Oh, What a Tangled Tax Web

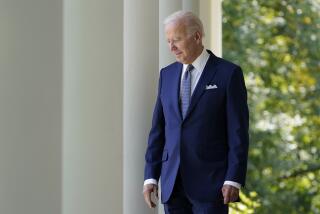

The legislative details in the voluminous deficit-reduction plan that is before President Bush provide a continuing voyage of discovery. Only now, as its more than 1,000 pages of provisions come to be scrutinized, is the public--to say nothing of the Congress that pondered and passed this measure--getting a real chance to appreciate what has been wrought.

Congressional tax-writers and outside observers agree that the special-interest benefits sprinkled throughout the bill don’t approach the level of favoritism contained in the 1986 tax act, which by common consent set a new record for shamelessly awarding specific goodies to revered constituents and contributors. Still, in that regard the new bill isn’t half bad.

The bill aims to cut $490 billion from projected budget deficits over the next five years, partly by levying about $137 billion in new taxes. What will be taxed is naturally of great interest. So is what will escape new taxation.

Oregon’s wineries, to take just a single example. Sen. Bob Packwood, the ranking Republican on the Senate Finance Committee from guess- what-state, won an exemption for the tax increase on wine--it’s scheduled to go from 3 cents a bottle to 21 cents--for wineries producing fewer than 150,000 gallons a year, and a partial exemption for those producing under 250,000 gallons annually. The cost to the Treasury will be $500 million. As it happens--why are we not surprised?--all 85 of Oregon’s wineries fall under the exemptions. In fairness, so do about 600 California wineries. But those enterprises account for only 3% of this state’s wine output; the Oregon wineries, for 100%. Advantage: Oregon.

There’s nothing horrifyingly new about any of this. Tax bills always come loaded with provisions to benefit both obscure and well-known special interests. What is disturbing, now as always, is the generally unpublicized--call it sneaky--way so many of these favors are dropped into complex measures, with no public hearings or informed debate or any chance for dispassionate examination. A hundred million here, $500 million there, pretty soon it adds up to quite a bundle. But it’s not the way to cut deficits, or to make tax policy.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.