Mortgage relief bill in sight

WASHINGTON — Under pressure to help Main Street after the government saved a Wall Street firm from bankruptcy, senators ended weeks of partisan stalemate Tuesday and agreed to try to quickly pass legislation that could help some homeowners avoid foreclosure.

Party leaders asked the top Democrat and Republican on the Banking Committee to draw up a compromise bill that could be brought before the Senate as soon as today.

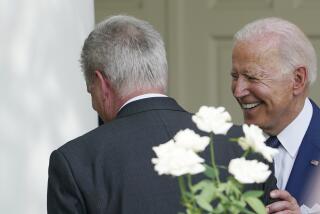

“The time has come for us to legislate, not continue our bickering,” Senate Majority Leader Harry Reid (D-Nev.) said at a joint appearance with Minority Leader Mitch McConnell (R-Ky.) -- an event so rare that Reid insisted it was not an April Fool’s joke.

The breakthrough came after lawmakers returned from a two-week spring recess during which the federal government stepped in to rescue investment bank Bear Stearns Cos. and the country’s economic troubles dominated the presidential campaign.

A controversial proposal to allow bankruptcy judges to modify mortgages for struggling homeowners is not expected to be included in the compromise measure. Democratic leaders say they will push to get that provision back in the bill over the objections of Republicans, the White House and lenders, who say it will raise costs to all borrowers.

The compromise bill is likely to include a provision that will allow state and local government housing agencies to issue up to $10 billion in tax-exempt bonds to refinance sub-prime loans. It is also expected to provide more money to counsel homeowners threatened with foreclosure, and a requirement that lenders disclose more information to consumers taking out loans.

The bill is aimed at stemming the rising tide of foreclosures, a big factor in the nation’s continuing housing slump. Addressing the longer-term causes and fallout, including reforming the mortgage process and dealing with homeowners who are “underwater” and owe more than their homes are worth, will have to wait for more comprehensive legislation.

“The Senate needs to take steps to help families with distressed mortgages, but without providing taxpayer-funded bailouts to real-estate speculators who took irresponsible risks,” Sen. John Cornyn (R-Texas) said.

Tuesday’s bipartisan agreement was a dramatic turnaround from just a few weeks ago, when Senate Republicans blocked consideration of a similar proposal that included the provision to allow bankruptcy judges to change mortgage terms.

Sen. Johnny Isakson (R-Ga.) said he told Senate Republican leaders that, based on what he heard from constituents, “I did not think that doing nothing was an option.”

As a way to stimulate the housing market, Isakson said he hoped to add to the bill a tax credit that could be used by anyone who bought and moved into a home that was in or approaching foreclosure.

Democrats also want the bill to include $4 billion for local governments to buy and renovate abandoned properties, a provision that could benefit California, which has been hard hit by foreclosures. But that idea is opposed by the Bush administration, which has called it a “bailout to lenders and speculators.”

The decision to take up the bill came as Federal Reserve Chairman Ben S. Bernanke on Tuesday appeared on Capitol Hill for the first of three days of questioning by lawmakers, a sign of the growing political anxiety over the economy.

Explaining the sudden stampede to take up the bill, Sen. Mel Martinez (R-Fla.) said, “Everyone was home for a couple of weeks, and if they heard what I heard in Florida, I think that they realize this is a serious, serious problem.”

Democrats sought to ratchet up pressure on Republicans to act by pointing to the Fed’s rescue of Bear Stearns.

“As bold as the action was to help Wall Street, we must be bold to help millions of Americans who live on Main Street,” said Sen. Christopher J. Dodd (D-Conn.), chairman of the Senate Banking Committee. Dodd and Sen. Richard C. Shelby of Alabama, the top Republican on the committee, will work to come up with a bipartisan bill.

Democrats vowed to push for a vote on the bankruptcy provision.

Kathleen Day of the Center for Responsible Lending, an advocacy group for borrowers, said that changing the bankruptcy law was an “essential component” to any relief measure, saying it would help about 600,000 people stay in their homes.

But the White House has threatened to veto the bill over the provision and Martinez warned that the proposed change would be a “poison pill” that would doom any bill.

Congressional action comes as foreclosures skyrocket across the country. In California, 31,676 homes were seized in foreclosure in the fourth quarter of 2007, a 421% increase over the same period a year earlier.

“California is on the front lines of this crisis,” Sen. Barbara Boxer (D-Calif.) said Tuesday, displaying a chart that listed seven California cities among the top 10 nationwide as ranked by foreclosure filing rates.

--

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.