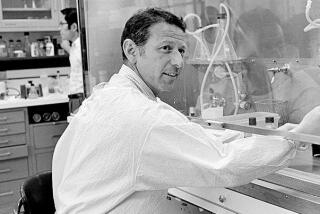

Founder of Amgen Takes On Another Challenge : Biotechnology: The man who guided firm to triumph jumped at the chance to work at Icos Corp. instead of retiring.

George Rathmann spent the 1980s nurturing a tiny Thousand Oaks company named Amgen Inc. from a vague idea into the most successful biotechnology company yet developed. His goal for the 1990s was simpler: retire.

So why is Rathmann, now 63, working as hard as ever at the helm of another infant biotechnology company called Icos Corp. in Bothell, Wash., and trying to duplicate his triumph at Amgen?

“There’s an irrational element in this,” Rathmann conceded about his retirement detour. He discovered that “not being in the operation of a business is not OK if you’re a person like me,” he said.

Investors seem willing to bet that, if Rathmann worked magic at Amgen, maybe he can do the same at Icos, which is developing anti-inflammation drugs. Ned Hamarat, president of Beekman Capital Management Ltd. in New York, loaded up on 250,000 shares of Icos stock in June. “Basically this is a concept company,” Hamarat said. “You’re buying people. More than anything else George Rathmann was the primary reason” to buy the stock.

Certainly Rathmann left a vast source of prosperity at Amgen. With its two breakthrough drugs, Amgen turned a $49-million profit in its latest quarter, and analysts say, its sales are quickly rising toward the billion-plus-a-year plateau. This year alone, Amgen’s stock price has tripled.

It turned out that Rathmann had plenty of marquee value left, which helped Icos raise $64 million from private and public stock offerings in the past two years--including $5 million put up by William Gates, the billionaire founder of computer software giant Microsoft, who owns 8% of Icos’ stock. In June, Icos stock went public at $8 a share, and it closed Monday at $18.50, in part because Amgen’s surge has lifted up many other biotechnology stocks.

Earlier this month, Icos took another important step when Rathmann signed a joint development project with Glaxo Holdings, a British company that is the third-largest pharmaceutical powerhouse in the world. Icos and Glaxo will share research on many of Icos’ projects.

Still, it’s a different life than the one Rathmann envisioned three years ago when he quit as chief executive at Amgen after picking his successor. He stayed on for awhile as Amgen’s chairman and planned to keep busy by joining the boards of other companies, going skiing, reading, playing with his grandchildren and easing into retirement.

But he was bored. So in January, 1990, he joined Icos as chairman.

Philip Whitcome, Amgen’s former strategic planning director, believes that, when Icos contacted Rathmann, he reacted like an “old fire horse who heard the fire alarm going off. The guy gets excited about things.” Rathmann also took on the Icos challenge, Whitcome believes, to disprove the theory that Amgen was built on luck, not skill, “and George wanted to duplicate its success.”

Icos wouldn’t be as exhausting as Amgen, Rathmann initially thought, because two other executives who had previously started biotechnology companies would be there to help run Icos day to day.

Once again, Rathmann’s plans went wrong.

Last month, Icos’ chief executive, Robert Nowinski, suddenly quit, and although Rathmann won’t go into the details, industry outsiders believe that there was a battle between the pair and, in the end, Nowinski went out the door and Rathmann went in as chief executive. Hamarat speculates that Icos’ founders were executives with “very, very large egos. And could that many giants stay in a room together? The answer is no.”

Indeed, Rathmann’s return to prominence has not come without criticism. Last year, an executive with PaineWebber Inc., which underwrote Icos’ private stock sale, reportedly complained that Icos’ founders--Nowinski, Rathmann and Christopher Henney, Icos’ scientific director--were getting too good a deal. The three founders control 18% of Icos stock, they each got annual salaries of at least $176,000, plus 10% yearly pay raises, and they were eligible for 40% to 60% annual bonuses, while putting up little money themselves.

Others complained that Icos was conceived more as a celebrity enterprise than as a scientific operation. Icos’ board now includes Walter Wriston, former chief executive of Citicorp; Frank Cary, IBM’s former chief executive; a former head of General Foods; a past Secretary of Commerce; and Gates from Microsoft--all notable figures, but none, Icos’ critics point out, is a biotechnology expert.

David Stone, a biotechnology analyst with the investment firm Cowen & Co. in Boston, said, “I’m skeptical of an organization where the genesis of it seems to be financial promoters and people who lent their names, like Wriston and Gates, and three recycled biotech executives. Did these executives join the organization because this group of scientists have a unique handle on diseases, or they were all mutually persuaded that this was a marketable idea?”

Rathmann did buy $450,000 of additional Icos stock--which, he said, is about 10 times his investment in Amgen. “I would have put in more money, but I didn’t want to be greedy,” Rathmann said. “I thought it (Icos) was cheap, and I got sick and tired of people telling me it was overpriced.” Still, given the $100 million or so in Amgen stock that Rathmann owns, his Icos investment is only a fraction of his wealth.

But it doesn’t upset Hamarat: “In small companies, it’s not so unusual that the brains contribute the brains and the money people contribute the money,” he said.

Now that Icos has raised the money, Rathmann plans to “bet heavily on science, science, science.” Icos has a team of about 60 scientists, and they are trying to crack an entirely different scientific mystery than Amgen did.

Each of the 15 or so biotechnology drugs and vaccines now sold in the U.S. are liquids that must be injected into patients--they contain gene-spliced copies of large protein molecules found in the body. This compares to typical pharmaceutical drugs in pill forms with such small molecules that they pass through the digestive tract without losing potency.

One of Icos’ goals is to blend the science of biotechnology and conventional pharmaceuticals to create drugs in pill forms that can stop chronic inflammation. It’s a vast scientific quest, because inflammation is a symptom common to horrible, debilitating diseases ranging from multiple sclerosis to rheumatoid arthritis and asthma. The company’s name comes from icosahedron--something with 20 sides, or in this case, Rathmann said, the shape of a virus under a microscope.

Inflammation is one of nature’s ways of fighting viral or bacterial infections by a sudden torrent of white blood cells moving into a troubled area, which then unleash chemical signals to instruct the body to destroy bacteria or other dangerous cells. The problem occurs when inflammation goes out of control and won’t stop. Multiple sclerosis patients, for instance, can suffer nerve damage and paralysis because of inflammation in their brains.

Part of Icos’ research team is studying a family of human enzymes called phosphodiesterase. The scientists have cloned, or copied, some of these enzymes, and their next task is to find a way to stop the enzymes from sending out signals to trigger inflammation. To do that, however, Icos needed help. “The main thing we lack is a chemical library and a broad group of chemists,” Rathmann said.

But Glaxo has both, and now scientists will test Icos’ enzymes and see if they can find chemicals to, for example, turn off the enzymes in the lungs that cause asthma without turning off any other enzymes in the body. If all goes well, Rathmann said, Icos’ first drug project might be ready for human tests by the end of 1992.

Despite Rathmann’s enthusiasm, Icos faces plenty of competition. “A dozen companies are working on inflammation (drugs), and it’s difficult at this early stage to say which is most promising,” biotechnology analyst Stone said.

But Jim McCamant, editor of the Medical Technology Stock Letter in Berkeley, thinks that Icos’ executive and scientific staffs, its financing, and its Glaxo alliance make “the odds very high that Icos will be successful.” Still, he doesn’t recommend Icos stock, saying it’s overpriced, and there remains the mystery of “when will they get products and how big are those products?”

If Rathmann finds the right answers, one legacy will be great wealth for his children. Rathmann has transferred most of the Icos stock that would have been his--a parcel already worth about $20 million--and split it evenly among his five children.

And what does Rathmann’s family think of him going back to work at full speed?

“They think it’s all predictable,” Rathmann said. “I’ve got five workaholic kids, and they know how crazy they are. They say they got it through their genes.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.