Cashing in or selling out?

THIS is a tale of two de-accessions, the term used for the disposal of works of art by a public institution, usually through sale. The practice is legitimate but thorny -- legitimate because any institution’s leaders, who benefit from public tax subsidy, must be free to make decisions they believe to be in the public interest; and thorny because the public is rarely unanimous in deciding what its interests are. De-accessioning often raises hackles.

Hackle-raising is what happened with these two cases -- one in Buffalo, N.Y., the other in Philadelphia -- although the specifics could not be more different. Together they represent the range of issues surrounding art’s disposal.

They also demonstrate why every instance is unique. Professional guidelines for de-accessioning do exist, but they are rules of thumb, not law.

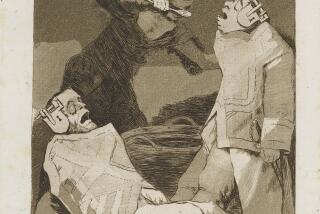

Philadelphia’s Thomas Jefferson University has negotiated the sale of Thomas Eakins’ monumental 1875 masterpiece, “The Gross Clinic.” This disturbing, epochal image of a doctor working on a patient before students in a surgical amphitheater dramatically intersects art with science as the engine of modern knowledge. Customarily regarded as the greatest 19th century American work of art, its price tag is $68 million.

Buffalo’s Albright-Knox Art Gallery, meanwhile, is selling more than 170 paintings, sculptures and decorative objects. Surprisingly, the forthcoming sale was announced in November, before a final checklist was compiled. But quality-wise, several works known to be headed to auction are so important that they have the market salivating.

One is an imposing, life-size granite figure of the Hindu god Shiva, seated atop a stylized lotus, carved in Southern India during the Chola dynasty of the 10th or 11th century. Another is an exceptionally rare bronze wine vessel, cast more than 3,000 years ago in Shang dynasty China.

Perhaps most striking is a large sculpture depicting the Olympian goddess Artemis, Apollo’s twin, shown with an emblematic sacred deer by her side. Made during the late-Hellenistic or early-Roman Imperial era and estimated to be worth at least $5 million, the sculpture is ranked by scholars among the top tier of Classical bronzes in America. (Like the Shang wine vessel, rarity is part of the reason: Large ancient bronzes were often melted down to retrieve the metal, so only a fraction survive.) Given the much-publicized problem of looted antiquities entering public and private collections during the last three or four decades, the offering of an ancient masterpiece with a pristine title and ownership history -- the museum acquired it in 1953 -- is likely to attract many eager buyers.

Similarities -- and differences

HOWEVER different the case in Buffalo is from the one in Philadelphia, the two have this important characteristic in common: Both feature unassailable masterpieces that have been in public collections for decades (in the Eakins case, for more than a century), and the decision to wrest them loose now is being driven by today’s booming art market. Prices for established masterworks, never modest, have become astronomical. The art’s stewards have decided to cash in.

The aggressive market is operating as a passive but powerful vacuum, literally tearing important paintings and sculptures from public walls and civic galleries. Current levels of public protection are not strong enough, and we risk the loss of irreplaceable treasures. Standards need to change.

The disposal of art that is poor quality, severely damaged, stolen, fake or outside an institution’s established collecting area is routine -- for example, the Getty Museum’s forthcoming sale of 39 mediocre paintings from its storage room. Yet I dare say that neither Buffalo nor Philadelphia would be the focus of de-accessioning controversies had the last decade’s steep spike in art prices not occurred. Without it, the brilliant art now being sent to market like a fatted calf would not be changing hands.

Jefferson and the Albright-Knox are selling for the same reason -- fundraising -- but with different goals. Jefferson is a medical school, not a museum, and the de-accession income will help underwrite a $400-million campus expansion. In announcing the Albright-Knox sale, a museum spokesman said the objects were chosen because they fall outside “the core mission” of collecting Modern and contemporary art. The $15 million the museum hopes to earn at Sotheby’s will be added to the $58-million endowment.

The Jefferson case is convoluted. According to published reports, university trustees approached Christie’s auction house in August. Christie’s, advising a private sale, contacted representatives of the planned Crystal Bridges Museum of American Art in rural Arkansas, whose benefactor, Wal-Mart heiress Alice Walton, has been spending top dollar to build a collection from scratch.

Walton’s advisor is Princeton’s patrician art historian, John Wilmerding. (His great-grandparents, Henry and Louisine Havemeyer, were among the foremost benefactors of New York’s Metropolitan Museum of Art, while his grandmother, Electra Havemeyer Webb, was the first great champion of American folk art.) Washington’s National Gallery of Art, where Wilmerding was once a curator and now serves on its trustees’ council, was brought in as a partner, and the deal was struck.

When the plan went public in November, the yowling rattled the rafters.

Jefferson staff and alumni had obvious reasons to complain, but the Philadelphia art establishment was faced with the loss of a peerless homegrown treasure. Yet their moral objections were blurred by the fact that they were already heartily engaged in “the rape of the Barnes” -- a shady maneuver by which the city managed to snag from a neighboring county the greatest privately assembled collection of Post-Impressionist and early Modern art. The local establishment is wrecking the Barnes’ irreplaceable value as a cultural monument, while squandering $200 million in charitable funds to move it downtown.

Still, its leaders set out to match the $68-million offer for the Eakins. With about half that amount currently pledged and the remainder guaranteed by a local bank’s bridge loan, shared title to the painting is expected to pass from Jefferson to the Philadelphia Art Museum and the Pennsylvania Academy of the Fine Arts at the end of January.

If I were Alice Walton, I would reconsider the quality of the advice I was getting. Yes, $68 million is a lot of money. With the exception of Asher B. Durand’s 1849 “Kindred Spirits,” bought by Walton’s museum for $35 million, it’s more than any 19th century American painting is known to have fetched by a factor of at least five. Still, my first thought on hearing of the sale was, “What a steal!” The caliber of the masterpiece, coupled with the state of today’s art market, made the price seem low.

A local outcry in opposition to the painting leaving town was also predictable. The neophyte collector, with a fortune estimated by Forbes at $18 billion, could easily have put the picture beyond competitive reach while feeling no pain. She didn’t, and the prize was lost.

Likewise, Jefferson trustees must now be wondering whether the sale did in fact maximize the monetary value of their asset. With more than one party able to pony up the asking price, the bar wasn’t high enough.

Regardless, we all owe the university a deep debt of gratitude. By negotiating only with public art museums, an irreplaceable masterpiece was kept from disappearing into a private collection. That counts for a lot. Would that the Albright-Knox had been so public-spirited.

Opinions differ as to the wisdom of the Buffalo de-accession. Tom L. Freudenheim, former assistant secretary at the Smithsonian Institution and director of several museums (and a Buffalo native), lambasted the sale -- convincingly -- in the Wall Street Journal.

The dubious claim advanced by current Albright-Knox leadership puts Greco-Roman, Shang and Chola dynasty sculptures outside the museum’s better-known specialization in Modern and contemporary art. Yet a 1979 collection catalog published by the museum took a more nuanced and enlightened view: “The acquisitions policy of the Gallery has long held that efforts to add certain works which elucidate affinities and parallels with the art of modern times is an important pursuit.” All art, no matter when or where it was made, lives in the present.

Keeping the public in mind

BUT the customary objections to an extraordinary de-accession program also apply. Museum staff and trustees are transient stewards for a civic legacy, and they have no right to dispose of it. Pruning mediocrity, as the upcoming Getty sale will do, is part of the curatorial job, but shipping masterpieces to the auction block, as the Albright-Knox is doing, is just mercenary.

The public loses. With the tax-exempt museum as guardian, the public has owned the magnificent “Bronze Figure of Artemis and the Stag” for 54 years. (I had the pleasure of first seeing it in Buffalo in the early 1970s.) After Sotheby’s June auction, however, it could easily disappear from public view -- into a Park Avenue apartment, a dacha outside Moscow or another private destination. The Albright-Knox, unlike Jefferson University, did not try to place the treasure in one of the handful of American art museums that actively collect antiquities, where continuing public access would be assured.

Every American museum must place its own self-interest in the foreground. But professional standards should also instinctively privilege the public over the private marketplace, acting as a check on its inevitable excesses. The Assn. of Art Museum Directors requires that de-accessioning be governed by a member institution’s written collection management policy. (The Albright-Knox declined a request to review its policy, saying through a spokesman that it is an internal working document.) It should strengthen that constraint by requiring that objects of substantial value be offered to other museums first.

Once an important object has left the art market and entered a public collection, powerful mechanisms ought to be in place to keep it there. Yet no such mechanism currently exists. With the art market in the stratosphere, its mighty pull demands a serious regulatory counterweight.

christopher.knight@latimes.com

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.