Data Hint at End of Recession

The U.S. economy grew slightly during the final quarter of 2001, the Commerce Department said Wednesday, surprising analysts and suggesting that the recovery may have already begun.

Within hours of the government’s upbeat report, the Federal Reserve announced it will leave interest rates unchanged, ending a yearlong streak of back-to-back rate reductions designed to counteract the downturn.

But Washington officials and Wall Street economists warned against reading too much into the fourth-quarter figures. The uptick is a preliminary estimate that could be revised downward, and the recovery, even if underway, may prove anemic.

“There’s enough wiggle room in the numbers that I wouldn’t say the recession’s over, but there definitely are signs of an upturn,” said Chris Varvares of Macroeconomic Advisers in St. Louis. “What’s still at issue is how vigorous it will be.”

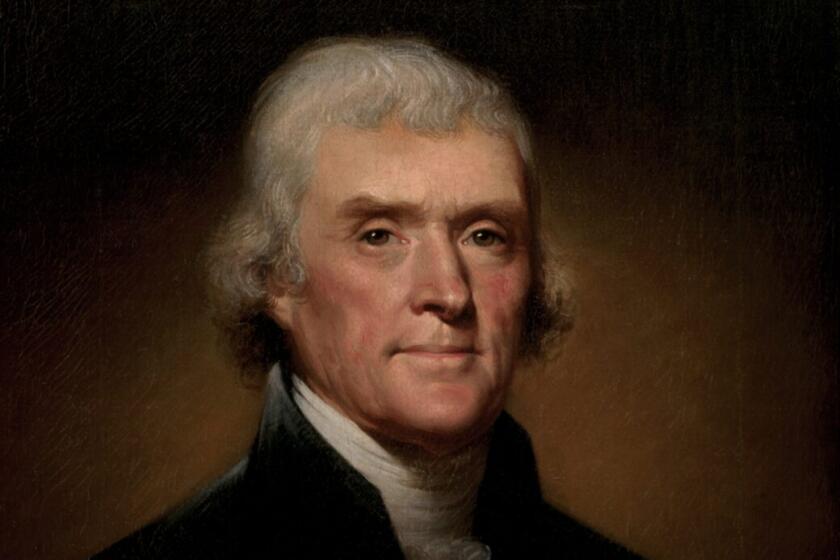

President Bush, whose push for passage of an economic stimulus package could be undermined by a recovery, found himself downplaying Wednesday’s data. “Today’s GDP report is positive, but we cannot take growth and job creation for granted,” he said in a statement.

The nation’s gross domestic product, the broadest measure of U.S. economic activity, expanded at an annual rate of 0.2% in the fourth quarter, the Commerce Department said. The increase reflected strong consumer spending, particularly on autos, and surging government outlays in the aftermath of Sept. 11.

GDP declined 1.3% in the third quarter, and the consensus view of analysts was that it would shrink by 1% or more in the fourth.

The standard definition of a recession is two consecutive quarters of GDP contraction, so if the GDP numbers hold up, the nation would have technically skirted a recession.

However, according to the National Bureau of Economic Research, the official arbiter of economic cycles, the recession began in March. If the economy began expanding in the fourth quarter, the downturn would turn out to have been as short as a recession can be, and unusually mild. But the official group would still consider it a recession.

“Recession is a loaded word,” said economist Ian Shepherdson of Higher Frequency Economics in Valhalla, N.Y. “But the unambiguous, undeniable thing that screams out of this report is that the economy did a heck of a lot better in the fourth quarter than just about everybody expected.”

The positive interpretation was endorsed by the Fed’s Open Market Committee, which emerged from a two-day meeting to announce it would keep the benchmark federal funds interest rate at 1.75%. It was the first time since December 2000 that the rate-setting panel left the key short-term rate unchanged.

“Signs that weakness in demand is abating and economic activity is beginning to firm have become more prevalent,” the Fed said in a statement. “With the forces restraining the economy starting to diminish, and with the long-term prospects for productivity growth remaining favorable and monetary policy accommodative, the outlook for economic recovery has become more promising.”

The announcement appeared to lift spirits on Wall Street, which rallied from losses earlier in the day. The Dow Jones industrial average rose 144.62 to close at 9,762.86, while the Nasdaq composite index climbed 20.45 to 1,913.44. The Standard & Poor’s 500 index increased 12.93 to 1,113.57.

The Fed warned, however, that the strength of business and household spending remain uncertain, and that it would continue to err on the side of monetary easing. Many economists do not expect the central bank to begin raising rates again until the job market firms, possibly late in the year.

“The job market is going to be very slow to turn around,” said Allen Sinai of Primark Decision Economics in New York. “Aggressive hiring, or even a return to normal hiring practices, still seems a long way off.”

Don Wainwright, chairman of the National Assn. of Manufacturers and chief executive of Wainwright Industries in St. Peters, Mo., said he expects the recovery to proceed slowly, with little immediate effect on employment. More than 1 million factory jobs have been lost since the economy began to soften.

“I just don’t see a lot of hiring going on right now,” Wainwright said in an interview with several reporters. “If anything, with the [negative] earnings that are going to be released in this quarter, we could see some more layoffs.”

The economy’s fourth-quarter growth was fueled by a 5.4% increase in consumer spending, which has remained surprisingly resilient throughout the economic downturn. Spending on big-ticket durable goods soared 38.4%, led by record auto sales as Americans responded to interest-free financing and other incentives.

Another big contributor was government spending, which jumped 9.2% as Washington responded to the Sept. 11 attacks with emergency outlays for New York reconstruction, homeland security and the war on terrorism.

Business investment continued to fall, however, and firms reduced their inventories at a record clip. But economists noted that the rate of inventory reduction should begin to slow soon, stimulating increased factory production and, eventually, job creation.

Bush said the strong consumer spending reflected in Wednesday’s figures show that last year’s tax cuts helped soften the blow of the recession. He urged lawmakers to enact another package of tax re ductions and spending to make sure the recovery doesn’t falter.

*

Times staff writer Edwin Chen contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.