Asia’s Crisis May Cool O.C. Growth

Orange County’s blazing economy is cooling several degrees heading into the new year. Ironically, the chill is coming from the very sector that has helped set the economy on fire the past couple of years: exports.

While prospects for company profits, jobs and spending are still pretty bright, economists say the Asian currency crisis undoubtedly will take its toll. Orange County sends 43% of its $8.6 billion in annual exports to Asia, a far higher percentage than the rest of the nation, making the county more vulnerable to that region’s financial distress.

Makers of everything from medical equipment to sporting goods are expected to feel some pain, because the plunging Asian currencies have made their goods far more expensive in those markets.

Local firms could be dealt a double blow, as devalued Asian currencies make products from those countries cheaper in some of the other foreign markets where Orange County goods are sold. The increased competition could force businesses here to slash prices just as they’re coming under increasing pressure to boost wages because of the county’s extremely low unemployment.

The worst-case scenario is that the turmoil in parts of Asia will spread to China, Latin America or Europe. Though a worldwide economic downturn is considered unlikely, for now the problems are highlighting the downside of Orange County’s membership in the new global economy.

“The ‘new economy’ has its dark side, and this is it,” said Mark Zandi, chief economist at Regional Financial Associates in West Chester, Pa.

Many local companies say they are starting to feel reverberations from Asia’s economic woes. They report sales declines of anywhere from 20% to 40% in Japan, South Korea and elsewhere in the past few months.

“The orders are still coming in, but the volumes are much smaller,” said Frank Medina, president of Diana Industries International, a Fountain Valley-based supplier of environmental cleaning and degreasing products.

Asia accounts for nearly one-third of Diana’s $2 million in annual sales. “We’re a small company,” Medina said. “When you put those kind of holes in a business, that’s pretty profound.”

Big companies are worried too.

Fluor Corp., the Irvine-based engineering and construction services giant, hasn’t had any Asian projects canceled or delayed, company spokeswoman Lisa Boyette said.

But Fluor has warned Wall Street that its 1998 earnings might not meet expectations. “Even though we haven’t had problems yet, we anticipate the turmoil in the market over there could slow the financing of our projects” in Asia, Boyette said.

The troubles might also trigger delays in building projects in other parts of the world, she said. A consumer products company, for instance, might back off plans to build a factory in Latin America if it believes there will be less demand for its goods in Asia.

*

The crisis began in July with the collapse of Thailand’s financial markets and has since spread to Malaysia, Indonesia and South Korea. Plummeting currencies in those countries have been accompanied by soaring interest rates, shaky banking systems and a credit squeeze.

The International Monetary Fund has approved bailout packages for some of the afflicted nations, but many economists fear they won’t be enough to prevent widespread loan defaults by banks and industrial firms. And with the Japanese economy worsening in recent weeks, the forecasts have grown increasingly gloomy.

“Japan and South Korea--their economies will be basket cases in 1998,” said Jack Kyser, chief economist at the Los Angeles Economic Development Corp.

As a result, he said, it will be “a year when Orange County’s economy takes a little bit of a breather. Then we’ll just have to see what happens in ’99.”

The sudden change in the outlook for the county economy is all the more dramatic considering that the double-digit annual increases in exports the past couple of years have been one of the biggest driving forces behind Orange County’s breathtaking growth.

This year, total exports will grow just 3.5%, to $8.6 billion, predicts Esmael Adibi, director of Chapman University’s Anderson Center for Economic Research. And over the next two years, Adibi expects anemic 2% annual increases in exports from the county.

In its recent economic forecast, Chapman predicted that slower sales to Hong Kong, Singapore, Indonesia and other parts of Southeast Asia would cost the county 2,400 jobs next year--although it said the losses could be partially offset by an increase in employment related to importing from those countries.

Among the local businesses that could be hit are medical equipment and electronics firms, exporters of consumer products, and professional service providers. In a bad sign for the county’s aircraft parts suppliers, Boeing Co., the world’s biggest aircraft maker, has warned that Asian airlines might delay taking delivery on as many as 60 jetliners over the next three years.

People in the tourist trade here are also bracing for a downturn in the numbers of business and vacation travelers from Asia. An estimated 1.63 million of the 6 million foreign visitors to Orange and Los Angeles counties this year were from Asia, according to CIC Research, a San Diego firm that tracks travel patterns for the federal government.

Experts say it’s impossible to predict how much that traffic might slow. “We’re still sorting this out,” said CIC Vice President Skip Hull.

Many Asian car makers have sales and distribution operations in Orange County that also could be hurt. This month, Hyundai Motor America Inc. in Fountain Valley fired 31 employees--6% of its U.S. work force--due to uncertain financial support from its South Korean parent.

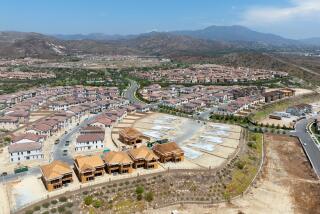

Even the resurgent real estate market, which economists have pegged as the major engine of growth for Orange County next year, could lose some steam because of the Asian crisis, they now say. People might grow more cautious about buying a new house if they’re worried about their jobs. And new office projects might be put on hold if Asian investors pull out of the market.

“A lot of the stuff being built right now, when it comes on the market, are there going to be tenants?” Kyser wondered.

*

Despite the spreading pessimism, many in the business community say they’re still in cheery spirits as the new year approaches.

Some local companies might even be positioned to benefit from the turmoil in Asia. Kott Koatings, which sells bathtub reglazing products through franchised distributors, derives about 40% of its $4.8 million in annual sales in Asia, and so far it hasn’t seen a slowdown in its business there. The Foothill Ranch company is setting up a new franchise in Thailand.

Company Vice President John Kott thinks that Asian franchisees will continue with their plans because businesses and consumers save money by reglazing rather than buying new bathroom appliances. Many of the products are sold to hotels, which must keep their facilities in good condition to stay competitive, even as the economy sours, he said.

Other firms say they’re partially offsetting slowing sales to the hardest-hit Asian countries by stepping up efforts in China, Mexico, Canada and Europe.

Hydrocal Inc., a Laguna Hills supplier of waste water treatment systems, recently got a taste of possible trouble ahead when one of its agents in South Korea asked if the company would cover his estimated $23,000 loss due to the plunging local currency.

“What do you say?” said Lynn Stewart, Hydrocal’s director of international operations. “Of course we can’t absorb $23,000,” she said, even though it might leave the agent in weakened financial condition.

Stewart isn’t turning bearish on foreign markets, though, and she expects that the firm’s growing sales in China will help counter the slowdown in other parts of Asia.

“You do endure these bumps,” she said. “It’s one of the hazards of doing business internationally.”

Many local businesses are employing hedging devices, such as contracts offered by financial institutions that allow them to lock in exchange rates, said Pete Belanger, an international tax partner at Coopers & Lybrand in Los Angeles.

Among Belanger’s Orange County clients, “it’s certainly far short of panic,” he said. “But there’s an absolute certainty that they have to do a better job of predicting and reacting.”

Indeed, many executives said the turmoil has prompted them to rethink their entire global strategy, realizing that “going global” might not be the panacea it was thought to be as recently as a few months ago.

“A lot of times in the international markets the expectations exceed the reality, both positive and negative,” said Robert Wallace, managing director of Export Specialists Inc., an Irvine export marketing firm.

For instance, he said, the economic union of Europe has emerged very slowly and hasn’t unleashed a tide of new exports there. On the flip side, dire predictions of the impact of the Mexican monetary crisis on Southern California three years ago proved largely unfounded. Mexico recovered relatively quickly and is again considered a highly promising market.

The lesson to be learned from Asia, Wallace said, is that international business requires extensive research, a well-developed strategy and long-term relationships.

“Some companies say, ‘Here’s our product and price list--good luck,’ ” he said. “A lot of times it’s the attitude and flexibility and ‘stick-to-it-iveness’ of manufacturers that’s the key.”

But for small, entrepreneurial firms, going overseas might not be worth the risk, particularly if it siphons resources away from the domestic market, said Mark Matsumoto, who owns Network International, a small export marketing company in Santa Ana.

“I don’t know if I would have said this a year ago, but you have to be very strong in domestic markets and look at foreign markets as gravy,” he said. “We got a little too carried away about this Japan Inc. and thinking that Asia was this endless growth region.”

For now, though, most companies are in a wait-and-watch mode--like New Horizons Computer Learning Centers Inc.

The Santa Ana franchiser of computer training centers has plans to double the number of Asian franchises to 40 next year. Still, Ed Miller, director of international franchise services, said that, in the firm’s just-completed budget for 1998, a larger reserve was set aside in case of losses due to the plunging Asian currencies.

“If the crisis continues, we might not be as aggressive at marketing new locations there,” he said.

In Orange County, where another “boring year of good news” was practically taken for granted, the future suddenly looks far less certain, Kyser said.

“You’re moving into treacherous waters, and you have to look at the horizon to see what’s bearing down on you,” he said. “The watchword for ’98 will be ‘caution.’ ”

(BEGIN TEXT OF INFOBOX / INFOGRAPHIC)

OC Exports

Dollar amounts in billions:

1994: $6.7

1995: 8.0

1996: 8.3

1997: 8.6

1998: 8.8

Note: 1997 is an estimate, 1998 is a forecast

County Exports Still Expanding

Orange County exports, which totaled an estimated $8.6 billion in 1997, are expected to climb to $12.5 billion by 2002. But the growth pace is expected to be more modest until the turn of the century:

Export Value (millions)

2002: 12,489

Change in export value from previous year:

(bar graph)

Biggest Markets

Mexico will replace Japan next year as the county’s single most valuable export market. Dollar value, in millions, of biggest export markets:

*--*

1996 1997 1998 1999 2000 2001 2002 Japan $1,532 $1,500 $1,530 $1,608 $1,776 $2,095 $2,506 Mexico 1,175 1,410 1,633 1,800 2,018 2,284 2,629 Canada 1,033 1,067 1,100 1,127 1,163 1,198 1,236 Europe 1,918 1,920 1,955 1,975 2,032 2,095 2,164 Asia* 1,959 1,900 1,691 1,530 1,767 2,177 2,724 Other 692 803 869 915 1,007 1,117 1,230

*--*

* Excludes Japan, China and Middle East

Note: 1996 numbers are actual, 1997 are estimates, 1998 and beyond are forecasts

Source: Anderson Center for Economic Research, Chapman University

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.