Lawmakers have negotiated a $2-trillion coronavirus stimulus package. What happens next?

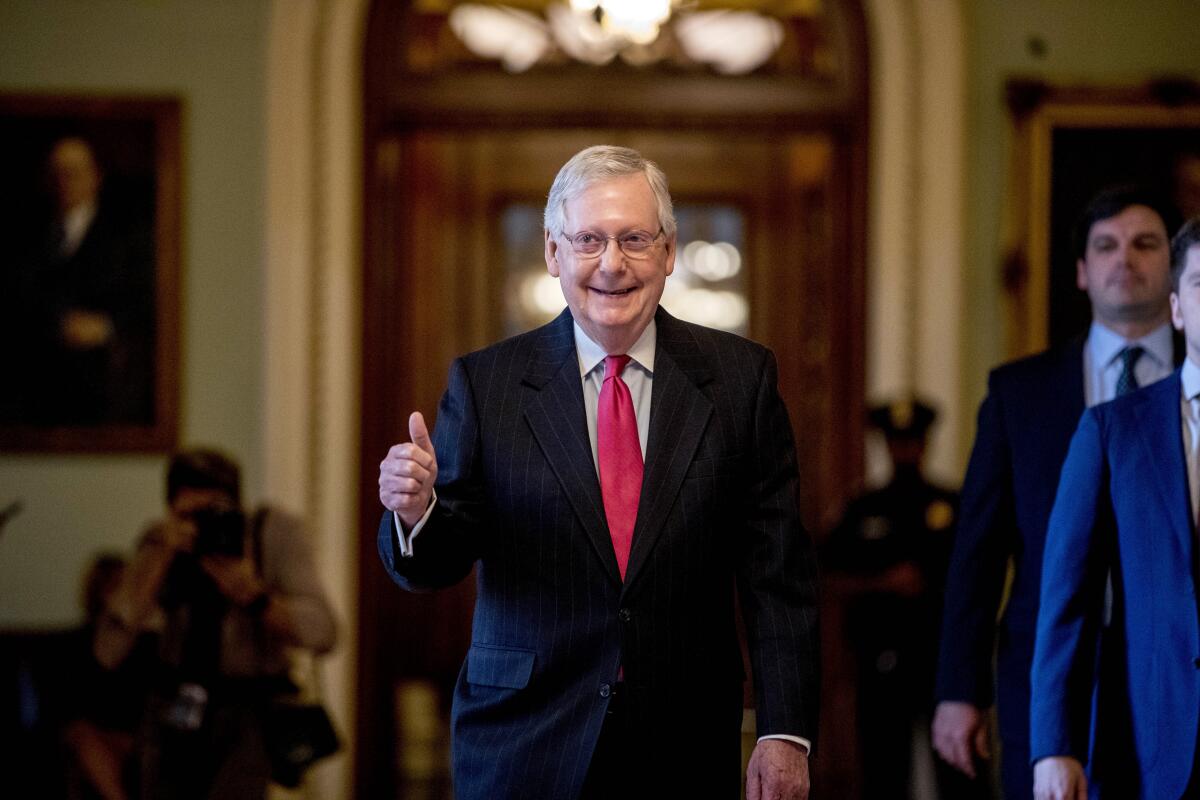

The Senate Wednesday evening passed a rescue package for the U.S. economy that is the largest in the history of the nation. Democrats and Republicans came to an agreement on roughly $2 trillion meant to help workers and distressed businesses hurt by the coronavirus pandemic.

Here’s what you need to know:

What comes next?

Speaker Nancy Pelosi (D-San Francisco) said the bill is likely to pass in the House with “strong bipartisan support” on Friday. She previously expressed hope the chamber would approve the bill by a fast procedure known as unanimous consent, which would not require most members to travel to Washington and be physically present for the vote. If any member objects, however, that procedure can’t be used, which would require calling House members back to Washington for a full debate and vote.

Will Americans get a check, and what are they supposed to do with it?

If the bill passes, many taxpayers will see one-time payments in their bank accounts as soon as early April. The move is meant to ease the financial burden many families currently have and encourage spending to bolster the economy. Not everyone will receive the same amount. Individuals who make $75,000 or less and married couples making up to $150,000 a year will receive $1,200 per adult and $500 per child. Those whose incomes are higher will see smaller checks. Individuals who make $99,000 or more and couples who make $198,000 or more would not receive a check. Income levels will be based on reported 2018 taxes.

What about Americans who lost jobs because of the outbreak?

The package includes up to four months of unemployment benefits, what Senate Minority Leader Charles E. Schumer (D-N.Y.) calls “unemployment insurance on steroids.” The bill expands coverage to include people who have been furloughed, gig workers and freelancers.

Will this bill help distressed industries?

Yes, it would give up to $500 billion in loans to distressed industries. In the original proposal, Senate Republicans wanted to give the Treasury latitude to disburse the funds, including the discretion to conceal for up to six months the identities of companies that got taxpayer dollars. The final deal includes an inspector general and a five-person congressional panel to oversee the fund.

Can President Trump’s, or any federal official’s, businesses benefit?

According to Schumer, no. The proposal would bar businesses controlled by the president, vice president, members of Congress and heads of executive branch departments from receiving loans or grants from the Treasury programs. Their children, spouses and in-laws also could not benefit.

Will the bill fix the economy and fully address the pandemic?

While the bill is intended to stimulate the economy and halt further market declines, there’s no guarantee it will be a cure-all. Markets surged Tuesday in anticipation of the deal, rose further on Wednesday and continued to rally Thursday morning. Economists believe the U.S. is already in a recession. States including New York have already expressed concern that the current deal is not enough, and many lawmakers feel additional legislation will be needed.

How will this affect the federal deficit?

It will grow, that is certain. But, leaders in both parties and main economists believe that’s necessary. The Committee for a Responsible Federal Budget, a bipartisan think tank based in Washington that normally campaigns for reduced deficits, said late Tuesday that the deficit would “easily exceed $2 trillion this year and next.” But it said that “now is not the time to worry about near-term deficits. Combating this public health crisis and preventing the economy from falling into a depression will require a tremendous amount of resources — and if ever there were a time to borrow those resources from the future, it is now. Larger deficits are not only an inevitability, but are, unfortunately, a necessity.”

Times staff writer Sarah D. Wire contributed to this report.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.