Panel to Hear Mexican Tale of David, Goliath : Free trade: A U.S. government committee will listen to the businessman’s allegations of how monopolies work in his country.

MEXICO CITY — Jose Mendoza believes that free trade should benefit all Mexicans, not just the biggest corporations.

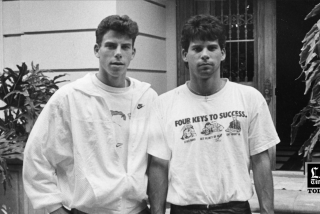

That is why he and his brothers, David and Juan Bosco, owners of a $15-million-a-year company, have taken on giant Monterrey-based Vitro Corp., a conglomerate with $3 billion in revenues and subsidiaries in the United States. And that is why Mendoza will tell his story today in Houston to a U.S. government panel seeking information to develop positions in North American free trade agreement negotiations.

His appearance at the session held by the staff of U.S. Trade Representative Carla Anderson Hills is unusual for two reasons. First, Mendoza will offer detailed allegations about how Mexican monopolies operate--intimidating customers and suppliers to keep out competition. His experience reflects the difficulties that mid-size Mexican companies face as their country changes from a protected, highly regulated economy to a free market system.

Second, Mendoza will be encouraging U.S. negotiators to insist that Mexico quickly tear down the 20% tariff on imported glass that protects Vitro by discouraging foreign competition here at the same time the corporation goes after an ever-larger share of the U.S. market.

“This is a big, transnational company,” Mendoza said in a telephone interview. “Vitro does not need to be protected.”

Mendoza’s testimony is expected to show another side of the huge glassmaker, a favorite of stock analysts who consider the corporation an example of how Mexican companies can compete in international markets.

Vitro bought floundering, Tampa-based Anchor Glass Container Corp. in 1989 and turned the company into a moneymaker within six months. Vitro’s joint venture partners include such prestigious companies as appliance maker Whirlpool and Corning’s consumer glass division.

But, Mendoza said that while Vitro led the charge into international markets, the company sought to protect its flanks by assuring itself a monopoly at home.

Vitro officials would not respond directly to Mendoza’s accusations, instead issuing a general statement that the company values all its customers and is committed to producing high-quality products.

Mendoza tells a different story. His company, Unividrio, takes the huge slabs of plate glass that Vitro makes and turns them into mirrors and smaller pieces of glass for furniture makers, windows and retail shops.

Early this year, when the Mexican government lowered tariffs for imported products that compete with Mendoza’s, his customers threatened to turn to the imports unless he dropped his prices to international levels. When Mendoza asked his supplier, Vitro, for a reduction that would allow him to compete, he said he was told that “Vitro’s interests are not always the same as those of our customers.”

His response was to check prices and terms at the five U.S. glass makers in hope of getting a response from Vitro. When the response came, it was not what he expected: Vitro cut off his supplies.

While his brothers got an order from the Mexican Commerce Department requiring Vitro to resume shipments, Mendoza visited U.S. glassmakers and signed a deal with Northville, Mich.-based Guardian Industries.

“The support was incredible,” Mendoza said. “A week after Vitro stopped supplying us, Guardian delivered to our Mexico City factory the supplies that we needed in the quantities and sizes we ordered.”

As a result, he never used the Commerce Department order to Vitro, which he said was issued swiftly.

But that did not end Mendoza’s problems. Customers canceled orders, telling him that they were under pressure from Vitro. Glass trucks refused to carry his products, again citing pressures from Vitro.

“They are all afraid,” he said. “Everyone says they are behind us, but no one will stand beside us.”

Then Vitro cut its prices, which had been exactly the international price plus 20%, the import tariff. The United States does not charge a tariff on this type of Mexican glass.

Mendoza once again turned to Guardian and was surprised by the company’s response, based on his experience with Vitro. The company met Vitro’s price.

Then Vitro, an important commercial customer, began pressuring banks to slow issuance of letters of credit needed to finance Guardian’s sales to Unividrio, according to Wally Palma, manager of the U.S. company’s Corsicana, Tex., glass factory.

“Our experience in Mexico is one of the most extraordinary we have encountered in our many years of sales to foreign markets,” Palma said in testimony prepared for presentation to the committee.

“Guardian wants to be in the Mexican market,” he said. “But what good does it do Guardian or Guardian’s potential Mexican customers if the purchase of lower-cost, high-quality float glass results in the asphyxiation of customers?”

Palma said Guardian’s experience reflects a problem of monopolies and coercion that pervades Mexican industry and should be discussed as part of the talks on the North American free trade agreement.

A Formidable Competitor Monterrey-based Vitro, Mexico’s largest manufacturer of glass products, has been one of the nation’s most successful competitors in worldwide markets.

U.S. market share of primary glass products: 28%

1990 revenue: $3.3 billion

1990 exports from Mexico: $311 million

Foreign sales as percent of 1990 sales*: 53%

* includes exports and sales by foreign-based subsidiaries

Source: Vitro S.A.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.