CRE Executives Anticipate Stability: Optimism Abounds Despite Inflation and Rising Interest Rate Concerns

As the economy continues to recover from the global pandemic, commercial real estate executives see strong market fundamentals and steady economic growth, according to the Real Estate Roundtable’s Q1 2022 Economic Sentiment Index. While optimistic about the economic outlook going forward, inflation concerns and a rising interest rate environment are frequently cited as potential headwinds for the industry.

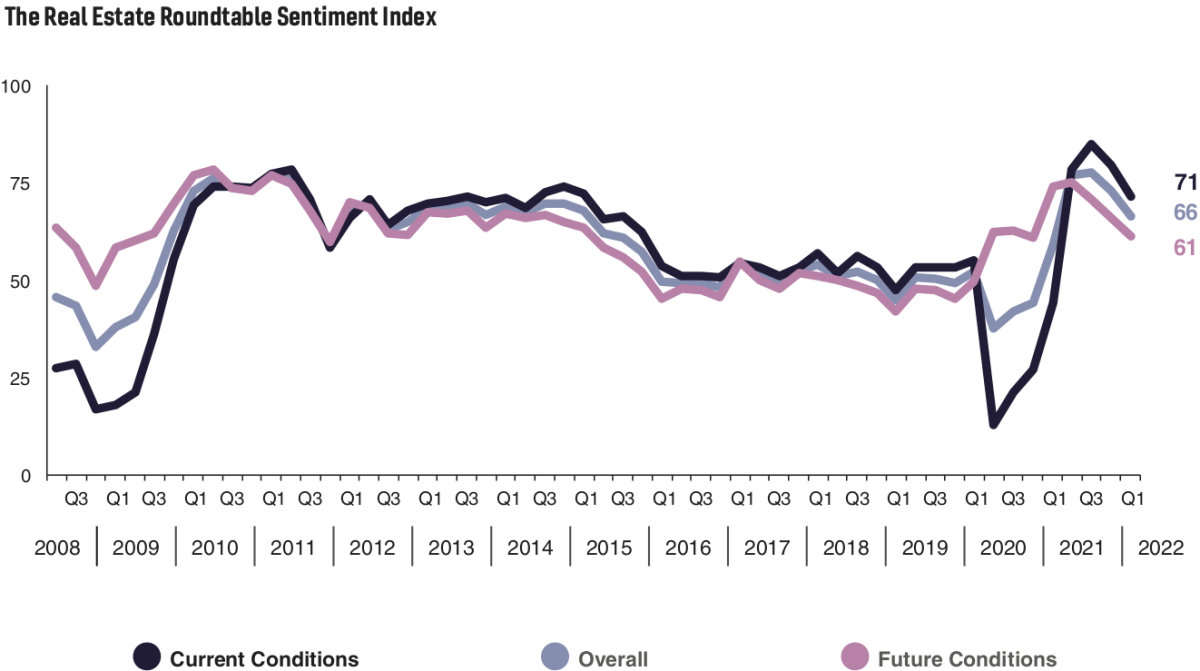

The Roundtable’s Overall Q1 2022 Sentiment Index – a reflection of the views of real estate industry leaders – registered a score of 66, a seven-point increase relative to the Q1 2021 score, demonstrating continued optimism for market conditions despite a decrease of seven points from Q4 2021. The “Current” Index registered at 71, a 27-point increase compared to Q1 2021. The Economic Sentiment “Overall” Index is scored on a scale of 1 to 100 by averaging the scores of Current and Future Indices. Any score over 50 is viewed as positive.

The Roundtable’s quarterly economic survey also shows that 69% of respondents believe that general market conditions today are “much better or somewhat better” versus one year ago – and that 53% anticipate conditions will continue to improve one year from now.

Roundtable president and CEO Jeffrey DeBoer said, “We are encouraged by the decreasing number of cases of COVID-19, pandemic-related restrictions being lifted throughout the country, cities continuing to reopen safely and efficiently, and increased travel and consumer spending. Our nation’s post-pandemic recovery is reliant on the revitalization of cities, safe transportation systems, significant return of employees to the workplace, and healthy real estate values.”

He added, “Throughout the pandemic the real estate industry has assisted suddenly jobless residents and troubled business tenants restructure leases to remain in their properties. Industry leaders now look forward to reimagining people’s living, shopping, work, and other spaces in the built environment to accommodate the evolving needs of the post-COVID economy.”

Among the topline findings:

• The Q1 2022 Real Estate Roundtable Sentiment Index registered a score of 66, a decrease of seven points from the fourth quarter of 2021 but a seven-point increase over Q1 2021. While optimistic about the economic outlook going forward, inflation concerns and a rising interest rate environment were frequently cited as potential headwinds for the industry.

• Survey respondents’ outlook varied between asset classes and location; most participants felt that real estate assets, particularly single and multifamily housing and industrial, remain largely “priced to perfection” with limited supply being chased by seemingly “boundless” capital.

• This supply-demand imbalance has generally led to compressed cap rates across favorable asset classes and results in perceptions that valuations will remain elevated.

• Participants cited a continued abundance of debt and equity capital and strong investor demand for real estate.

Data for the Q1 survey was gathered in January by Chicago-based Ferguson Partners on the Roundtable’s behalf.

The Real Estate Roundtable brings together leaders of the nation’s top publicly held and privately owned real estate ownership, development, lending and management firms with the leaders of major national real estate trade associations to jointly address key national policy issues relating to real estate and the overall economy.

See the full report at rer.org.