Encino Bank Ordered Sold : Regulators: The Federal Reserve says it is secretly controlled by a Luxembourg holding company, but a Saudi tycoon says he owns it.

- Share via

WASHINGTON — Federal regulators Tuesday ordered a Luxembourg bank convicted of laundering drug money to sell its alleged secret controlling stake in Independence Bank of Encino, which maintains it is owned by Saudi Arabian tycoon Ghaith R. Pharaon.

In the ruling, the Federal Reserve Board said it believes that the foreign institution--Bank of Credit & Commerce International--gained a majority of the voting shares of Independence Bank through a series of loans involving BCCI and Pharaon.

Without admitting ownership of Independence Bank, BCCI agreed to sell any stake it may have in the Encino institution.

While Pharaon has maintained that there is no financial link between BCCI and Independence, the largest bank based in the San Fernando Valley, the regulators’ allegations raises new questions about Pharaon’s ties to BCCI over the past 15 years.

In an interview Friday, he said: “I can tell you that at Independence Bank there is no shadow of a doubt that I can prove to anybody that the ownership of that bank is 100% mine.” Attempts Tuesday to reach Pharaon were unsuccessful.

But his New York attorney, Richard F. Lawler, said, “Ghaith Pharaon owns Independence Bank.” And Fulvio V. Dobrich, chief executive of Independence Bank, said the investigation and order will not affect the operations of Independence Bank.

This is the second time in recent weeks that the Federal Reserve has ordered BCCI to sell an undisclosed stake in an American bank. In March, the regulators told the bank to sell its stock in First American Bancshares of Washington, the largest banking company in the nation’s capital. BCCI was also told to close its U.S. offices, including one in Los Angeles.

Under federal banking law, it is illegal for a bank holding company, such as BCCI, to acquire more than 25% of the stock of another bank without approval from the Federal Reserve. In the cases of Independence and First American, regulators say no such approval was given.

The Manhattan district attorney’s office is investigating a string of multimillion-dollar transactions around the world involving BCCI. Two subjects of the inquiry are First American executives Clark M. Clifford, a prominent Washington lawyer and political adviser, and his law partner, Robert K. Altman.

For a decade, Clifford and Altman repeatedly assured regulators that there was no link between BCCI and First American. They have claimed that they were unaware of BCCI’s stake in First American. Published reports this week disclosed that Clifford and Altman earned $9.8 million on First American’s stock in 1988 in a deal financed with loans from BCCI.

The Justice Department and the House and Senate banking committees are also investigating BCCI’s activities. The Federal Reserve inquiry is continuing.

“This latest action by the Federal Reserve demonstrates that BCCI’s secret control of U.S. financial institutions could have literally extended from coast to coast,” said Sen. John Kerry (D-Mass.), who first raised questions about the bank two years ago.

BCCI, one of the world’s largest privately held banks, came under intense scrutiny last year after pleading guilty in Tampa, Fla., to laundering money for drug traffickers. Five employees were also convicted, including an executive who was former Panamanian leader Manuel A. Noriega’s banker at BCCI.

Pharaon, who has extensive business interests around the world, bought Independence in 1985 for $25 million. Last week, he described BCCI as an investment adviser on the deal. Dobrich said BCCI suggested the acquisition to Pharaon.

Documents obtained by government investigators show that BCCI’s London office arranged a pivotal $5-million letter of credit from a French bank, which helped Pharaon buy the Encino bank. Pharaon apparently then used that guarantee to help him borrow $11 million from the Bank of Boston for the purchase of Independence.

According to a source familiar with the transactions, Pharaon’s stock in Independence was collateral for the loan. Dobrich has said that Pharaon paid off the Bank of Boston loan when his Saudi businesses encountered financial difficulties in 1986. But the source said it was BCCI that assumed the Bank of Boston loan and thus assumed control over the Independence stock.

While BCCI has been involved in many of Pharaon’s business deals in recent years, the Federal Reserve order represents the first accusation that Pharaon may have been a front man for the international bank. It comes at a time when Pharaon has tried to distance himself from the bank.

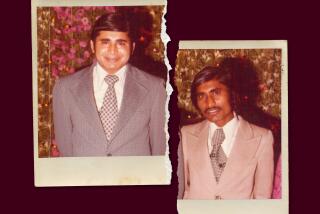

The son of an influential Saudi statesman, Pharaon attended Colorado School of Mines and Stanford University and received an MBA from Harvard in 1965. Assisted by connections with the royal family of Saudi Arabia, he founded a construction and engineering company in his homeland that grew dramatically in the Mideast building boom of the 1970s.

He also began expanding his empire into the United States, often with the assistance of BCCI, in which he was then a major shareholder.

For instance, in 1977 Pharaon met Bert Lance, the Georgia banker who had resigned as President Jimmy Carter’s budget director. The introduction was made by Agha Hasan Abedi, the Pakistan-born founder of BCCI. Abedi had recently hired Lance to advise BCCI on potential U.S. investments.

Lance wound up selling his National Bank of Georgia to Pharaon for $2.4 million. The day after the sale, a $3.4-million loan Lance had at a Chicago bank was paid off by a wire transfer from BCCI. Pharaon’s attorney insisted at the time that the acquisition of the Georgia bank was not related to the payoff of Lance’s loan.

Last December, Lance spent three hours testifying before a grand jury in New York about BCCI and the National Bank of Georgia. In an interview, he declined to discuss his testimony, but he said: “Mr. Abedi brought Ghaith in as an investor. I’ve never seen anything to indicate it was anybody else. Ghaith was acting on behalf of Ghaith Pharaon.”

During the 1980s, Pharaon’s empire grew dramatically. By 1987, Forbes magazine estimated his wealth at nearly $1 billion. He owned dozens of Mercedes-Benzes, two executive jets, a Boeing 727 and homes on three continents. His Jidda mansion is filled with priceless artworks. His 1,800-acre plantation in Savannah, Ga., once belonged to Henry Ford.

Growing as fast during this period was BCCI, which by the mid-1980s had offices in 72 countries and assets approaching $20 billion. And the relationship between Pharaon and the bank continued, as evidenced by Pharaon’s $25-million acquisition of Independence Bank in 1985.

In 1987, Pharaon sold his Georgia bank to First American in Washington. At the time, he told a Georgia reporter that he was familiar with First American’s Arab shareholders. He also said he had reduced his share in BCCI to about 5%.

The same year, Pharaon bought 24% of the stock in CenTrust Savings Bank, a high-flying thrift in Miami run by entrepreneur David Paul. A year later, regulators were pressuring Paul to raise more capital for the ailing thrift, and he got a hand from BCCI.

According to documents prepared by thrift regulators, a brokerage house in which Pharaon was the major shareholder helped arrange a questionable $25-million junk-bond deal between CenTrust and BCCI that helped prop up the thrift.

The sale of the bonds enabled CenTrust to remain open another year, and its losses continued to grow until the thrift was closed by regulators in 1989. Officials say CenTrust’s failure will cost taxpayers $1.7 billion.

Neither Paul nor Pharaon has been charged in connection with the junk bond incident. Pharaon said he had done nothing wrong but would not discuss the deal.

In the wide-ranging interview last week, Pharaon said he sold his BCCI stock in 1986 to an Arab investor group that he declined to identify. BCCI records do not list him as a stockholder in 1988, although his brother, Wabel, held more than 10% of the bank’s stock then.

Yet, in an application for Argentine citizenship dated June 16, 1988, Pharaon listed his extensive business holdings to demonstrate that he was fit to be a citizen. The list included BCCI, CenTrust and Independence as well as dozens of other companies around the world. He also said that he had helped arrange BCCI’s acquisition of a medium-sized bank in Argentina.

Last month, Pharaon was asked about his immigration statement during questioning in a civil suit in Buenos Aires. Pharaon said BCCI had been listed inadvertently by an employee.

In the interview, Pharaon decried BCCI’s involvement in money laundering and repeated that he cut his ties to the bank five years ago. He also criticized the attention on BCCI’s crimes, claiming that the bank is the victim of anti-Arab sentiment.

“It is convenient right now to picture the Arabs as a bunch of hoodlums,” he said. “That is unfortunate. BCCI without a doubt acted criminally, but don’t you think other banks have acted just as criminally?”

Douglas Frantz reported from Washington and John Medearis from the San Fernando Valley.

INDEPENDENCE BANK AT A GLANCE Location: 15910 Ventura Blvd., Encino Branches: 14 Founded: 1963 Ownership: Saudi Arabian businessman Ghaith Pharaon claims 100% ownership, but federal regulars believe that Luxembourg-based Bank of Credit & Commerce International has a secret controlling stake. Top officer: CEO Fulvio V. Dobrich Assets: $659 million as of March 31 Earnings: It lost $16.9 million in the first quarter ended March 31, contrasted with net income of $1.5 million in the same period in 1990; it earned $94,000 in 1990, compared to a net loss of $3.8 million in 1989.

Source: Independence Bank, Federal Reserve Board

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.