Greenspan Insists Target Is Inflation, Not Stock Market

- Share via

Mr. Greenspan, are you or are you not “targeting” the stock market?

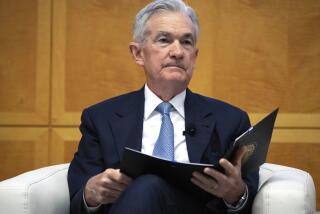

Not guilty, Federal Reserve Chairman Alan Greenspan insisted in Senate testimony Wednesday.

Although some Wall Street pros have theorized in recent months that Greenspan, worried about the so-called wealth effect, will continue raising interest rates until the stock market cries “Uncle!” and declines sharply, Greenspan said that just isn’t so.

“We are not focusing monetary policy on the stock market. We are focusing on the economy,” he told the Senate Banking Committee.

“To the extent that the stock market affects the economy, we respond to that,” he said. “We don’t look at stock prices and say, ‘If they are rising, we have to raise interest rates.’ ”

Greenspan has publicly fretted during the last year that the stock market’s gains are adding so much buying power to the economy--by making many consumers feel much wealthier--that growth overall is running at a potentially inflationary pace.

He continued Wednesday to stress that the Fed believes the economy is growing too fast for its own good and needs to be slowed somewhat by higher interest rates.

But “the basic purpose of what we are trying to do is to sustain this extraordinary recovery, this extraordinary acceleration in growth and a vibrant labor market,” Greenspan said.

“We are in no way arguing that the growth in this economy should not continue robust,” he said.

Although those kinds of comments are standard for any Fed chairman--no central banker ever plans on causing a recession, after all--Greenspan also seemed to back away from some concerns over the wealth effect.

“Let me emphasize that I’m not making judgments as to whether in fact the wealth effect is overdone, [or whether stock] values are overdone or not,” he said.

Some senators didn’t see it that way, saying it appeared to them that the Fed was more concerned with growth in stock prices and the resulting wealth effect than with expanding opportunities for Americans of all income levels.

“We’re finally drawing people into the work force who were never there before, giving them a chance to sort of share in an opportunity,” Sen. Paul S. Sarbanes (D-Md.) said.

The Fed’s theory, according to Sarbanes, is that “you’re getting this run-up in the equity assets that creates a wealth effect. That’s going to stimulate a demand without a supply to respond to it. So now we’ve got to curtail the economy.”

In the end, he said, that hurts “these young people I’m talking about that we’re trying to draw into the labor force.”

Sarbanes noted that half of all Americans don’t own stocks at all, and that most people who do own stocks have relatively small holdings. Why target the wealth effect of a relative few with large holdings? he asked.

Greenspan didn’t directly address that question, but insisted that Fed policy is designed so that “unemployment should continue very low and that prosperity should continue as far out as we can manage to induce it to do so,” he said.

But if the Fed is worried about inflation flaring again because of rapid growth, where is it? he was asked.

Greenspan agreed with those who said there’s no evidence that inflation is picking up. “I cannot find it, no matter where I look,” he said.

But he noted that market interest rates had begun to rise last year well before the Fed’s first rate increase in June. That’s a sign that market forces are trying to slow the economy to a more sustainable pace, the Fed chief said.

“Market forces, not the Federal Reserve, are driving up interest rates to close the gap” between demand and supply in the economy, he said. “We at the Federal Reserve are acting in conjunction with the market and responding to it.”

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox twice per week.

You may occasionally receive promotional content from the Los Angeles Times.