Burbank Chamber offers endorsement, funding if Burbank Unified tweaks parcel tax proposal

Less than a year after Burbank Unified’s proposed parcel tax, known as Measure QS, failed to pass —falling short by 938 votes — the Burbank Chamber of Commerce delivered school district staff and board members its own proposed parcel tax, with the promise of support for it.

The chamber took no position on Measure QS.

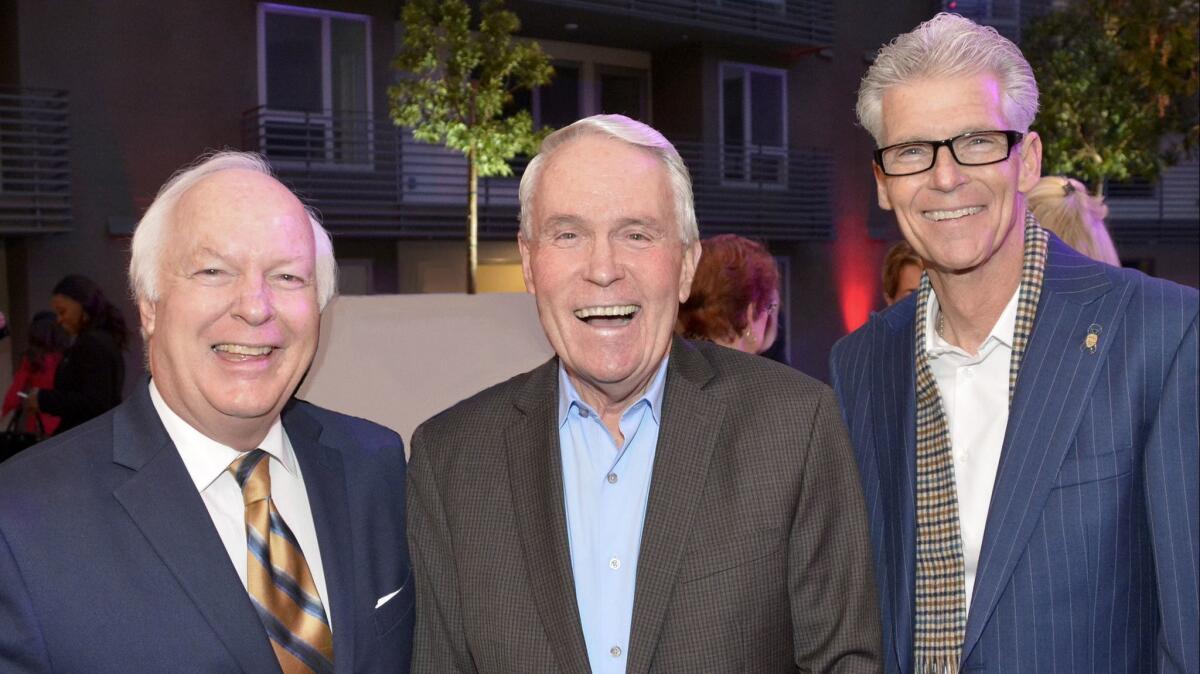

Tom Flavin, the chamber’s chief executive, unveiled a plan during a school board retreat on Saturday that he says seeks “equity” by raising the amount homeowners and small businesses pay, lowering contributions from large businesses by setting a ceiling and incorporating a 12-year sunset clause, which was absent from Measure QS.

If Burbank Unified officials agree to the chamber’s proposal, the business organization will fund a “Yes” campaign for a parcel tax next year.

Burbank Unified’s board will meet Thursday and is expected to discuss the potential of placing a parcel tax on the ballot in March.

“Of course, we want to see the parcel tax pass this time,” Flavin said. “We just want equity with our business community.”

Measure QS called for a 10-cents-per-square-foot annual fee on real property, which school district officials said would have placed 48% of the tax burden on commercial properties, 35% on homeowners and 17% on apartment-building owners.

Had it passed, Measure QS would have secured the deficit-spending school district roughly $9 million annually at the cost of around $170 per year for the average Burbank homeowner.

The chamber’s proposal hikes the fee from 10 cents to 15 cents and places a $3,000 cap on commercial businesses, not counting their parking lots, over 20,000 square feet.

According to the chamber, that would generate $4.6 million annually from commercial property owners. Approximately 3,210 buildings in the city are less than 20,000 square feet, which totals about $3.03 million annually.

The chamber estimates 525 businesses are over 20,000 square feet, with those companies generating $1.57 million annually under the chamber’s proposed parcel tax.

“Businesses in Burbank have always stepped up and done their fair share and really do more than that,” Flavin said. “Individual members of the community are also involved in supporting many school fundraising efforts.”

On the flip side, the average Burbank homeowner would have to pay roughly $255 per year. The 5-cent increase would also affect apartment-building owners.

The chamber estimates residential and apartment-building property owners combined would pay $4.56 million annually. Then, including commercial property owners, the chamber’s proposed tax would generate $9.16 million a year for the district.

“Our analysis says [that with] a 10-cents-per-square-foot approach, which was tried last year, the business community would pay more than 70% of that new tax burden,” Flavin said. “Our proposal is a 50-50 sharing of the burden with business and residential taxpayers.”

Flavin was Burbank’s mayor in 1990 when Lockheed relocated from Palmdale and Burbank to Georgia, citing the cost of doing business. The Media City lost between 9,500 and 10,000 jobs.

“For 50 years, they were the largest employer, property owner and taxpayer in the city,” Flavin said of Lockheed. “The reason they did it is because they said, ‘Hey, the cost of doing business in California got the point where we don’t feel we can compete anymore.’ We can’t continue to place these burdens on our business community.”

This past November, 42,549 out of 65,428 registered Burbank residents, or 65.03%, voted in an election that also saw the city of Burbank place Measure P, a three-quarter-cent sales tax, on the ballot.

While the sales tax needed only a majority vote to pass, Measure QS and any parcel tax, for that matter, required a two-thirds ‘yes’ vote, or 66.7%, to pass.

Despite over 25,000 “yes” votes, the parcel tax failed with 64.33% of the vote, while the sales tax passed with 61.97%.

While the chamber did not take a position on Measure QS, it did endorse Measure P.

“Our view was the sales tax was an equitable burden shared by those who lived here and worked here,” Flavin said.

District Supt. Matt Hill acknowledged he and school board members have studied the chamber’s proposal and will likely incorporate some aspects, such as the sunset clause, but not all.

“We are concerned about raising the square-foot tax from 10 cents to 15 cents,” Hill said.

“We feel that this would put a disproportionate burden on homeowners and businesses who own small properties,” he added. “The 15-cent-per square-feet proposal would increase the financial burden on those property owners (over 26,000 properties) by 50% compared to the [10-cent] assessment.”

While Flavin said he wasn’t expecting the board to fully go along with the chamber’s proposal, he’s curious to see what happens Thursday.

“We’re open-minded to any and all suggestions,” Flavin said. “I suggested that we have further discussion to see if we can flush them out. We can endorse or take no position, like last time.”