CFO Awards Photos and Shared Insights from the Event

The CFO Leadership Awards ceremony was held at The Beverly Hilton Hotel in Beverly Hills on June 21, 2022. The evening kicked off with a lively cocktail reception in the courtyard, followed by an informative and fascinating panel discussion and concluded with the awards presentation and multi-course dinner. The in-person event recognized the region’s top talents in the Chief Financial Officer position, serving companies from small nonprofits to multinational corporations.

Directly before the CFO Awards were presented, Brian Hegarty, Principal and L.A. Managing Director for Marsh McLennan Agency, moderated an engaging panel discussion that covered sweeping issues impacting CFOs both today and in the near future. The two panelists, experts in their field, provided unique insights about post-COVID recovery, supply chain challenges, inflation issues and how to navigate this challenging time with success through 2023 and beyond.

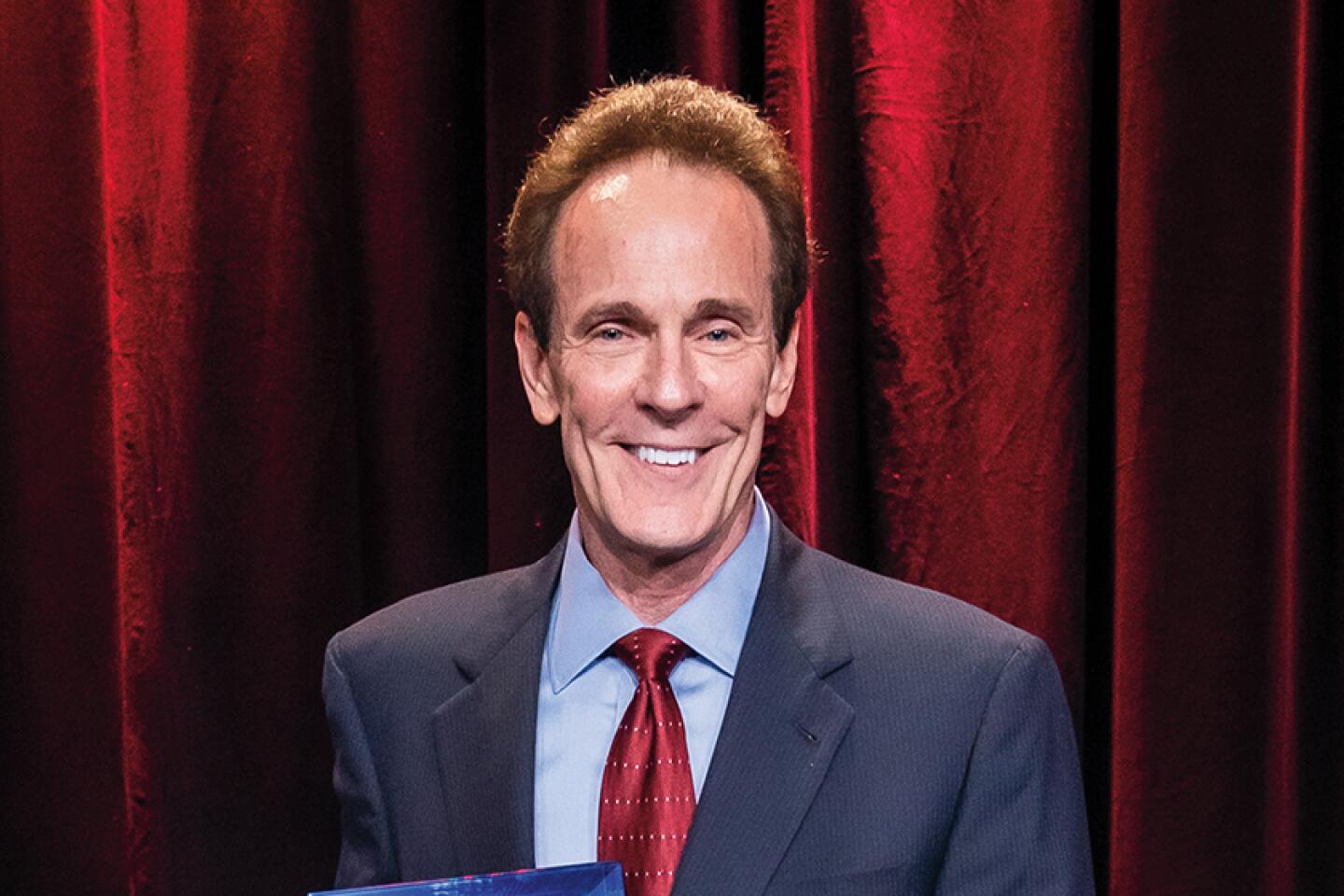

MODERATOR: Brian Hegarty

Principal, L.A. Managing Director

Marsh McLennan Agency

Brian Hegarty is the Managing Director of the Los Angeles office for Marsh & McLennan Agency (MMA). In addition to overseeing the firm’s rapid growth in the Los Angeles market, Hegarty specializes in employee benefits programs for mid-size to large companies. He works hand-in-hand with clients to build employee benefits programs focused on improving the employee experience and driving retention and recruiting efforts.

Since joining Marsh McLennan in 2008, Hagerty has worked closely with many leading Los Angeles industry sectors, such as technology, entertainment, apparel and hospitality, among others. Focused on enhancing the experience for both employers and employees, he is adept at helping organizations that are expanding their operations nationally and internationally.

PANELIST: Anant Patel

Partner, Transaction Advisory Services Practice Leader

GHJ

Anant Patel, CPA, has over 25 years of public accounting experience and leads GHJ’s Advisory Services Practice, Transaction Advisory Services Practice and is also a member of the Executive Committee. He advises on mergers and acquisitions and provides consulting for quality of earnings, working capital analysis, EBITDA analysis and projections and deal structuring. Patel has assisted on deals ranging from $20 to $750 million and is a Certified Merger & Acquisition Advisor.

Patel provides audit and accounting, tax and general business consulting services. His multiindustry experience includes food and beverage, entertainment, technology, manufacturing, wholesale/distribution, consumer products and real estate.

Due to his impact on the community and accounting industry, he was recognized as one of 2018 and 2019’s “Most Influential Private Equity Investors and Advisors”; a 2018-2020 “Most Influential Minority CPA”; a 2019-2020 “Leader of Influence in Private Equity Advisory”; and multiple times as a “Top 40 in 40s” by the Los Angeles Business Journal.

Prior to joining GHJ in 2000, Patel worked for six years at a national accounting firm in England. He graduated, with honors, from the University of Leeds with a B.A. in accounting. Also, he is a member of the California Society of CPAs and the American Institute of Certified Public Accountants.

PANELIST: Kalika Yap

CEO

Citrus Studios

Kalika Yap is a serial entrepreneur, inventor, author and podcaster. Her businesses, which range in nature from upscale branding companies to consumer-facing cosmetics, include the award-winning brand agency Citrus Studios, Luxe Link, the Waxing Company, The Tangerine Company and Orange & Bergamot.

Born in Quezon City, Philippines, Yap attended NYU and became a journalist with CNBC before setting out on her entrepreneurial path on the West Coast. After making just $6 an hour at one point in Los Angeles, she grew her many companies to revenues over $35 million, harnessing her never-quit spirit and infectious enthusiasm.

She is the host of the Entrepreneurs Organization’s “Wonder Podcast,” which places women entrepreneurs in conversation with thought leaders to empower listeners, share unique journeys and highlight the relatable challenges that extraordinary people face.

Yap’s goal is to help one million women entrepreneurs make $1 million in revenue and create one million jobs.

Shared Insights from the Event

Q: Can you share what digital systems your teams have implemented to improve processes and efficiency?

Yap: As an owner of two digital agencies, we’ve been using many SaaS (Software as a Service) platforms in the past decades and implemented many of these platforms for our clients. Some of the software tools I use include Calendly, which handles my appointments and allows my assistant to focus on other tasks that can help me drive revenue. Other tools I use include but are not limited to Basecamp, Invision, Live Chat, Monday, Sketch, Slack (for day-to-day communication) and Trello (for programmer project management). My advice for software is to 1) go back to the basics, 2) understand your collected data before imputing it and 3) details count. To that last point, pay attention to things like your website speed, broken links, even your email signature - because your consumers certainly do.

Q: With the added strain of the COVID-19 pandemic, inflation has impacted sales, margins, debts, and cash flows. What have you seen in the marketplace?

Patel: Inflation has had a major impact on sales, margins, debt and cash flow. Supply-chain obstacles continue to present challenges, raw material costs have markedly increased, and consumer demand remains mostly strong. Inflation is trending where it is, given these pressures, which is not a surprise. It is higher than most people have been used to because of the extended economic cycle, despite inflation historically still being fairly low.

Yap: Customers will be trading down for value, so we all need to be creative with our products and service offerings. Here’s the “golden question”: How can you reduce time to value - creating lower-priced products while preserving margins? Flags are forming. There’s a supply chain backup, continued inflation and aging AR that is coupled with shock, realignment, and change of consumer behavior. Simply put, there’s a really good chance we will be in an “official” recession by the end of the year where we will see large-scale layoffs, a credit crunch, and cascading effects throughout the economy, so I’d suggest that preparing now is a proactive move.

Q: What are some supply-chain issues you need to watch out for, and how have others been impacted?

Patel: The real impact of the broader logistical challenges depends on the company’s position in the supply chain. Companies closer to the consumer have less ability to increase prices and take on the cumulative impact of increases further upstream, whereas those at the beginning of the supply chain can pass on price increases to offset inflation from, say, a wage increase. Ultimately, those fluctuations trickle down to the consumer.