This tiny Sierra Valley town voted to pull out of CalPERS. Now city retirees are seeing their pensions slashed

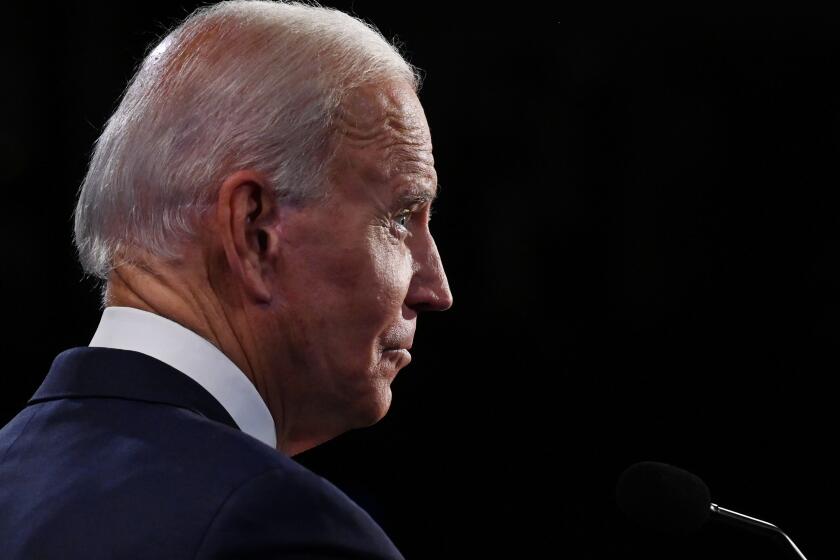

The tremor in John Cussins’ right hand worsened as he described restless nights haunted by worries about paying the bills.

After suffering a stroke in 2012, he retired as a 21-year employee of the city of Loyalton, Calif., where he oversaw the town’s water and sewer systems. Cussins, 56, believed his city pension and the Social Security payments he and his wife received would bring in enough to provide a decent retirement in the tiny, old timber mill town in the Sierra Valley.

Then a letter arrived in October. The California Public Employees’ Retirement System was cutting his $2,500-a-month pension by 60 percent, bringing it to about $1,000 a month.

“I was really shocked when I found out about it,” Cussins said. “We thought the pensions were there for the rest of our lives.”

Loyalton’s four retired city employees became the first in California to see their pensions sliced by CalPERS because of a city defaulting on its payments to the fund, but hundreds of other government retirees across the state may soon face a similar fate. At the same time, financially strapped local governments that considered pulling out of the state pension system, some hoping to find more affordable alternatives, have found it next to impossible to do because of the large termination fees they must pay CalPERS if they do.

As the nation’s largest public pension fund, CalPERS manages a $300-billion retirement system that services more than 1.8 million members and a retiree healthcare program that serves close to 1.4 million more. CalPERS functions as a money manager, investing the funds paid into the system by state and local governments. But those governments decide what pension benefits they will provide their employees and are ultimately responsible for ensuring there is enough money in their pension funds to provide the benefits promised.

Cussins was a member of the Loyalton City Council when the pensions were cut, but he said he had no idea it was coming. More than three years before he was elected, the council voted to pull out of CalPERS when its last pension-eligible employee retired, deciding the monthly payments were too steep for a town that for years flirted with insolvency.

CalPERS levied a $1.66-million termination fee on the city. Loyalton, home to about 760 people, has a single full-time city worker and an annual budget just shy of $1 million. The city didn’t pay the fee, so the four retired city employees saw their pensions slashed in November.

“I’m scared to do anything. I’m scared to spend much money,” Cussins said. “I guess worst comes to worst, we’d even have to sell our property and try to go to some low-income housing deal.”

He now has company. The CalPERS Board of Administration in March voted to cut the pensions of close to 200 retirees from the East San Gabriel Valley Human Services Consortium, a Southern California job training program created by the cities of Azusa, Covina, West Covina and Glendora. The agency stopped contributing to the state pension system when it folded in 2014. On July 1, CalPERS sliced the pension checks for the consortium’s retirees by 63%.

Retirees of the Niland Sanitary District, just east of the Salton Sea, could also face action, although the agency is currently negotiating with CalPERS officials to determine how much it may cost to leave the pension system.

At the center of all of these cases is the termination fee local governments must pay to CalPERS if they opt to leave the system — money that officials at the state pension system say is needed to ensure retirees receive the full pensions they were promised.

After the city of Stockton declared bankruptcy in 2012 following the nationwide recession, the federal court judge handling the case called the fee a “golden handcuff” and “poison pill” that prevents cities and other local governments from leaving CalPERS to find other options for employee pension benefits. The price tag for Stockton to pull out of CalPERS was $1.6 billion. The city chose to stay put.

If a city decides to pull out of the state pension fund, CalPERS places the municipality’s pension fund into a pool of lower-risk investments, which lowers the return rate on what that city earns. As a consequence of the reduced investment earnings, the city will have less money to pay the full pension benefits of its retirees, increasing the termination fee imposed by CalPERS to make up the shortfall.

Loyalton’s CalPERS account was worth $1.1 million when it voted to pull out. And when placed in the pool of terminated pension accounts, the city was expected to earn a 2.4% rate of return on those investments. That rate of return for Loyalton’s terminated account was far lower than what CalPERS expects to earn for active pension accounts — roughly 7%.

CalPERS spokeswoman Amy Morgan said the agency placed the pool of terminated accounts in conservative investments as a precaution because CalPERS would be obligated to cover any shortfall if there was a drop in earnings. That risk is compounded by the fact that cities exiting CalPERS stop contributing to the pension system — monthly payments that serve as a buffer to investment losses and other potential impacts, including inflation.

Close to 100 cities and other government entities have terminated their CalPERS accounts and, combined, those pension funds create a pool of money that exceeds $222 million. As of June 2015, the amount CalPERS expected to have to pay in pensions from that fund was estimated to be $88.5 million — meaning the pension account had a $111-million surplus, according to a March report.

Villa Park in Orange County toyed with the idea of leaving CalPERS in 2014, in part because officials wanted to determine the small city’s long-term pension liability. Former Villa Park Mayor Rick Barnett said other, more affordable options are available, including deferred compensation plans similar to a 401(k). But Villa Park opted not to move forward after CalPERS tallied the termination fee: $3.6 million.

“It’s a joke,” said Barnett, an Irvine bankruptcy attorney. “You’re trapped.”

CalPERS warned Loyalton officials about the exit fee back in June 2014 and met with city leaders several times to discuss the consequences. CalPERS officials said that Loyalton received 10 collection notices before the pensions were cut. But the retirees said neither the city nor CalPERS warned them that their pensions were at risk until last fall.

“As a Board, we have a fiduciary responsibility to keep the CalPERS Fund on secure footing, and as part of this duty we must ensure that employers adhere to the contracts they agreed to. When they don’t, the law requires us to act,” said Rob Feckner, president of the CalPERS board, in a statement after the November decision. “The people who suffer for this are Loyalton’s public servants who had every right to expect that the city would pay its bill and fulfill the benefit promises it made to them.”

Loyalton City Council members told CalPERS officials in November that the city would directly reimburse retirees for the pension money they lost — $5,000 a month for all four retirees combined.

But that promise may be short-lived. The City Council has been providing those supplemental payments since CalPERS sliced the city retirees’ pensions, and it has voted to continue those payments until November. After that, the payments may be reduced — or cut off entirely.

How a governor’s bid to exert control over California public pensions backfired>>

Most of Loyalton’s annual budget is dedicated to running the city’s water and sewer system. The city only has about $160,000 for other expenses, including paying the Sierra County Sheriff’s Office for police protection, the salary of the city’s single full-time employee who works inside City Hall and outside contractors that help run the city. Loyalton only expected to have $30,000 in reserves, city officials said. Reimbursing the city’s retirees will cost $60,000 a year.

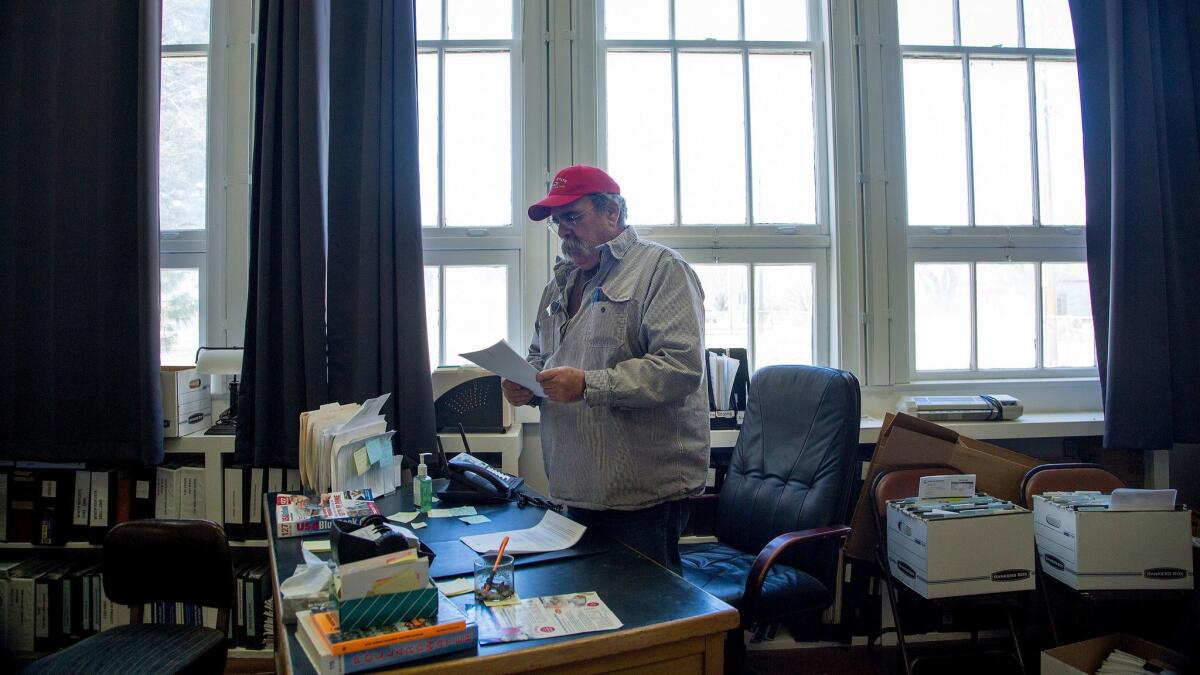

Loyalton Mayor Mark Marin knows the math won’t work. The son of the former town fire chief, Marin spent most of his life logging in the Sierra Nevada until he said he was talked into running for mayor just over a year ago, adding that he only ran for City Council to help untangle the city’s financial mess.

“I don’t know where we’re going to get the money unless we start selling crap off,” Marin said. “What’ll end up happening is that we won’t be able to pay our obligation and the retirees will come back with a lawsuit. The only way they’re going to get any money is if they take property. It’s a Catch-22.”

Marin noted that it would have been a lot cheaper if the city had just stayed in CalPERS. Loyalton was paying just $3,500 a month, and that covered the cost of its retirees’ full pensions.

Once a proud and vibrant company town known for solid-paying jobs and a frontier lifestyle, Loyalton was flattened in 2001 when Sierra Pacific Industries — the largest employer in Sierra County at the time — shut down the sawmill that sustained the town for more than a century.

And more recently, Loyalton has been bitten by a series of self-inflicted financial blunders and misfortune.

In 2014, a Sierra County grand jury issued a scathing report that detailed a litany of mismanagement issues in the city. It found some members of the City Council were “less than honest” and questioned whether the city would survive financially.

“The City, through its City Council, has decided that amateurs know the best way to run the city, and this is causing problems that are starting to show up. This is exposing the citizens of the city to liability issues in many forms and from many sources,” the report stated.

In 2010, the city’s bookkeeper was arrested and charged with embezzling public funds. The FBI was called in to help sift through the city’s tangled finances.

Around the same time, Loyalton’s city employees received a big raise — close to 50 percent. Explanations for how that happened differ. Marin says it was knowingly approved by a former City Council. But Councilman Brooks Mitchell, who was on the council when the raises went through, insists that he and his colleagues approved only a 5% raise and that the figure was mysteriously switched to 50% after the vote. It took years for city officials to notice, Mitchell said.

Mitchell figures that mistake cost the city more than $650,000, though Loyalton’s insurance policy allowed the city to recoup about $330,000.

But that pot of money disappeared fast. The council spent a chunk to convert an old elementary school into a new home for Loyalton’s City Hall and the town museum in 2015. It also spent more than $20,000 on a pair of engraved stone signs to welcome visitors to Loyalton.

“The City Council went overboard. They got all this money back from the insurance and started spending everything. Then, later on, they cut our retirement,” said Patsy Jardin, 71, who worked for the city for three decades as the City Hall office manager and bookkeeper.

Jardin said her $4,100 monthly check from CalPERS was slashed by close to $2,000 after the City Council voted to pull out of the pension fund in 2012.

The council “promised me it wouldn’t cut my retirement,” Jardin said. “They promised me.”

Loyalton’s mayor said there’s no doubt the city messed up by granting pension benefits without thinking hard about whether the small town could pay for them down the line. But, he said, Loyalton’s predicament is just a symptom of a overly generous state pension system that has become unsustainable.

“There are people who made $200,000 a year and they’re drawing $200,000 in retirement,” Marin said. “How’s that going to work?”

Twitter: @philwillon

Updates on California politics

ALSO

Cutting jobs, street repairs, library books to keep up with pension costs

El Monte's mayor wants to end bonus pensions costing millions but his hands are tied

When city retirement pays better than the job

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.