FCC Rules Spark Game of ‘Filing for Dollars’ : Broadcasting: Investors sell out ‘sham’ license bids for millions. Regulators may be ready to pull the plug.

WASHINGTON — They call it “filing for dollars.” Savvy investors and communications lawyers have developed it into a nearly risk-free means of getting rich.

Here’s a simplified version of how it works: The Federal Communications Commission plans to award a new FM radio license. You apply for the license, along with a dozen or so others, even though you may have no intention of ever operating a station.

But that doesn’t matter. You hang on, through a hearing process that takes three to five years. If you win, you can sell the station at a huge profit. Far more likely, someone who really wants to run the new station, usually an existing broadcaster, will pay you a lot of money to go away before the FCC awards the license.

“Filing for dollars” has generated hundreds of millions of dollars in legal payoffs. Eight out of 10 broadcasting licenses are settled by the parties involved, according to FCC records. In 50 settlements of FM licenses in the first half of 1988, the winner paid competing applicants an average of $79,873. The payoffs sometimes run to millions of dollars.

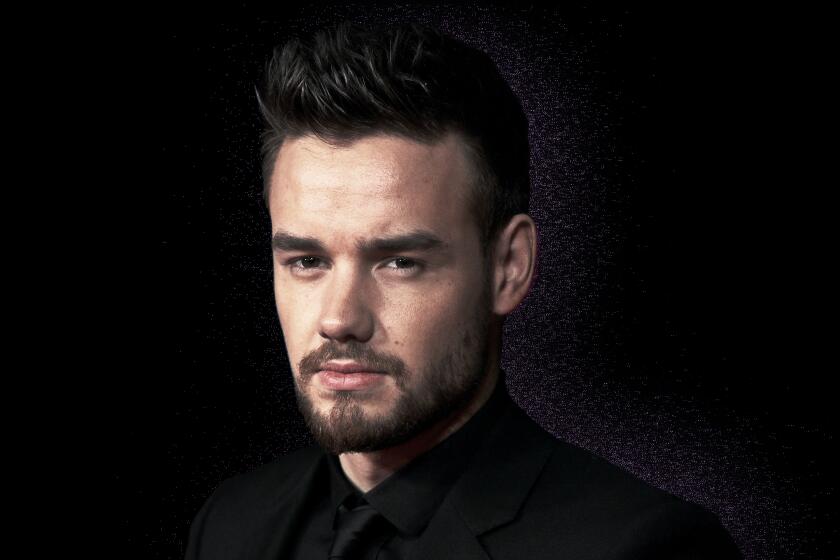

Among the recent beneficiaries are entertainer Bill Cosby and civil rights leader Vernon E. Jordan Jr.

The practice, spawned by the Ronald Reagan Administration’s deregulatory campaign, developed into nothing less than a private auction of public airwaves.

Along with big bucks for applicants, it has resulted in countless suspect applications, dilution of policies aimed at increasing the numbers of minority and female station owners and damage to the FCC’s ability to grant licenses to the most qualified applicants, according to interviews and a review of dozens of FCC cases.

“It’s a national scandal,” said Henry Geller, a former FCC general counsel. “The system is totally broken. It’s just burning money, and the public and FCC get no benefit.”

Before leaving the FCC last year, Commissioner Patricia Diaz Dennis offered this evaluation: “The applicant with the worst comparative qualifications can buy out the other applicants, and the FCC routinely approves the settlement.”

Now, battles are developing at the FCC and the Supreme Court over the way broadcast licenses are awarded. The results are likely to shape ownership of the public airwaves for decades.

The debates are timely because the FCC, which regulates the broadcast industry, plans to award 300 to 400 new AM radio licenses in the coming years. The creation of about 600 FM licenses a few years ago at a time of widespread deregulation opened the door to the current problems.

At the FCC, President Bush’s appointee as chairman, Alfred C. Sikes, appears to be moving away from some of the free-market policies of the 1980s.

“Generally speaking, there’s been a cottage industry developed here in Washington--pursuing valuable rights for the principal reason of reselling them,” Sikes said last week. “Fortunes have been made. I don’t want to do anything that encourages that practice, and I, in fact, want to reverse it.”

Last month, the FCC took the first step by unanimously overturning a 1988 commission ruling involving a new FM station in Marco, Fla. The previous commission had approved a settlement in which a radio company that had not applied for the license got the station by paying off the applicants.

“Approving such agreements disserves the public interest by creating an economic incentive for the filing of sham applications,” the commission said in ordering new hearings on the Florida license.

Some FCC observers believe the Marco decision signals a cautious return to more active regulation of broadcasting.

“Those of us who believe that the system is fundamentally sound hope that this marks a turning point, and that the FCC is going to put an end to these destructive and even corrupt practices,” said Andrew J. Schwartzman, executive director of Media Access Project, a nonprofit law firm in Washington that filed the appeal leading to the Marco reversal.

Federal law requires a broadcaster to be a public trustee, because ownership of the airwaves constitutes a monopoly. The FCC has developed public-service criteria--such as offering public-affairs programs and service to the local community--for deciding who gets and retains radio and television licenses.

When there are competing applications for a license, the FCC conducts a hearing to weigh the merits of the applicants and select the best qualified ones. Challenges to license renewals also get hearings.

But Mark S. Fowler, who was FCC chairman from 1981 until 1987, felt that the marketplace should regulate the broadcast industry, a view he once capsulized by observing that “television is just a toaster with pictures.”

So, during the Reagan years, the time that an owner must hold a license once the FCC had awarded it was reduced to one year from three years, allowing for faster turnover of licenses. In addition, the ceiling on settlements between competing applicants was eliminated. Such payments had been limited to reasonable expenses connected with the application.

The result has been a system in which some applicants “file for dollars, not for licenses,” according to an analysis by the Federal Communications Bar Assn., a trade group of 1,400 communications lawyers.

“People know that a million dollars can be yours in 90 days if you settle,” said Richard R. Zaragoza, a Washington lawyer and president of the communications bar.

But the 4-0 vote of the FCC in the Marco, Fla., case last month and Sikes’ comments may signal a change.

The other arena in which licensing policy may be in for a dramatic change is the Supreme Court. The court has said it will decide by this summer whether FCC preferences for minorities and women in awarding licenses amount to unconstitutional reverse discrimination.

The case gives the court’s conservative majority a chance to place new limits on federal affirmative-action programs, and it could reverse a decade of attempts to bring more minorities and women into the ranks of broadcast owners.

Since 1978, the FCC has given extra credit to applications if minorities and women will be among the owners and managers of a station. The policy has been at least somewhat successful.

The number of minority owners among the nation’s nearly 12,000 radio and TV stations has tripled to 300 from 100 in 1980, according to Broadcap, a nonprofit financing organization. Figures on women were not available, although several women’s groups said the trend is up slightly.

The race and sex preferences have also been used to tailor applications to FCC qualifications. The stronger the application, the greater its chance of winning the license and the higher the potential settlement payoff.

“People get an idea, through the discovery and hearing process, of where they stand, and the settlement amounts reflect that standing,” said Dennis J. Kelly, a Washington communications lawyer.

Often, women and minorities recruited for applications have no broadcast experience, invest no money and would play limited roles at best in operating the station.

In recent years, commission hearing judges have become wary of such shams, but sheer numbers have overwhelmed the agency. The FCC staff is buried under a backlog of 1,800 applications for new FM licenses.

The overall caseload also has soared because of the explosion of new technologies, such as cellular telephones and satellite transmission. But the FCC staff has shrunk by 23% since 1980, to 1,750 from 2,261. Under current policy, insiders say, two employees must quit before one can be hired.

So most detective work is left to the competing applicants, who scrutinize each other carefully in the hope of finding something that would cause the FCC to eliminate a competitor.

In the fight over a license for an FM station in Silver Springs, Fla., a private detective hired by one applicant discovered that the woman named as the general partner of another applicant had three felony convictions for writing bad checks. The convictions had not been disclosed on the application, as required by the FCC. While the application was pending, she was convicted three more times and jailed. Her application was withdrawn before the FCC awarded the license.

In another Florida case, a woman who was supposed to come up with a $500,000 loan to build an FM station had recently filed an affidavit in a paternity suit swearing that she had no assets, took home $133 a week and had monthly expenses of $800. Her application also was withdrawn early in the licensing process.

Part of what Sikes called a “cottage industry” consists of companies that recruit women and minorities so that investors can meet FCC preferences. They also search for local residents who do not own other broadcast outlets, because the FCC gives extra points to applicants who live in the community and do not already own stations.

The proposed settlement of an 8-year-old dispute over an FM license in Evergreen, Colo., shows the potential rewards of a carefully constructed application.

The settlement calls for Susquehanna Radio of York, Pa., to pay $4.5 million to 10 applicants. Susquehanna will get a 49% interest in the station and the right to buy the remainder for another $2 million.

Susquehanna was not among the original applicants and, because it owns 18 stations, probably could not have won the license through comparative hearings. But it stands to get the license anyway because of its deep pockets.

Among the recipients of the $4.5 million would be a partnership formed by Philip Tunis of Rye, N.Y. Tunis told the FCC that he read about the availability of the Evergreen license in a magazine and hired a firm to find three women to serve as his general partners.

Tunis said that he met once with the women, who each contributed $100 to the venture, and that he spent $63,788 hiring lawyers and engineers for the application. The group’s share of the proposed settlement is $515,000.

Another $200,000 is supposed to go to an application filed by Robert J. Buenzle, a Washington communications lawyer, and his wife, Terry G. Buenzle. Although Terry Buenzle was named as the only voting shareholder, documents show that she told the FCC her involvement had been little more than typing the application. Her husband, she said, had done the rest of the work.

The settlement was approved by the FCC general counsel, but the commission has been asked to overturn the decision by Media Access Project, which said the best-qualified candidate did not get the license.

The largest payoffs have come in cases involving the radio and TV licenses of RKO General. A total of $200 million has been paid to 70 applicants, according to Channels magazine.

In 1965, a Los Angeles group challenged RKO’s right to retain KHJ-TV (Channel 9). The FCC ultimately ruled in 1987 that RKO was unfit to hold broadcast licenses and ordered it to sell its 12 radio stations and two television stations.

The Walt Disney Co. bought KHJ-TV from RKO for $324 million, and the Los Angeles group that mounted the original challenge got $105 million of that, by far the largest FCC settlement ever.

To speed up the sale of the RKO licenses, the FCC pressured participants to settle the cases. This meant that many of the stations went to broadcasting companies that had the money to pay off license competitors.

For instance, RKO’s classical music stations in Washington, WGMS-AM and WGMS-FM, were sold to a partnership of a local broadcast company and two brothers who run a major conglomerate. The partnership had not applied for the licenses, and the settlement divided $10 million among the eight groups that had applied.

Entertainer Bill Cosby was a partner in an application that got $350,000 in that case, according to FCC records. The partnership got the money even though the FCC hearing judge disqualified its application on grounds that Cosby’s partner had forged the signatures of his wife and children on 42 applications for low-power TV stations, according to FCC records. Cosby was not involved in the other 42 applications.

Civil rights activist and lawyer Vernon E. Jordan Jr. was part of a group that received $765,000. Jordan had told the FCC he would work 40 hours a week as the WGMS news and editorial director and retain his full-time, $300,000-a-year job at a Washington law firm.

Partners, including members of a Virginia law firm, shared $1.2 million in the WGMS settlement. The application’s general partner was a black woman who worked as a law clerk at the firm.

Neither Cosby nor Jordan responded when a reporter sought their comments.

A payment of $2 million went to a partnership in which Antoinette D. Cook held a 26.5% ownership interest. When she filed the application, Cook was a private attorney specializing in communications. She is now on the staff of the Senate Commerce, Science and Transportation Committee, which oversees the FCC.

Although they are not always partners, communications lawyers often help to assemble applications and share in settlement payments. Such an arrangement is described in FCC filings in a challenge to the license of an FM station in Florida.

In 1986, Washington communications lawyer Lewis I. Cohen told a New York investor about the chance to challenge the owners of WHYI-FM in Ft. Lauderdale. Cohen said he could recruit someone to satisfy the FCC’s gender and minority preferences, the investor told the FCC.

The final arrangement called for Cohen’s law firm to receive a $50,000 retainer, fees totaling $200,000, a $500,000 “bonus” if the investors won the license, and 15% of any settlement, according to FCC documents.

Cohen contacted Gloria R. Butler, a black Floridian with no radio background, and she received a 4% interest as general partner without investing any money, according to FCC records. With Butler as the sole general partner, the application would receive credit under the minority, female and local-resident preferences.

When an investor expressed concern about the speculative risks of the venture, according to FCC testimony, Cohen assured him that settlements short of winning often led to financial results that were “satisfactory, very satisfactory.”

So far, it has not turned out that way in this case.

The hearing judge called the ownership arrangement with Butler a “mummery” and dismissed the challenge to WHYI’s license. Upholding the judge’s order last November, the FCC review board called the application a “sham” organized by the lawyers and investors who used Butler as a “front.”

In an interview, Cohen disputed the findings and said the decision has been appealed to the full commission.

“The woman met all the commission criteria and the Court of Appeals and commission have said over and over again that there is nothing wrong with trying to put together an application that puts your best foot forward,” Cohen said. “Nothing is wrong with that or illegal with that, and that’s exactly what happened here.”

Last year, the FCC proposed a dramatic solution to the burdens of comparative hearings: Abandon the comparison process altogether and simply give away radio and television licenses by lottery. The commission reasoned that this would be faster and cheaper, and serve the public just as well.

The proposal met immediate opposition, led by the communications lawyers who make their living through the current system. Opposition to the lottery also came from a diverse group of public-interest organizations.

The alternative is to revamp the current selection system to reduce the chance of abuse. Steps outlined by the communications bar include:

--Limit settlement payments and prohibit substitutions of outside parties.

--Require a winner to retain the license for at least two years, perhaps three, instead of the current one year.

--Demand more detailed financial statements from applicants to cut down on sham applications.

--Establish a time limit for FCC action on a license to avoid disputes that last years and can be solved only through a settlement.

High sources within the commission say the lottery proposal is dead and that the FCC will probably initiate hearings to consider the remedies proposed by the lawyers’ group and others.

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.