When Cash Crosses Over

There is a bank in India that sends out ATM machines to roam the countryside, allowing villagers to withdraw some of the cash earned by their relatives in places like the Middle East, Britain and California. It’s a modern twist on a venerable tradition. Depending on your village, Wednesday could be cash day at the market.

Remittances is jargon not only for those hard-earned sums flowing into India but also for the money sent home by Mexican maids in Los Angeles and their Filipino counterparts in Hong Kong. It’s a phenomenon obsessing global bankers and social workers alike.

Nobody planned it this way, but that money sent home by migrant workers around the world has become one of the most important means of alleviating poverty.

This north-south flow of money is closing in on $100 billion a year. In the case of Latin America, the roughly $45 billion in remittances, coming largely from the United States, now exceeds all foreign direct investment and development aid combined. And unlike investment or aid that often fails to reach its intended recipients, remittances flow straight to those in need.

“This is all about poor people sending money, somehow, to even poorer loved ones,” says Don Terry, the manager of the Multilateral Investment Fund at the Inter-American Development Bank. Terry, an expert on the remittance economy, estimates that one in 10 people worldwide is involved in this flow of capital, either sending or receiving.

For Mexico, the annual flow of dollars from Mexicans working abroad in 2004 amounted to $16.6 billion, according to the Inter-American Development Bank. The average amount sent at one time was $328.

Because of the sums involved, it’s not surprising that more businesses are vying to enter the market. Technology and increased competition have helped slash transaction costs. Migrant workers who once might have paid double-digit percentages to send money home can now pay commissions closer to 5%.

Their range of options is also expanding, from the traditional money-wiring storefronts on Broadway in downtown L.A. to big banks like Wells Fargo. Indeed, as banking becomes more prevalent among migrant workers in this country and among their relatives back home, the whole notion of “wiring” money will become antiquated. It’s easier for far-flung relatives to have linked accounts accessible with an ATM card -- hence those roaming ATMs in India.

*

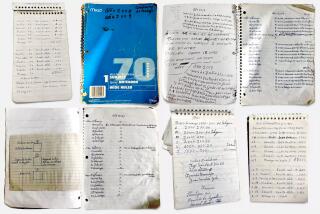

(BEGIN TEXT OF INFOBOX)

Remittances in 2004

(In millions of dollars)

1. Mexico: $16,613

2. Brazil: $5,624

3. Colombia: $3,857

4. Guatemala: $2,681

5. El Salvador: $2,548

6. Dominican Republic: $2,438

7. Ecuador: $1,740

8. Jamaica: $1,497

9. Peru: $1,360

10. Honduras: $1,134

11. Haiti: $1,026

12. Nicaragua

13. Paraguay: $506

14. Bolivia: $422

15. Costa Rica: $306

16. Argentina: $270

17. Venezuela: $259

18. Panama: $231

19. Guyana: $143

20. Uruguay: $105

21. Trinidad & Tobago: $93

22. Belize: $77

23. Surinam: $51

Source: Inter-American Development Bank Multilateral Investment

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.