Bertelsmann in Deal With Barnes & Noble

NEW YORK — German media giant Bertelsmann has paid $200 million to buy a 50% stake in the online venture of bookselling heavyweight Barnes & Noble Inc., the companies said Tuesday.

The world’s largest bookseller temporarily postponed the widely anticipated initial public offering of its online venture, barnesandnoble.com, in light of the announcement, which came after markets closed.

For barnesandnoble.com, the joint-venture agreement ties it to the world’s third-largest media and entertainment company.

Bertelsmann owns BMG Entertainment, which includes Arista Records and RCA Records, as well as Random House, the No. 1 U.S. book publisher that boasts a wealth of best-selling authors, including Michael Crichton, Norman Mailer, John Grisham and Maya Angelou. Bertelsmann also owns Bantam Doubleday Dell.

That may help barnesandnoble.com obtain exclusive book deals, as well as expand into different areas in electronic commerce, such as music and videos.

“It does provide a deep-pocketed investor at a time when the notion of going public is a little bit more uncertain in these markets,” said Danielle Turnof Fox, an analyst at J.P. Morgan Securities.

Bertelsmann, meanwhile, gains access to an already established Internet business, which it will use as a resource when its launches its BooksOnline service in several European countries in November.

“They have everything except a brand name, and Barnes & Noble is probably the biggest brand name in books,” Fox said.

“The combination is going to be terrific,” Fox added.

Under the terms of the deal, both companies will also pool $100 million toward seed money in barnesandnoble.com, which is touted to have the potential to grow into a profitable highflier like Amazon.com Inc.

Further, Bertelsmann would throw in certain U.S. resources to barnesandnoble.com from its previously announced BooksOnline service, Barnes & Noble said.

In several European countries, Bertelsmann will move forward separately with the BooksOnline service, it said.

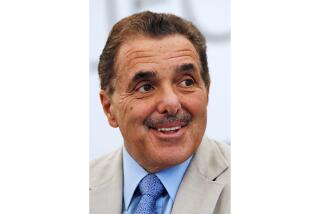

“Bertelsmann’s extensive expertise in direct marketing and preeminent position as a media company will strengthen our capital structure, enhance the quality of our offering, and, most profoundly, provide barnesandnoble.com with immediate access to global markets,” said Barnes & Noble Chairman and Chief Executive Leonard Riggio.

Bertelsmann’s Thomas Middelhoff added: “Books have always been our core business, and we believe our e-commerce initiatives will benefit consumers, publishers and the entire book industry.

“Amazon is a heavyweight,” said Middelhoff, who will take over as Bertelsmann’s chairman and chief executive on Nov. 1. “We have a good position now to start tough competition.”

This is the second recent strategic alliance for Bertelsmann with a U.S. company. Earlier, it closed a deal to buy giant U.S. publisher Random House from privately held Advance Publications Inc.

Barnes & Noble shares closed up 19 cents at $23.57 on the New York Stock Exchange.

The stock has fallen 42% since the IPO plans were announced Aug. 20.

More to Read

Sign up for our Book Club newsletter

Get the latest news, events and more from the Los Angeles Times Book Club, and help us get L.A. reading and talking.

You may occasionally receive promotional content from the Los Angeles Times.