Market’s Binge on Drug Stocks Based in Reality

The stock of Bristol-Myers vaulted to new highs this week on the company’s announcement that it would seek permission from the Food and Drug Administration to test a vaccine against acquired immune deficiency syndrome, or AIDS.

The specter of AIDS is terrifying, so the stock market’s fevered reaction--traders adding more than $1 billion to the market value of Bristol-Myers in a single week--is perhaps understandable.

But the market’s drug habit is not confined to AIDS. The stock of Upjohn was up 40% so far this year--before a 5-point swoon on Thursday--on hopes that its minoxidil solution, called Regaine, will grow hair on bald men. Merck, the drug industry’s leader, is up close to 30% so far this year, and Squibb is up 40%. Bristol-Myers’ stock was strong long before the AIDS vaccine announcement.

Moreover, most drug stocks are not only selling at or near their 52-week highs, but at historic levels, significantly above any price the companies, many half a century old, have ever sold for.

What’s going on? Is the market on mood elevators? Or is its drug stock enthusiasm based on real progress in pharmaceuticals?

Real Drugs, Real Illnesses

The answer is real progress. The U.S. pharmaceutical industry is enjoying a period of accelerated new product introductions as research spending over this decade yields results. So more than concern for AIDS or hair loss, what is pushing the stocks is the fact that in a leading U.S. industry the outlook is for more new products in the next few years than in the past 10.

Real drugs for real illnesses: Merck expects soon to be on the market with a drug called Mervacor that lowers cholesterol levels and is expected to be a big product. Squibb has Capoten, a drug that combats high blood pressure. Bristol-Myers, a company that gets 40% of its $4.8-billion sales from prescription drugs--and more than half from products like Bufferin and Lady Clairol--has a non-addictive, anti-anxiety drug called Buspar. Eli Lilly has an antidepressant, Pfizer has a new blood pressure medicine, and so forth.

Yet the most interesting lesson of all for business may lie in why all this is happening now. The industry’s harvest of new products and bountiful outlook results from a change of direction and a focusing of research spending in the early 1980s. At that time, the drug companies turned back from diversification into fields such as chemicals and hospital equipment to concentrate on their traditional business, pharmaceuticals.

Merck in Spotlight

It is a demanding field. Drug companies spend more than any other industry, including computers, on research. Also, because drugs must be tested and approved before marketing, it takes six to eight years to go from laboratory work to prescriptions in doctors’ offices and sales in drugstores. The payoff is that a company with a successful new drug gets 10 years of patent protection to make good profits before competitors can market the same formula.

And the stock market gets enthusiastic because a single drug can transform a company, as Tagamet, the ulcer remedy, changed Philadelphia’s Smith Kline & French--now SmithKline Beckman Corp.--from a $780-million sales company in 1977 into a $2-billion giant four years later.

The company many experts see that happening to today is Rahway, N.J.-based Merck, but due to a stream of new products, not just one. Analyst Elizabeth Greetham, of the Eberstadt Fleming investment banking firm, thinks Merck’s $4.1 billion in sales could grow by $1.8 billion, or 43%, by 1990, with the profits growing even faster than the sales.

But the whole industry is growing rapidly, from $45.9 billion in total revenues this year to a projected $66 billion two to three years from now, according to the Value Line investment firm. So in favoring pharmaceuticals, the stock market is only doing what comes naturally--paying for growth.

Business aside, though, is there any real hope for an AIDS vaccine? Yes there is.

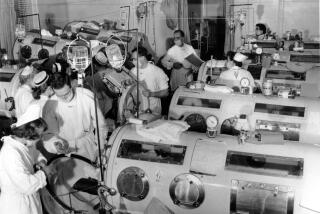

Bristol-Myers’ Oncogen subsidiary is only one among scores of laboratories working on the AIDS virus. In fact, so massive is the research that it recalls the postwar 1940s push to combat polio, which led to Jonas Salk at the University of Pittsburgh discovering the vaccine and the beginning of mass inoculations in 1954.

Finally, for business, the lessons of the drug industry are too plain to ignore. The industry, of necessity, thinks long term, spending massively on research and waiting more than half a decade to get its products to market. It is a world industry, getting up to half its sales overseas and retaining the competitive edge against European and Japanese competition. Yet it is also more profitable and grows faster than most other industries.

If the supposedly shortsighted stock market loves a business that does all that, why are all those other industries making excuses?

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.