UAW Local at Douglas Gives Airbus a Hand

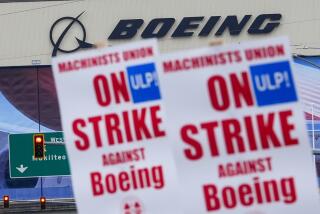

A labor union local is giving management fits at the Long Beach plant of McDonnell Douglas. Angry that Douglas management wants to change work rules, Local 148 of the United Aerospace Workers is slowing production by working strictly by the book.

The tactic is having an effect. McDonnell Douglas says the labor slowdown, among other things, has made it miss delivery dates for 10 commercial airliners. And Local 148 is gleeful that it’s making an impact.

But people elsewhere in the global marketplace see the matter differently. Local 148’s parent organization, the United Auto Workers union, is unhappy. It has advised Local 148 members to accept the work rule changes and has called the local union’s officials to Detroit for a hearing on Wednesday . Meanwhile, in Toulouse, France, there are a lot of people cheering the Long Beach slowdown.

Toulouse is the headquarters of Airbus Industrie, the European aircraft consortium that thinks it has McDonnell Douglas on the run. “I don’t think McDonnell Douglas seriously intends to continue in commercial aviation,” says Alan Boyd, chairman of Airbus Industrie of North America, the consortium’s U.S. arm. “It keeps reworking a 20-year-old design rather than investing in an all-new plane.”

Costs Are High

Boyd is engaging in gamesmanship, trying to suggest to potential customers that St. Louis-based McDonnell, a giant defense contractor that gets roughly two-thirds of its $12.6 billion in revenue from military work and less than a third from commercial aircraft, lacks the stomach for the huge investments needed in the civilian plane business.

Boyd is talking his own company’s case, of course. The 20-year old design he’s referring to has been one of McDonnell Douglas’ great strengths--the venerable DC-9, which the company has adapted successfully to produce the MD-80 medium-range airplane and the DC-10, soon to be the long-range MD-11. It gives you some idea of the costs in this business that McDonnell is spending $500 million to develop the MD-11, and that’s a bargain price because it is adapting an existing design. The company, moreover, is investing its shareholders’ money while Airbus, a partnership of French, West German, British and Spanish companies, is using European taxpayers’ money.

Lots of it. The French government voted last week to give Airbus $1 billion for work on a new series of airplanes, including the long-range A-340, which will compete with the MD-11 and with Boeing’s long-range adaptation of the 747. The British government recently voted more than $250 million for Airbus, and the West German government is being asked for $2 billion.

Europe’s Motives

The European governments are coughing up the money because they understand that the aircraft industry provides more than jobs. It keeps a country up to speed technologically, in engineering, metallurgy, electronics, fuels and propulsion. The Europeans see the benefits the Americans get because Seattle’s Boeing and St. Louis’ McDonnell support advanced technical work by thousands of suppliers in practically every state in the union. And they want to grab that kind of business.

So Airbus is attacking on all fronts, while both Boeing and McDonnell try to keep customers from buying Airbus planes until they can come along with new fuel-saving aircraft, using propfan engines, in the early 1990s. A big reason that Boeing made its $700-million investment two weeks ago in the stock of Allegis, parent of United Airlines, was to secure orders for the long-range 747 and keep United from buying the A-340. But Airbus scored recently when American Airlines bought 25 of its planes in March, and Northwest Airlines ordered 20 A-340s in April.

The competition is fierce and expensive. One aircraft expert likens it to a poker game, with Airbus taking hands by clever play, Boeing--the player with the biggest stack of chips-- raising the ante, and McDonnell, the worried player, wondering whether to keep up with the betting.

Worried it may be, but it’s still playing to win. McDonnell announced at the start of this year that it was going ahead on its own with the MD-11. It has garnered 120 orders for the plane--which is capable of flying nonstop from New York to Hong Kong--while Airbus has 81 for the A-340. Before it went ahead, however, McDonnell’s executives journeyed to France to discuss a joint venture on the long-range plane with Airbus.

But so confident is Airbus these days that its French chief executive, Jean Pierson, said he wasn’t interested. Pierson, who has over 100 U.S. orders for the medium- range Airbus A-320, talks of building an assembly plant in the United States if he gets more orders--or if he can drive McDonnell from the business.

The one certainty is that the union that thinks it’s smart to slow production in Long Beach doesn’t know the game it’s playing in. With Airbus aiming at its head, McDonnell Douglas doesn’t need to be shot in the foot.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.