Pete Buttigieg wants to end cap on state and local tax deductions

Presidential candidate Pete Buttigieg released a tax reform package Monday that would roll back the Trump administration’s cap on the state and local tax deduction, which disproportionately affects residents of high-tax states such as California.

Buttigieg, the former mayor of South Bend, Ind., also calls for expanding the child tax credit and the earned income tax credit.

“As president, I will rebalance our economy so it works for all Americans, hold Wall Street and corporations accountable and bring fairness to our tax system so we can lift millions out of poverty and into greater opportunity,” Buttigieg said.

Buttigieg announced his tax proposals as the presidential campaign turns toward Super Tuesday, when California and 13 other states will vote.

The tax proposal appears designed to appeal to voters here because of the impact the cap on state and local tax deductions — part of President Trump’s 2017 tax reform — had on Californians as well as residents of other costly states such as New Jersey and New York. Under the law, the total amount of state and local taxes that can be deducted from federal taxable income is $10,000.

The state’s Franchise Tax Board reported that roughly 1 million Californians paid more in federal taxes because of this cap.

Under Buttigieg’s proposal, the cap would be eliminated for households that earn less than $400,000.

The state and local tax deduction cap has not been a subject of discussion during the 2020 presidential campaign, and it is a tricky subject for Democrats who are focused on increasing taxes on the wealthy and reducing the tax burden of the poor. The cap most greatly affects high-income households.

Former Vice President Joe Biden has also proposed eliminating the cap. Former New York Mayor Michael R. Bloomberg’s plan would maintain it.

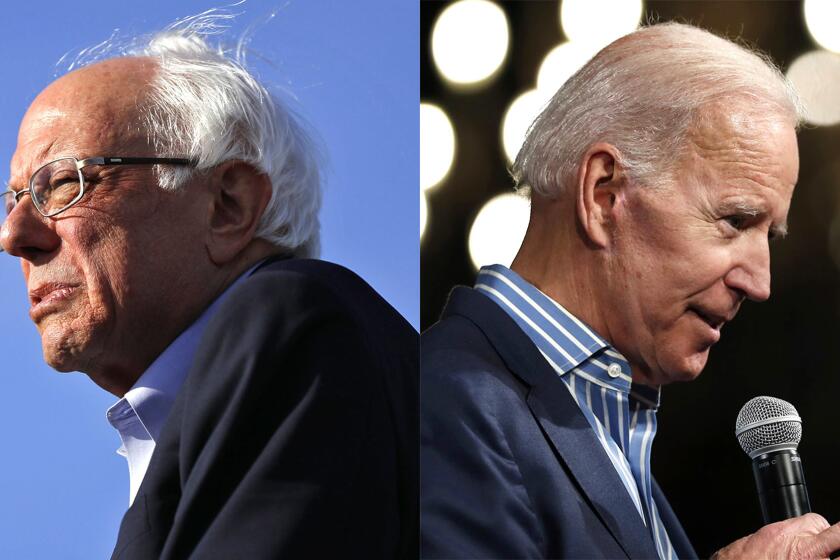

Here are 2020 Democratic presidential candidates Joe Biden and Bernie Sanders’ plans on healthcare, immigration, climate, gun control and housing and homelessness.

In October, the Senate voted against repealing a Treasury rule that quashed states’ attempts to work around the cap. Minnesota Sen. Amy Klobuchar voted to repeal the rule; Sens. Bernie Sanders of Vermont and Elizabeth Warren of Massachusetts were not present for the vote.

Buttigieg also proposes providing families that earn less than $400,000 with a $2,000 child tax credit, and an additional $1,000 credit for children younger than 6, in an effort to reduce childhood poverty.

The total effective tax rate on millionaires would grow from 31% to 49% under a Buttigieg administration. He also proposes a 0.1% tax on all stock and securities trades and raising taxes on American companies’ foreign profits from 10.5% to between 28% and 35%.

Joe Biden is the likely Democrat nominee to face President Trump now that Bernie Sanders has suspended his presidential campaign. Meet the candidates.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.