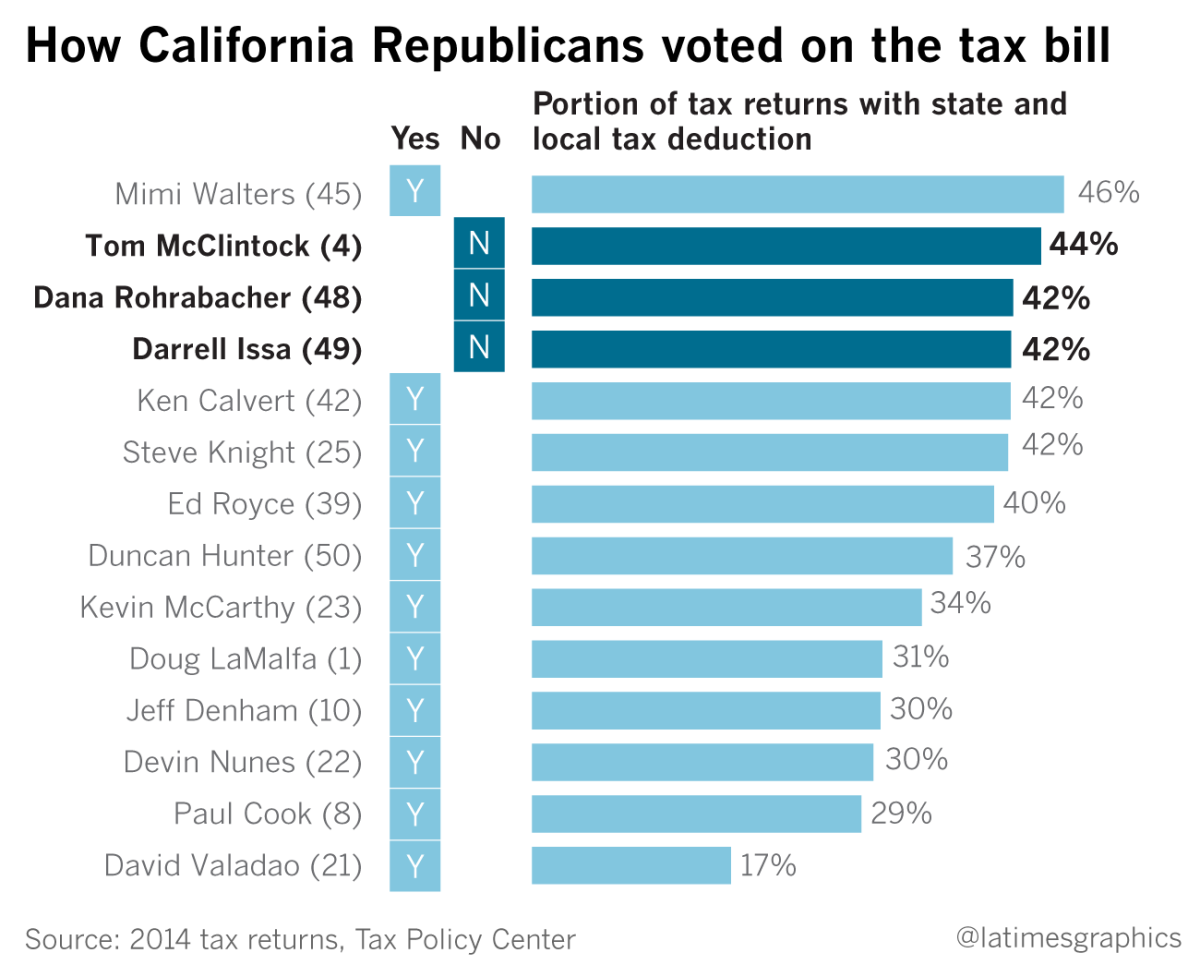

Three Republicans — Reps. Darrell Issa of Vista, Tom McClintock of Elk Grove and Dana Rohrabacher of Costa Mesa — joined Democrats in opposing the tax plan, which passed 227 to 205. The lawmakers said they couldn’t vote for a bill that raised taxes on Californians. Issa and Rohrabacher are considered to be among the most vulnerable House members in the country.

Democrats, who are lambasting the GOP healthcare votes in ads, have warned vulnerable GOP members their “yes” tax votes will be used against them as Democrats work to regain power in the House.

“After their deafening silence, any California Republican who votes for the GOP tax scam will be forced to answer why they care so little for their constituents,” Minority Leader Nancy Pelosi (D-San Francisco) said in a statement this week.

The current Senate tax bill contains even deeper cuts to state and local tax breaks that are popular with Californians but maintains the mortgage interest deduction at its current level instead of cutting it in half as the House plan does. It also repeals Obamacare’s individual mandate, a move that could further complicate the situation for California members who represent districts with a lot of Obamacare enrollees.

Some Republicans in the California delegation are hoping the final result will be palatable enough for voters who could lose thousands of dollars in popular tax deductions.

Rep. Ken Calvert (R-Corona), who stood with House leadership in a news conference after the vote, told The Times on Wednesday that they will “keep moving in the right direction. I think the bill will continue to be improved.”

“It’s not the final outcome on it. We still have a ways to go,” Rep. Doug LaMalfa (R-Richvale) said. “The all-important final vote on the conference bill will be where the rubber meets the road.”

Rep. Mimi Walters (R-Irvine) said she voted for the bill because she got assurances from House leaders that the compromise version with the Senate will address the effect of the lost deductions.

“I’m a lot more confident with this bill because I think we’ve seen the process move forward with ... not a lot of drama, and both houses have worked really hard and worked well together, and I don’t believe that our bill is that far apart from the Senate bill,” she said.

Members have been hit with negative ads, calls from voters and protests at their offices, but public reaction to the tax bill has been muted compared with the outpouring of opposition over the threat to Obamacare in the spring. Much of the tax reform opposition has come from interest groups advocating for provisions that affect their industry, such as home builders or the real estate industry, which are opposed to further limits on the mortgage interest deduction.

Walters said she saw more pushback on the healthcare bill.

“We don’t have that same campaign going on this time, I think because by and large people know that they want a tax break and more money in their pocket, so they’re not as motivated to go against this plan,” Walters said.

Republicans in the delegation largely kept their concerns about the bill private since the tax plan was introduced, and they noticeably didn’t work with Republicans from other high-tax states to negotiate on the reduction in tax breaks. The members’ staff said House Majority Leader Kevin McCarthy of Bakersfield recognized it would be a difficult vote for some of his fellow California lawmakers even though the party is desperate for a legislative win going into 2018. House Speaker Paul D. Ryan even went to the delegation’s weekly lunch Wednesday to answer questions.

Rohrabacher said there was a lot of pressure from House leadership to vote for the bill, but it was calls from constituents about how much their taxes would go up that swayed him. He is also considered a vulnerable member in 2018.

Rohrabacher said the doubled standard deduction in the House plan isn’t enough to offset the loss of the deductions in his coastal Orange County district. He’s open to voting for a compromise bill if that changes.

“This was not an easy vote to figure out, it was not an easy vote to determine, but when my constituents who are very good with their numbers tell me that they are going to be [paying] $5,000 to $10,000 more in taxes, I’m supposed to represent their interests,” Rohrabacher said.

After pushing colleagues for changes all week, McClintock decided Thursday morning to vote no. It’s the first major vote he's taken since Democrats added his district to their target list this month.

“I knew this morning when we could not get a commitment to protect all taxpayers,” said McClintock. “I made a pledge not to raise taxes. This bill raises taxes on a significant number of my constituents and Californians disproportionate to the population.”

Issa, who was among the Republicans who said he voted for the healthcare bill because it would be fixed in the Senate, said voting for a bad tax bill wasn’t going to make it any better.

Several Republican members from rural districts that would be less affected by the tax break reductions enthusiastically supported the bill.

“My district is very different, obviously, than the rest of California,” Central Valley Rep. David Valadao said. “My situation is different than what is going on in San Francisco and the coast. Overall for my constituents, this is actually a really good piece of legislation.”

Follow @sarahdwire on Twitter

Read more about the 55 members of California's delegation at latimes.com/politics

ALSO:

California could flip the House, and these 13 races will make the difference

Updates on California politics

UPDATES:

3:30 p.m. This article was updated with reaction from lawmakers.

This article was originally published at 11:55 a.m.

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.