A Ray of Sunshine Amid Southland’s Real Estate Gloom : Housing: Surging sales at Aliso Viejo development and increased activity by shoppers and sellers doesn’t mean the slump is over, but many see brighter days ahead.

IRVINE — The mood at the Kathryn G. Thompson Development Co. headquarters these days is pretty upbeat.

Like just about every other home builder in Orange County, Thompson Development saw sales and revenue sink dramatically during 1990.

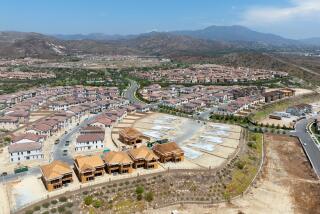

But in January, Thompson Development sold 52 homes in its 362-acre Laguna Audubon planned community in Aliso Viejo. And in the first 10 days of February, 14 sales contracts were signed, said G. R Bandy, vice president of sales and marketing.

That’s an average of 1.6 sales a day, considered a respectable pace when the real estate market is hot and a remarkable pace in today’s sharply depressed market. But nobody really expects sales to remain that brisk.

The recession is continuing, and there are no strong signs of a recovery in the housing industry yet. Several area bankruptcy attorneys, in fact, have said privately that they expect to see a number of developers file petitions for Chapter 11 bankruptcy reorganization petitions in the next two or three months.

Still, industry observers say Thompson’s recent performance, bolstered by a willingness to deal with buyers who are pushing for a bargain, may signal at least a slight upturn in home sales in the county and throughout the Southland.

“It is too soon to make much of it, but yes, we have seen sales and traffic (at model homes) increase” since January, said Arthur E. Svendsen, chairman of Standard Pacific L. P. in Costa Mesa, a major California home builder.

At Laguna Audubon, Bandy said, the number of shoppers hit a seasonal high of 832 people last week, up from the mid 700s in January, Bandy said.

The reason?

Well, in part it is money.

Some of the sales at Laguna Audubon have been condominiums priced from $105,900 to $165,000, putting them well within the definition of affordable housing by Orange County standards.

But other sales were for detached homes priced as high as $340,900.

“My opinion is that people have just about figured that the bottom of the market is here,” Bandy said. “So they believe that now is the time to make the purchase. We are seeing a lot of new people in the market, people that haven’t been through the models before.”

Some other signs of improvement in the industry are:

* Larry Webb, president of the southeast division of Kaufman & Broad Homes, said his sales agents have been reporting a significant increase in foot traffic through the company’s various projects in Orange, Riverside and San Bernardino counties;

* After 250 people signed up to buy 32 homes, Fieldstone Development Co.’s Cypress Homes subsidiary held a drawing to winnow down the waiting list at its Sorrento planned community in Cypress.

* Bart Hansen, a principal with Shawntana Development in Newport Beach, said at a recent Building Industry Assn. meeting that his 9-year-old company is actually experiencing one of its “most active years ever.”

Hansen was quick to point out that he didn’t say this is shaping up to be one of the best years. “We won’t make any money, but we have a tremendous workload,” he said.

That sums it up for many builders, said Charles Dryer, president of Dryer & Young Inc., a Newport Beach real estate sales and marketing firm.

Developers are begining to move homes again after nearly six months of inactivity, but they are doing so by offering inducements that often bring the sales price down to the break-even point--and sometimes cost them money.

“But they are lowering their inventories, and that is important because it costs money to have a bunch of unsold, empty houses on hand, too,” Dryer said.

Real estate economist Alfred Gobar says the outbreak of war in the Persian Gulf last month is one reason people are shopping for homes again.

“The start of war took away that sense of uncertainty that was one of the things screwing up the housing market,” he said.

And, said Gobar, “we have seen some tenuous evidence in preliminary employment figures that the economic slide that hit Southern California in the last half of 1990 has bottomed out. We are seeing a slight improvement in job growth in the early numbers.”

But Gobar cautions that there are not enough hard numbers available yet to point to a major improvement.

The market’s direction should be more apparent in April, when figures become available on the number of sales contracts signed in January that actually closed escrow, said Buck Panchal, senior consultant with the Meyers Group, an Ontario-based real estate marketing firm.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.