Capitol Journal: Blasting California’s gas tax while working to cut federal tax breaks? That’s called hypocrisy

- Share via

Reporting from In Sacramento — California Republicans seem to have conflicting tax philosophies. Or maybe they’re just outright hypocritical.

They’re trying to gain political mileage by squawking about Sacramento Democrats raising the state gas tax to repair roads.

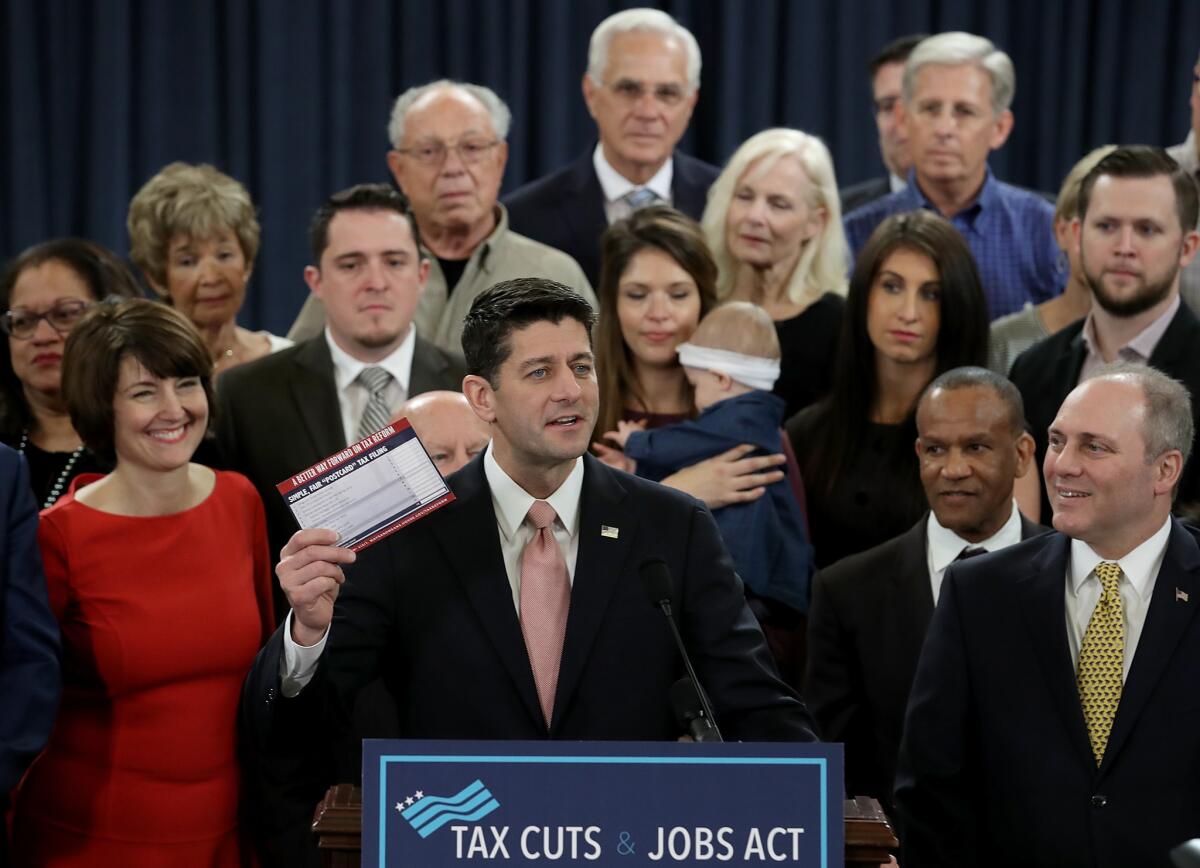

But they’re not voicing a peep of protest about Washington Republicans attempting to take away federal tax breaks used by millions of middle-class Californians. President Trump and the GOP are scooping up money to lower taxes for big corporations.

The federal tax hits would hurt many Californians a lot worse than the modest state hike in gas taxes will.

Eliminating the federal income tax deduction for state taxes and capping local property tax write-offs at $10,000 would especially smack Californians. So would limiting mortgage interest deductions on future home purchases to loans under $500,000.

That’s because California has the highest state income taxes in the nation. And home purchasing costs in some regions — the Southland coast and the Bay Area, especially — are practically out of sight. We’ve become very accustomed to deducting those big expenditures on our federal income tax returns.

Some data: Roughly 6 million California taxpayers — one-third of the total — itemized on their 2015 federal tax returns, taking an average of $18,400 in deductions for state and local taxes. That amounted to approximately $113 billion in deductions for all of California, according to the state Finance Department.

For middle-class taxpayers with incomes between $50,000 and $150,000, the average deduction for state and local taxes was roughly $10,400. Of that, $6,100 was for the state income tax and $4,300 for property taxes.

The Republican U.S. House plan retains property tax deductions up to $10,000, so most new homes worth under roughly $900,000 would still be fully covered. But interest on only $500,000 of the mortgage would be deductible. And none of the state income tax would be.

How it all shakes out will vary from taxpayer to taxpayer, from region to region. Standard deductions would be roughly doubled, but personal exemptions eliminated. There’d be fewer tax brackets. Medical savings accounts and alimony deductions would be quashed. Lots of calculating to do.

Some people would gain. They’d probably be wealthy. But millions would lose, many of them middle-income itemizers.

Coverage of California politics »

One thing is for sure: The California gas tax and vehicle fee hikes, by comparison, are penny-ante. The state Finance Department estimates the annual cost per driver at $117.

A 12-cent-a-gallon gas tax increase took effect last week, along with a 20-cent boost in diesel fuel. That will cost motorists an average $69 a year. On Jan. 1, there’ll be a new annual fee based on a vehicle’s value, ranging from $25 to $175. The average is pegged at $48. And beginning in 2020, there’ll be a $100 annual fee on electric cars.

Those taxes and fees are supposed to raise $5.2 billion a year, or $52 billion over a decade. At least motorists will be seeing gradual improvement in road conditions. The state estimates there’s a $130-billion backlog in transportation maintenance.

By contrast, losing the federal deduction for income taxes and capping the property tax write-off could cost Californians into the thousands of dollars in higher federal taxes. But, hey, corporate tax rates would be slashed to 20% from 35%. And, over 10 years, $1.5 trillion would be added to the national debt.

Don’t get me wrong. As I’ve written previously, I see nothing unjust about dumping the deduction for state and local taxes. There’s no credible justification for the feds subsidizing California’s high levies by making them less painful.

Many argue that California sends more tax money to Washington than it gets back in benefits, so federal subsidies of its state and local taxes are fair. But I don’t buy it. Fairness has nothing to do with it. We get less back from Washington mainly because California is more prosperous and younger than most states. So we pay higher taxes while being entitled to less Social Security, etc.

But voting to help corporate America while hurting millions of middle-class Californians is politically risky. House Minority Leader Nancy Pelosi (D-San Francisco) seemed on target when she asserted that California Republicans “have gone straight down the line like lemmings to the sea to vote against the interest of their constituents.”

They haven’t voted yet, but I haven’t noticed any GOP House member from California coming out against the bill either.

There are seven California Republican House members in competitive districts who would be handing their Democratic challengers a big fat target by voting for the tax bill.

“In a campaign context, opposing the gas tax is not going to sufficiently counter voting to eliminate state and local tax deductions,” says Republican strategist Rob Stutzman. “Those are not equitable issues that wash out.”

Democratic strategist Bill Carrick: “California is ground zero for Democrats to get a bunch of House seats back [and regain control]. But if Republican candidates are going to have to defend their voting for higher taxes, that’s a bad start running in a district that voted for Hillary Clinton.”

All seven of those endangered Republican incumbents represent districts that voted for Hillary Clinton over Donald Trump.

“It’s a pretty easy to understand campaign argument: Congressman ‘X’ voted to raise your taxes,” Carrick adds. “It strikes right at the Republican base.”

Republican politicians need some consistency. They can’t convincingly justify raising millions of people’s income taxes while bemoaning a bump in gas taxes. That’s called hypocrisy.

Follow @LATimesSkelton on Twitter

ALSO

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox twice per week.

You may occasionally receive promotional content from the Los Angeles Times.