Protect Your Insurance When You Change Jobs

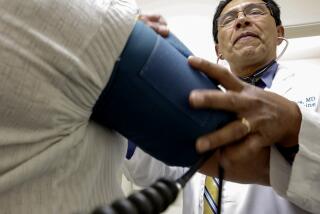

You had a recent heart attack. Or you’re pregnant. Or you’re receiving treatment for diabetes or just had major surgery. And now you’re changing jobs. Will your new employer’s health insurance cover those conditions?

It has been a question--and fear--of many workers with serious health problems. Many employers carry “existing condition” clauses in their health insurance plans that bar new employees from getting coverage for certain health conditions for several months after enrolling. Some workers have declined new jobs simply because of these clauses.

But now, thanks to a provision in the 1989 Budget Act that took effect in January, workers with serious health conditions who change jobs will find new security.

The new law allows workers who cannot get immediate coverage for serious medical conditions with their new employers to retain for up to 18 months the coverage they carried while they were with their old employers. Spouses and other dependents may also get continuation coverage.

The new law closes a loophole in previous federal law governing continuation coverage. The old law required firms to provide continuation health coverage to former employees but only until those workers enrolled in a plan at their new job.

Accordingly, under the old law, many workers--to retain continuation coverage--simply wouldn’t tell their former employers that they had found new jobs and had enrolled in new health plans, says Barbara Vomela, a consultant in the Los Angeles office of William M. Mercer Inc., an employee-benefits consulting firm.

The 18-month continuation period under the new law should be sufficient, Vomela says, because most existing-condition clauses expire six months or a year after a worker enrolls in a new employer’s plan.

These clauses are widespread. They are included in the health plans of two-thirds of the nation’s major employers, according to a survey by Hewitt Associates, another employee-benefits consulting firm. They usually prohibit coverage on medical conditions for which an employee has received treatment within three months of enrolling. Typical medical conditions included in these clauses are pregnancy, major illnesses such as diabetes, cancer, heart disease and recent major surgery.

“Employers are just trying to protect themselves from someone who jumps to a new job just to get coverage,” says John Bauerlein, a group-benefits actuary in the Santa Ana office of Hewitt Associates.

The new law sounds great, but it does have a catch: If you choose to retain coverage with your former employer, you may have to pay the full cost of it, plus an additional 2%. That’s because employers are not obligated to subsidize the cost of continuation coverage for former workers.

Thus, retaining your old coverage can be expensive--several thousand dollars a year in most cases. And if you also enroll at your new job--which generally is advisable, even if it does have existing-condition clauses--you will end up paying for two policies. That could cost you even bigger bucks.

Here are some tips from employee-benefit consultants to help you decide whether to retain an old health plan:

* Find out what existing-condition clauses are included in your new employer’s plan.

* If you have one of those conditions, figure out how much it will cost for you to pay for treatment without insurance. Compare that cost to the cost of premiums for retaining coverage with your old employer. If the cost of paying for treatment on your own is greater, then it most likely will pay for you to retain your old coverage.

* Notify your old employer in writing that you wish to retain coverage. Be sure to do this promptly.

* Be sure to promptly pay the premiums on your continuation plan. Your former employer can terminate coverage if you are late with payments, although many employers allow a 31-day grace period.

Determine when the existing condition clause on your new plan will expire. Once it does--usually after six months or a year--you no longer need the continuation coverage with your former employer.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.