Closing Arguments Made in Gioiosa Tax-Fraud Case

- Share via

CINCINNATI — Lawyers for Thomas Gioiosa tried to convince a U.S. District Court jury Monday that he cashed a winning race-track ticket for Pete Rose out of friendship, not as part of a tax-fraud scheme.

Gioiosa’s lawyers said in their closing arguments that federal prosecutors failed to prove a conspiracy between Gioiosa and Rose, who lived together from 1979-84, to defraud the government.

Defense lawyer Martin Weinberg said Gioiosa cashed a $47,646 race-track ticket for Rose as a favor to the man he admired.

“Is that a conspiracy (to defraud the government) or is that the result of a decade-long friendship?” Weinberg said.

The 12-member jury began deliberating Monday in Gioiosa’s trial on charges of tax evasion and conspiracy to distribute cocaine.

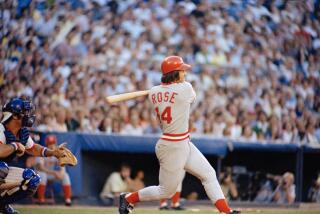

Rose, who hasn’t been charged with any crime, is under investigation by a federal grand jury in Cincinnati looking into whether the former Cincinnati Reds’ manager claimed all his income from gambling, memorabilia sales and autograph appearances.

One of the tax counts against Gioiosa involves a $47,646 Pik Six payoff from Turfway Park in northern Kentucky that Gioiosa cashed and claimed on his taxes. Three witnesses testified that Rose owned the majority share of the ticket.

Rose wasn’t called as a witness. Weinberg tried to use that to Gioiosa’s advantage.

“The question is, what did Pete Rose do?” Weinberg said. “Did he also report the $47,000? We don’t know what Pete Rose did. The government hasn’t produced Pete Rose’s tax return.”

The government wasn’t interested in arguing the point Friday, generally avoiding mention of Rose. Instead, Assistant U.S. Attorney William Hunt suggested to the jury that Gioiosa was trying to hide his income from cocaine involvement and illegal gambling.

“He needed to cover up the illegal money that he was making that he couldn’t report,” Hunt said. “Here was the perfect opportunity for him to seize that chance to defraud the IRS.”

More to Read

Go beyond the scoreboard

Get the latest on L.A.'s teams in the daily Sports Report newsletter.

You may occasionally receive promotional content from the Los Angeles Times.