Nixon’s Influence on Fed Revealed : Critical Letter From Reagan Shunted Aside, Memos Show

- Share via

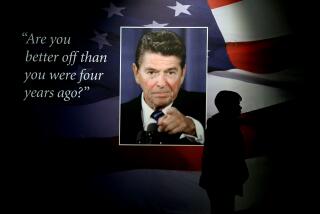

WASHINGTON — The Nixon White House kept heavy pressure on Federal Reserve Board Chairman Arthur Burns to do its bidding but gently turned aside complaints from one Fed critic, then-California Gov. Ronald Reagan, documents made public on Tuesday show.

Among 400,000 pages of White House records released by the National Archives is a Sept. 17, 1973, letter from Reagan to then-President Richard M. Nixon complaining about the effect of a Fed decision on California mortgage loans.

The documents also included many internal White House memoranda suggesting that White House aides devoted considerable effort to encourage Burns, appointed by Nixon in 1970, to stimulate the economy before Nixon’s 1972 reelection campaign.

Critics claim that the easy-money policy pursued by Burns in the early 1970s did keep the economy humming through 1972 but set the stage for sharply rising interest rates and inflation in the following year, triggering a recession.

In his letter to Nixon, Reagan contended that the Fed and the Federal Home Loan Bank Board were drying up the availability of mortgage money in California.

They were doing this by easing restrictions that had kept interest rates that banks could pay on savings accounts below those offered by savings and loan associations, Reagan said.

The result, he wrote, “has been a flow of funds from savings and loans to banks.”

Since savings and loans are the “major supplier of funds for home building in California,” the result of the action threatened “irreparable damage” to his state’s home-building industry, Reagan charged.

Shultz Answered Letter

“Present events have occurred which places the home-building industry in the state of California in a potentially grave situation,” Reagan wrote.

The Reagan letter was shunted back and forth among several aides, with Tod R. Hullin, an assistant to domestic policy adviser John Ehrlichman, recommending that it be given “special attention.”

Although White House assistant Kenneth Dam wrote a draft of a White House response, the final job of answering Reagan was given to George P. Shultz, then Nixon’s Treasury secretary and now Reagan’s secretary of State.

Shultz told his future boss that while the Nixon Administration “shares your concern,” a return to the former limitations on interest paid by banks would not solve the problem of California savings and loans.

“We have been limited in our ability to maintain the availability of home mortgage credit,” Shultz said.

Then, he added: “Inflation is our most important domestic problem and this Administration firmly believes that the nation is best served in the longer term by our vigorous efforts to curb inflation.”

The documents released on Tuesday were a second installment of Nixon White House material made public by the archives. An earlier 730,000 papers from the White House Central Files Unit, containing many personal documents kept by Nixon and his top lieutenants, were made public in December, 1986.

The newly released documents seemed likely to fuel longstanding speculation by critics that Burns deliberately manipulated monetary policy to help reelect Nixon--an allegation the late central bank chairman repeatedly denied.

In any event, the documents show a pattern of close White House involvement with the Fed on monetary issues during Burns’ tenure, including frequent meetings among Burns and top White House officials.

At one point, the White House even arranged an “appreciation” luncheon for Burns in late 1971 to which 58 leaders from the financial community were invited.

Although the first 20 minutes of the Burns’ speech to the group “was somewhat professorial,” Burns at the end of his speech “was very optimistic. From this point of view, the lunch was a success,” former White House aide Peter Flanigan said in a confidential memo to Nixon.

Noting that financial writers were then brought into the luncheon to speak to Burns, the memo continued: “While Arthur is no (then-Treasury Secretary) John B. Connally in terms of stimulating a response, the exercise was clearly a plus.”

In an Aug. 20, 1970, memo to Nixon, his then-chief economic adviser, Paul McCracken, praised Burns for “effective leadership” at the Fed in easing monetary policy and proposed that the money supply be permitted to grow even more rapidly.

“We urge this in no sense of trying to ‘take over’ monetary policy, but merely as those who will be held accountable for the economy’s performance during this period,” McCracken wrote to Nixon.

Points to Growth

“The relationship between Administration officials and the Federal Reserve system has always been a somewhat uneasy one,” McCracken added. “But it is the President who will be held politically accountable for the economic results of Federal Reserve Policy.”

Burns himself wrote a confidential note to Nixon on March 9, 1970, pointing out how the nation’s money supply had grown since he had been named Fed chief five weeks earlier.

“Let me add that the (Fed) board’s liberalizing action took place only on Feb. 10--the first meeting of the Federal Open Market Committee over which I presided,” Burns wrote to Nixon. The committee is the Fed’s chief policy-making unit.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.