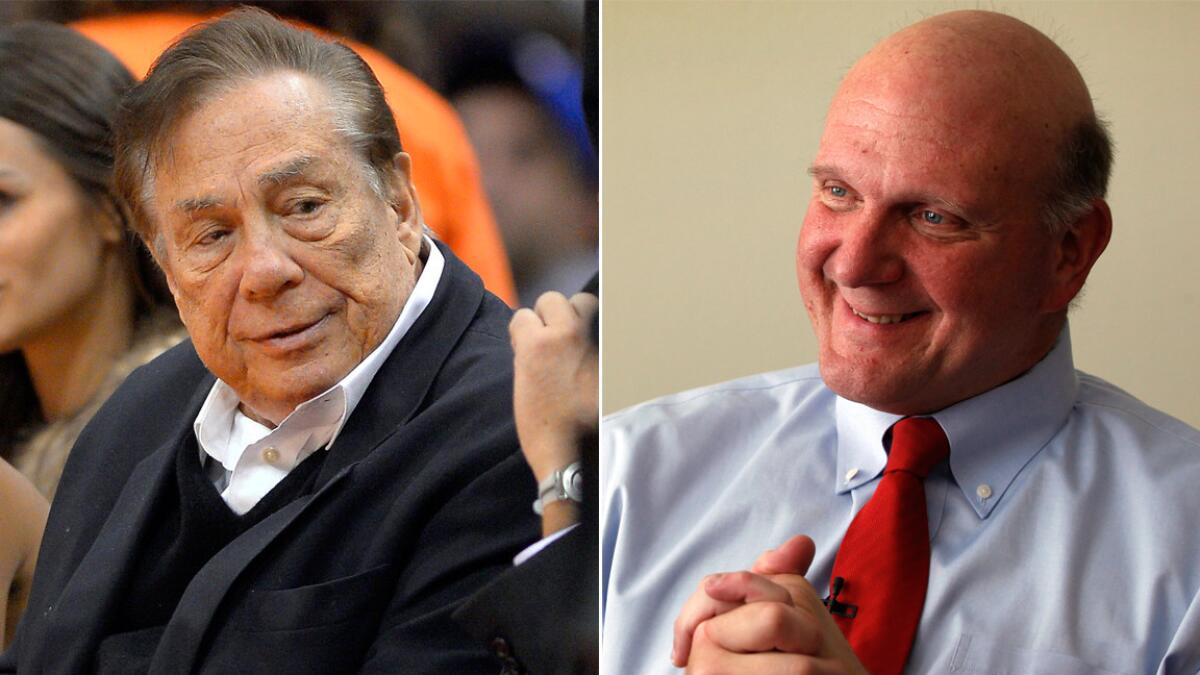

Donald Sterling meets with Clippers suitor Steve Ballmer

- Share via

For the first time since he began a nearly two-month battle to block his wife from selling the Clippers, Donald Sterling met Monday with Steve Ballmer, the man who would like to replace him as principal owner of the team.

Whether the 11/2 -hour afternoon session at Sterling’s Beverly Hills mansion signals a possible breakthrough is unclear.

Lawyers for Sterling and his wife are scheduled to return to court Tuesday to continue a trial in which a probate judge has been asked to determine whether Shelly Sterling acted properly when she took over the family trust that owns the NBA franchise and other assets. She signed a sales agreement May 29 to sell the team for $2 billion to Ballmer, former chief executive of Microsoft.

The trial Monday morning delved into the issue of whether Donald Sterling, 80, had caused harm to his family’s finances when he moved in June to dismantle the trust. A Sterling employee testified that the owner’s action could force the trust to repay $480 million in real estate loans, a claim that was hotly disputed by Donald Sterling’s representatives.

The meeting between the current Clippers owner and possible future team owner came hours after court had adjourned for the day. People familiar with the session said Sterling invited the Seattle-based Ballmer to come to Los Angeles to discuss his bid for the NBA franchise after Sterling met for three hours Sunday with his wife, Shelly.

Although the get-together was described as cordial, none of the participants or others familiar with the talks said any substantive progress had been made. But the fact that Sterling would meet Ballmer offered some hope for a settlement, said two people familiar with the meeting, which included lawyers for Shelly Sterling, Donald Sterling and Ballmer. The sources asked to remain anonymous while discussing talks that were to remain confidential.

Donald Sterling and Ballmer have not scheduled any additional meetings and the probate hearing will continue Tuesday and Wednesday. Closing arguments are set for Monday.

In the days following Ballmer’s winning bid for the team, Donald Sterling had briefly said he would support the deal. But his representatives said he did so believing that the NBA would drop a $2.5 million fine and lifetime ban imposed on him after he was captured on a recording telling a companion not to bring black people to Clippers games.

NBA Commissioner Adam Silver said, however, that he would not drop those sanctions and that he would urge the other owners to vote to strip Sterling of the team if he did not sell the franchise. Sterling responded by vowing to wage a protracted war to block the sale of the Clippers.

One of the issues in the probate case is whether Judge Michael Levanas — if he validates Shelly Sterling’s sale of the team — should also grant an order essentially making his ruling appeal-proof. To merit such an extraordinary action, Shelly Sterling is trying to prove that the family trust would suffer irreparable harm if an appeal were allowed to kill the deal.

Her attorneys on Monday called Darren Schield, longtime chief financial officer for the Sterlings, who testified that Donald Sterling’s June 9 revocation of the family trust meant that three banks could call for repayment of $480 million in loans. That, in turn, could force the billionaire real estate magnate to sell part of his apartment empire, Schield said.

The officer for the Sterlings’ Beverly Hills Properties voiced concern about those “severe consequences” but also acknowledged on cross-examination that none of the banks have recalled their loans.

Shelly Sterling testified earlier in the trial that she planned to use some of the proceeds of the sale to repay loans from the three banks.

An attorney for Donald Sterling rebutted the notion that the loans would be recalled and property sold to repay them. “It’s never going to happen,” Max Blecher said outside court. “They will fix it first.”

Schield described working for the Sterlings for more than 20 years and overseeing a real estate empire of about 10,000 units in 150 buildings. He said the Sterling trust had a $350-million line of credit with Bank of America, a $100-million loan with Union Bank and $30-million in outstanding debt with City National Bank.

Without the sale of the Clippers to repay the loans, Schield suggested, the family would have to unload real estate quickly and possibly at a cut rate. “I don’t know if we could sell that many apartments,” he testified.

Under cross-examination by Blecher, Schield acknowledged that there could be several other less-onerous outcomes for the family, such as a restoration of the trust, establishment of new loans with other lenders or taking the company public.

Scheduled to testify Tuesday are Dick Parsons, the interim executive appointed by the NBA to oversee the Clippers; Dean Bonham, a sports marketing expert, and Shelly Sterling.

Twitter: @LATimesrainey

More to Read

Go beyond the scoreboard

Get the latest on L.A.'s teams in the daily Sports Report newsletter.

You may occasionally receive promotional content from the Los Angeles Times.