Bergen Agrees to Be Acquired by AmeriSource in $2.3-Billion Deal

- Share via

One of Orange County’s largest companies, Bergen Brunswig Corp., said Monday it agreed to be acquired by rival AmeriSource Health Corp. in a $2.3-billion stock deal that would create the nation’s largest drug distribution company.

The proposed deal, the latest in a health care consolidation wave, would create a company with $35 billion in annual revenue. But Orange County also would lose one of its five Fortune 500 companies.

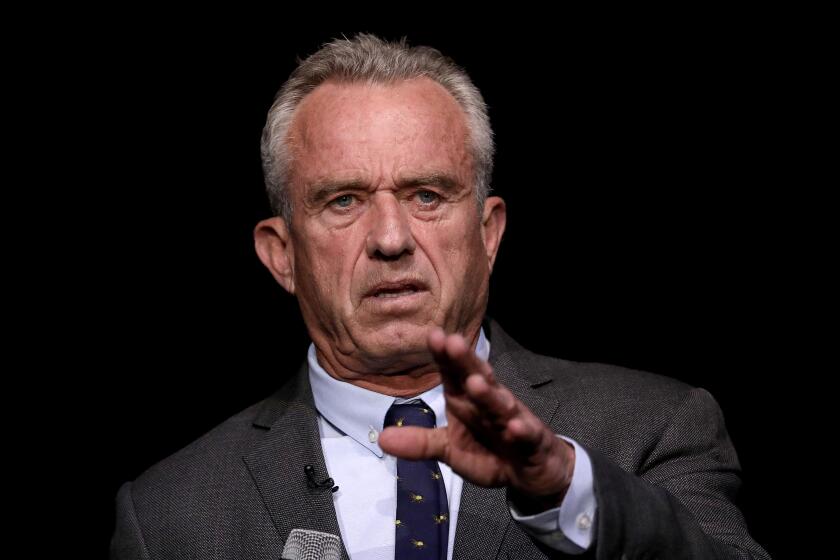

The combined company, to be called AmeriSource-Bergen Inc., would be based in Valley Forge, Pa. AmeriSource’s chief executive, R. David Yost, would become CEO of the combined company. Bergen’s chairman and chief executive, Robert E. Martini, would become chairman.

Although Bergen had $23 billion in revenue last year, twice the sales of AmeriSource, it has struggled after two previous acquisitions that went awry and left the Orange company $1.3 billion in debt.

The merger is expected to reduce operating costs by $125 million a year after three years, largely through the consolidation of Bergen’s 30 national distribution centers and AmeriSource’s 22 centers.

Executives declined to estimate how many of the 900 employees at Bergen’s Orange headquarters will lose their jobs, saying the operation will remain a significant regional administrative office.

AmeriSource will issue 50 million shares to Bergen Brunswig shareholders and take on Bergen’s $1.3-billion debt, valuing Bergen at a total of about $3.6 billion. Bergen shareholders would receive 0.37 of an AmeriSource share for each share of Bergen stock.

Shares of AmeriSource closed at $45.20, down $3.28. Bergen’s shares were off 7 cents to $15.87. Both stocks trade on the New York Stock Exchange.

The deal illustrates how consolidation is affecting health care, with national drug-store chains and hospital groups striking tougher deals with distributors than independent pharmacies and hospitals ever could.

With those shrinking margins as a backdrop, Bergen and AmeriSource had discussed a possible merger for years, renewing the talks in December, when Yost called Martini.

If the Federal Trade Commission approves the merger as expected by summer, longtime industry leader McKesson HBOC Inc. will drop to No. 2 in sales, with about $31 billion this year, Bergen officials said. A third huge competitor, with a projected $30 billion in revenue, is Cardinal Health Inc., which last month acquired Bindley Western Industries Inc.

The FTC in 1998 blocked proposed combinations of Bergen with Cardinal and McKesson with AmeriSource, ruling consumers would suffer if the four largest drug wholesalers consolidated into two giants. At the time, Cardinal’s offer to buy Bergen was valued at nearly $3 billion in stock and debt, and would have created a company with $22 billion in annual revenue.

But Yost and Martini said customers such as pharmacies and hospitals support their merger plan after the Bindley-Cardinal deal, believing an AmeriSource-Bergen combination would promote competition by creating three large healthy companies.

“Putting our two companies together always made sense,” Martini said. “The big issue was whether the transaction could get done. We now feel strongly that it can be done.”

The FTC will examine the proposal, said Richard Liebeskind, assistant director of the commission’s Bureau of Competition. As for the executives’ claims that the merger will make the industry more competitive, Liebeskind said, “We’ll listen to what they have to say.”

After Bergen’s merger with Cardinal was blocked, the Orange company snapped up Statdlander Pharmacy and PharMerica Inc. in an effort to expand beyond its core wholesale business. But the deals plunged the company into the red and left it mired in debt. Chief Executive Donald Roden was fired in November 1999.

After Martini took the reins again as chief executive, the stock rebounded, more than tripling its $5 price range last year. But at about $17 a share, the AmeriSource offer is still less than half the $37.19 that Bergen shares peaked at in January 1999.

At this level, the proposed sale “shows the prospects for returning to profitability as an independent entity are not good,” said Richard Evans, an analyst with Sanford C. Bernstein. “A lot of people had hoped Bergen could manage its own fate and come out of this situation independently.”

Bergen Brunswig grew out of a wholesale apothecary that was founded in Los Angeles in 1888 and was later named Brunswig Drug. Co. In 1969, the former Bergen Drug Co. of Hackensack, N.J., which was controlled by the Martini family, bought Brunswig Drug Co., forming the current corporation.

If the merger goes through, Bergen would join a number of major firms that have been acquired by out-of-state companies or moved out of state in recent years. They range from banking giants like First Interstate Bancorp and BankAmerica Corp. to aerospace notables such as Lockheed Corp. and Rockwell International Corp.

While the growing technology and entertainment industries have picked up slack, and local companies such as Walt Disney Co., Hilton Hotels Corp. and Northrop Grumman Corp. have made acquisitions of their own, the net result has been an outflow of the large corporate headquarters that support charities and spend heavily on services like advertising, accounting and government relations.

“It’s the ongoing erosion of the Fortune 500 base in Southern California,” said Jack Kyser of the Economic Development Corp. of Los Angeles County. “A lot of detractors are going to use this as a lever to point to imagined flaws in our economy,”

The loss of the headquarters of a major company like Bergen Brunswig would probably mean both layoffs and other losses for the local economy, said Esmael Adibi, director of the Center for Economic Research at Chapman University.

Generally speaking, economists figure that for every job lost in the wholesale drug industry, 2.1 jobs will probably be lost in the overall economy.

If the deal goes through, it would leave four Fortune 500 companies headquartered in Orange County: Ingram Micro Inc. in Santa Ana, Fluor Corp. in Aliso Viejo, PacifiCare Health Systems Inc. in Santa Ana and Pacific Life Insurance Co. in Newport Beach.

(BEGIN TEXT OF INFOBOX / INFOGRAPHIC)

Companies at a glance

Bergen Brunswig Corp.

Headquarters: Orange

Chairman/CEO: Robert E. Martini (will be chairman of combined company)

Business: Drug and medical products distributor

Employees: 10,000, including about 400 in Orange County

Exchange: NYSE

Stock price: $15.87

2000 net sales: $22.9 billion

2000 net loss: $753 million

AmeriSource Health Corp.

Headquarters: Valley Forge, Pa.

Chairman/CEO: R. David Yost (will be chief executive of the combined company)

Business: Drug and healthcare products distributor

Employees: 3,400

Exchange: NYSE

Stock price: $45.20

2000 net sales: $11.6 billion

2000 net income: $99 million

Sources: Bloomberg News, Bergen Brunswig Corp.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.